/International%20Business%20Machines%20Corp_%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

IBM (IBM) is expanding its enterprise artificial intelligence (AI) footprint through a strategic collaboration with S&P Global (SPGI), which embeds IBM's WatsonX Orchestrate agentic framework into S&P's offerings, starting with supply chain management solutions.

The partnership tackles one of business's most formidable challenges: managing increasingly complex global supply chains. By combining IBM's AI capabilities with S&P Global's proprietary data and analytics, the companies are building AI-powered tools that enhance visibility into procurement, trade risks, country risks, and supplier selection.

S&P Global will develop new agents for IBM's WatsonX Orchestrate Agent Catalog, utilizing its specialized data to accelerate supply chain decision-making. The collaboration extends beyond logistics, with plans to integrate IBM's AI technology into additional risk intelligence services within S&P's Market Intelligence division.

IBM's WatsonX Orchestrate serves as a central solution for orchestrating AI agents, assistants, and workflows across businesses. The platform's Agent Catalog already features over 500 pre-built agents and tools from IBM and its partner ecosystem.

Rob Thomas, IBM's Chief Commercial Officer, emphasized that AI agents help businesses regain control over supply chains by connecting data to action and quickly adapting to optimize performance. The companies plan to expand their agentic AI collaboration into other core business functions, including finance, procurement, and insurance.

This partnership validates its enterprise AI strategy as companies seek practical applications of AI agents to streamline operations and enhance decision-making across complex business processes.

The Bull Case for IBM Stock

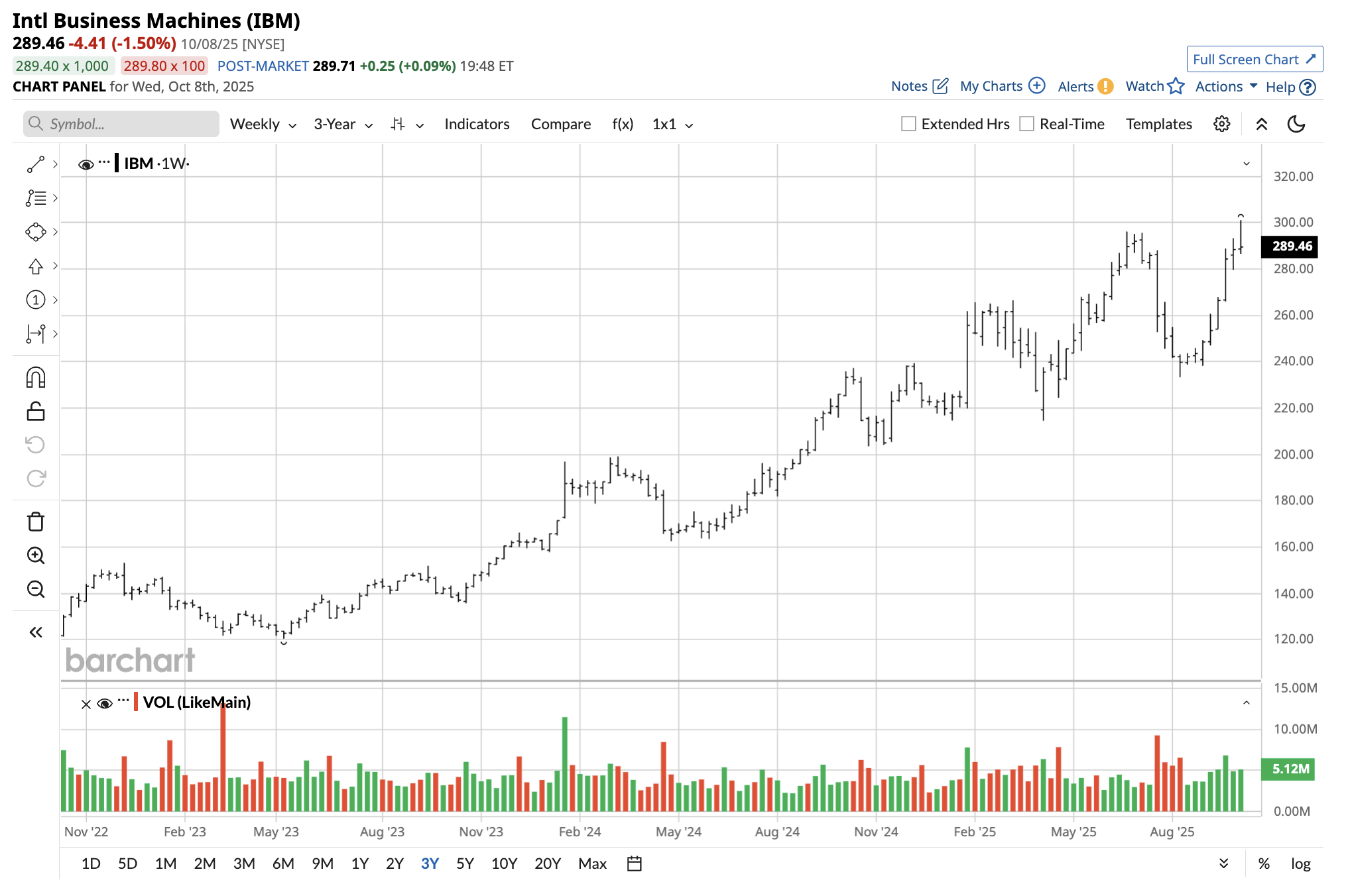

IBM's transformation from a hardware-centric company to a software powerhouse is paying off as it capitalizes on the demand for enterprise AI adoption and hybrid cloud infrastructure.

Software now accounts for 45% of IBM's revenue, up from 25% five years ago. That shift is driving accelerating growth, with IBM delivering mid-single-digit revenue expansion and raising free cash flow guidance to above $13.5 billion for 2025.

The software business is projected to achieve double-digit growth this year, driven by four core pillars: Red Hat, automation, data and AI, and transaction processing. Red Hat continues to exceed expectations, with mid-teens growth fueled by the strong adoption of OpenShift container platforms and growing demand for virtualization alternatives. The automation portfolio, bolstered by the HashiCorp acquisition, has delivered above-model growth as enterprises seek to manage complex hybrid environments.

IBM's AI book of business has reached $7.5 billion, with a roughly 80% split between consulting and 20% software. The company is deploying AI across 70 internal workflows, generating $4.5 billion in annual productivity savings. This "client zero" approach resonates with enterprises, with over 400 clients now engaging IBM to replicate similar transformations.

The new Z17 platform, which launched in June, delivers 17% better power efficiency and 450 billion AI inference operations daily. Transaction processing software, which runs on mainframes, has shifted from declining to low-single-digit growth as capacity expansion drives increasing software consumption.

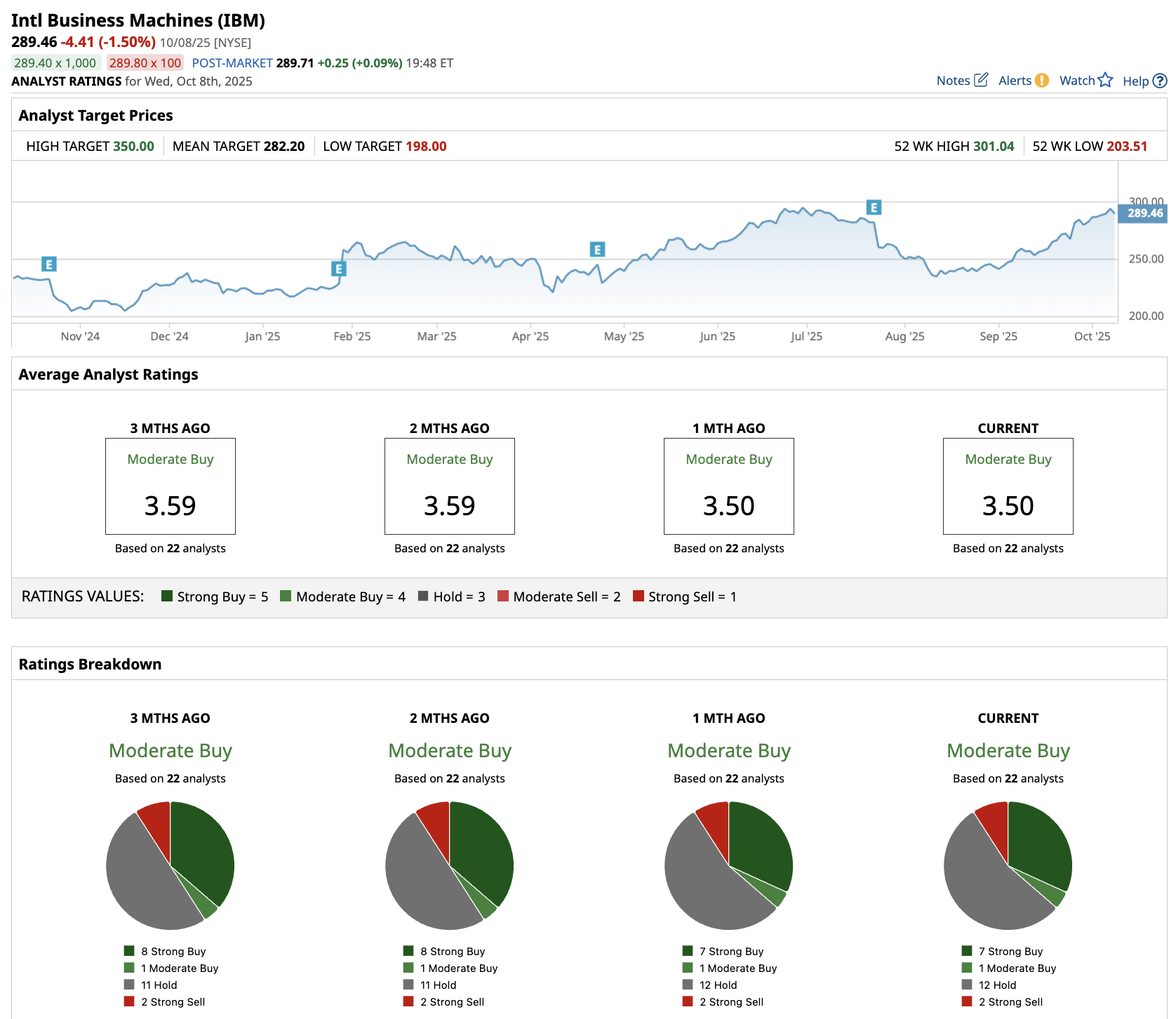

What Is the IBM Stock Price Target?

Analysts tracking IBM stock forecast adjusted earnings per share to increase from $10.33 in 2024 to $13.83 in 2029. During this period, free cash flow is expected to grow from $12.75 billion to $18.75 billion.

If the tech stock is priced at 20 times forward FCF, which is reasonable, it should gain over 40% within the next four years. If we adjust for dividend reinvestments, cumulative returns could be closer to 50%.

Out of the 22 analysts covering IBM stock, seven recommend “Strong Buy,” one recommends “Moderate Buy,” 12 recommend “Hold,” and two recommend “Strong Sell.” The average IBM stock price target is $282, below the current target price of $289.

CEO Arvind Krishna emphasized that 99% of enterprise data remains untouched by AI, representing a massive opportunity. IBM's WatsonX Orchestrate platform now features 150 prebuilt agents for automating enterprise workflows across HR, sales, procurement, and IT.

Strategic partnerships with AWS (AMZN), Microsoft (MSFT), SAP (SAP), Oracle (ORCL), and Palo Alto Networks (PANW) are generating billions in consulting revenue while creating natural tailwinds for IBM's complementary software products. The company's balanced geographic diversification and recurring revenue model provide resilience against macro uncertainty.