Affirm Holdings (AFRM) is riding a wave of renewed investor interest, buoyed by its latest earnings, merchant integrations, and buzz around Buy Now, Pay Later (BNPL). In a world where fintech startups are many but dominant survivors are few, Affirm sits in the crosshairs of both excitement and skepticism. Its recent earnings beat, gross merchandise volume growth, and strategic moves command attention.

Recently making headlines is Affirm’s expanded partnership with Alphabet (GOOGL) by joining the Agent Payments Protocol (AP2) initiative, an open, "payment-agnostic" system developed with major tech and payment players to support secure, agent-led payments across platforms. This collaboration builds on Affirm’s existing integrations with Google Pay and Chrome’s autofill.

Through AP2, Affirm aims to embed its BNPL technology directly into the next generation of digital commerce, spanning wallets, browsers, chatbots, and artificial intelligence (AI) agents. The company’s real-time assessment and transparency align with the protocol’s goals of trust, flexibility, and security in payments. Both firms emphasized that the partnership marks a key step toward open, scalable, and responsible digital payment ecosystems.

Amid the current hype, should you buy, sell or hold AFRM stock? Let’s dig deeper.

About Affirm Stock

Affirm is a fintech company that builds a payment network focused on consumer financing and merchant tools. Affirm enables BNPL options, letting consumers split purchases into installments with transparent terms. Headquartered in San Francisco, California, the firm also offers a merchant commerce platform and integrates with a variety of digital and point-of-sale channels. Affirm currently has a market capitalization of $22.1 billion.

Over the past 52 weeks, AFRM stock has staged a remarkable rebound, up 62%, underscoring how strongly investor sentiment has swung back toward high-growth fintech plays. On a year-to-date (YTD) basis, the stock has also delivered solid gains of 18% as markets look for growth stories in the digital payments and BNPL space. In the more recent stretch, the announcement of a deeper collaboration with Google around its Agent Payments Protocol (AP2) has acted as a fresh catalyst, fueling a pronounced uptick in trading volume. AFRM stock closed up by 6% on Oct. 20.

In short, what was once a beaten-down fintech name has roared back in strong form, driven by renewed optimism around growth, strategic partnerships, and the positioning of Affirm as a payments infrastructure player rather than just a BNPL lender.

AFRM currently trades at a premium compared to the sector median at 79.77 times forward earnings.

Affirm Swung to Operating Profitability in Q4

On Aug. 28, Affirm released its fiscal fourth-quarter 2025 earnings results. In the quarter ended June 30, Affirm turned a profit, reporting EPS of $0.20, reversing a loss of $0.14 per share in the prior-year period and beating consensus estimates. Revenue for the period came in at $876.4 million, up 33% year-over-year (YOY).

Gross merchandise volume (GMV), a core volume metric, surged 43% to $10.4 billion, driven by strong performance in its merchant base, 0% APR installment products, and expansion of repeat transactions. Meanwhile, operating expenses rose, but Affirm posted operating income and improved its margin, generating $58.1 million of operating income versus a loss in the prior-year period.

For full-year 2025, Affirm recorded $3.2 billion in revenue, compared to $2.3 billion in the prior year. The firm also processed $36.7 billion in GMV, compared to $26.6 billion last year. Additionally, it generated net income of $52.2 million and EPS of $0.15, a significant increase from the prior-year loss. However, the company still logged an operating loss for the year of $87.3 million, reflecting investments in growth, credit provisioning, and technology. At year-end, the company had 23 million active consumers and 377,000 active merchants.

Looking ahead, Affirm expects GMV to come in at more than $46 billion for fiscal 2026. For Q1 2026, it guided for GMV of $10.1 billion to $10.4 billion and revenue between $855 million and $885 million, with an expected adjusted operating margin in the 23% to 25% range.

Analysts remain optimistic, as they predict EPS to be around $0.85 for fiscal 2026, up 467% YOY, before surging by another 69% annually to $1.44 in fiscal 2027.

What Do Analysts Expect for Affirm Stock?

Earlier this month, Rothschild Redburn upgraded Affirm stock from “Neutral” to “Buy,” raising the price target from $74 to $101. The upgrade reflects Affirm’s strong return over the past year and its continued success in the U.S. market. Analysts also highlighted international expansion as an additional upside and praised the company's established products and merchant partnerships, which support a larger addressable market and favorable long-term prospects.

However, some analysts are still on the sidelines. For example, BTIG reiterated a “Neutral” rating on AFRM stock.

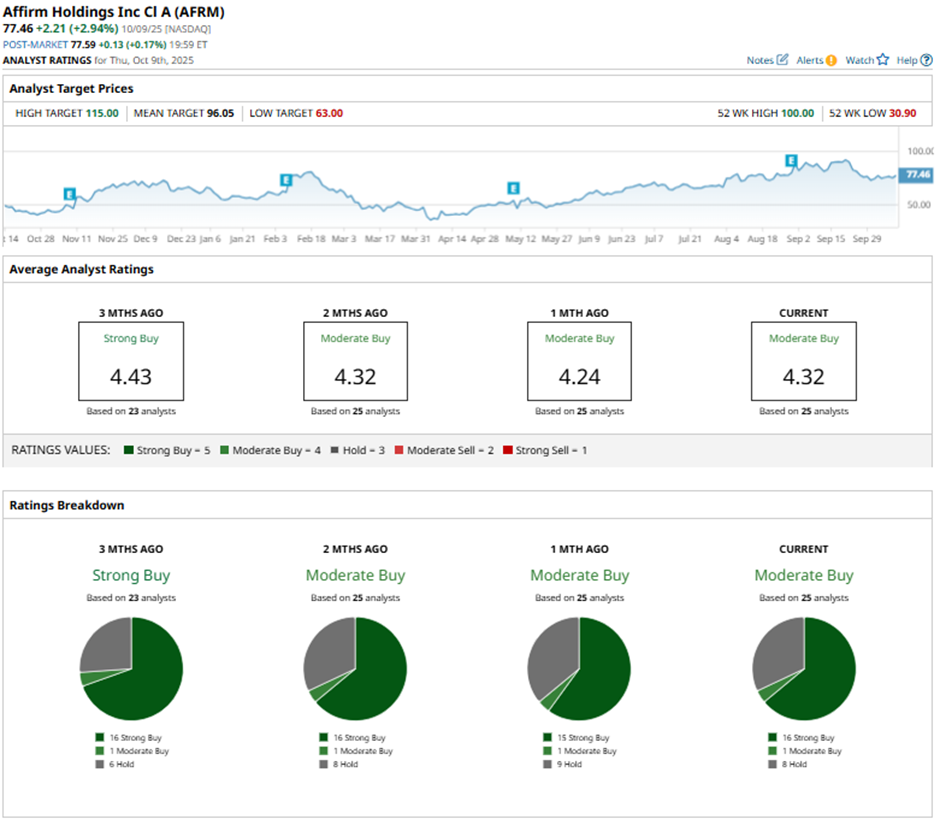

Wall Street is moderately bullish on Affirm. Overall, AFRM stock has a consensus “Moderate Buy” rating. Of the 25 analysts covering the stock, 16 advise a “Strong Buy,” one suggests a “Moderate Buy,” and eight analysts are on the sidelines with a “Hold” rating.

The average analyst price target for AFRM is $96.75, indicating potential upside of 34% from current levels. The Street-high target price of $115 suggests that the stock could rally as much as 60% from here.