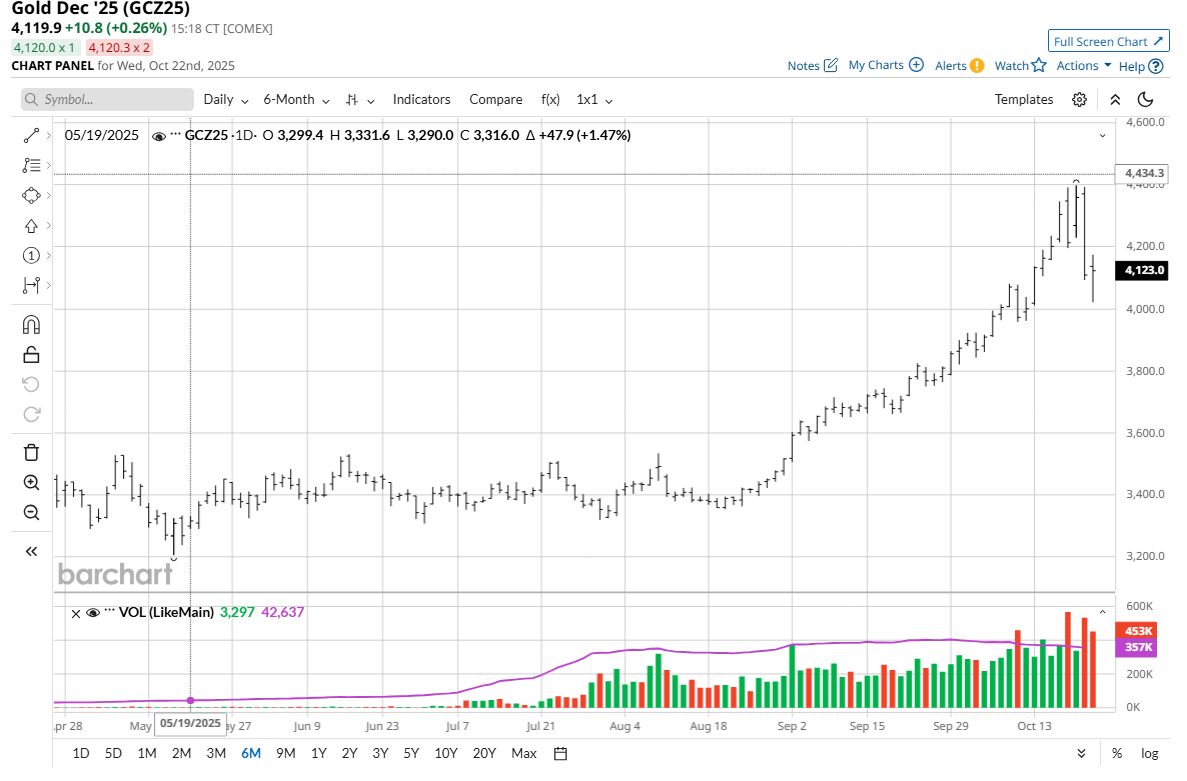

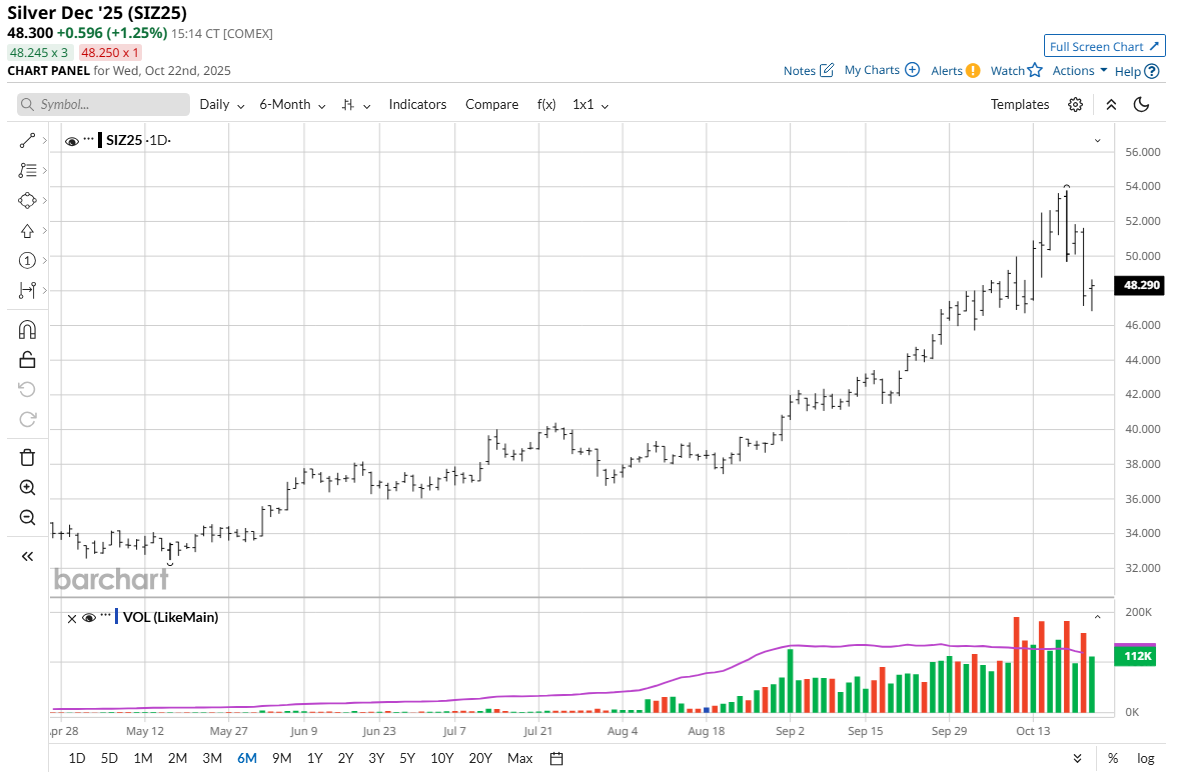

Gold (GCZ25) and silver (SIZ25) futures prices extended losses overnight into Wednesday after both metals suffered major losses on Tuesday and saw their worst routs in many years on concerns the rallies had run too far, too fast.

Gold futures prices at one point were down over $250 an ounce, while silver saw prices down over $3.50 an ounce. The general marketplace at mid-week will continue to pay closer attention to gold and silver markets, as more extreme volatility could cause concerns about market-making efficiency and even market dislocations — which could spill over into selling pressure in other commodity futures markets.

Gold, Silver Have Become ‘Gunslinger’ Markets

The daily price volatility in gold and silver has become so extreme that both bulls and bears could be forced out of the markets in the same trading session, due to major whipsaw price action.

For those gunslingers still willing to trade the gold and silver markets straight away, the micro and mini gold futures are the way most should do it.

Even trading the smaller-size contracts during such volatile market activity can be very risky. However, the smaller-sized futures contracts allow traders to access the markets with lower capital commitment.

Micro gold (GRZ25) futures from the CME Group (MGC) represent one-tenth the size of a standard 100-ounce Comex gold futures contract, meaning each contract is for 10 troy ounces of gold. The smaller size translates to significantly lower margin requirements, making them ideal for new traders or those with smaller trading accounts. With a smaller tick value (10 cents, which equals $1.00, meaning a $1.00 move is $10.00 in value), micro gold futures offer less financial impact from price movements, which makes them a useful tool for testing trading strategies or managing smaller-scale portfolios.

How to Trade the Highly Volatile Metals Markets with Options

Purchasing put or call options on gold and silver futures allows the trader to precisely know his risk outlay, which is the price paid for the option. The downside to trading options on futures in highly volatile markets is that “implied volatility” in the options is also high — meaning you’ll pay a higher premium for the put or call options.

I believe a good strategy for gold and silver traders, at present, is buying well-out-of-the-money options. Why? Well-out-of-the-money options cost less but still can provide profit potential due to the much bigger daily price movements. For example, on Monday, a trader could have bought a put option on December silver futures that was “out of the money” by $3.00 (considered well out of the money at that time) and one day later be “in the money” and making profits.

What Gold and Silver Bulls Should Do Here

So, after these big price downdrafts, if you are still a bull in the gold and/or silver markets and want to do some bargain hunting, buying well-out-of-the-money call options on gold/silver futures may be your ticket.

Fundamentally, the bulls can argue that not a lot has changed in the past week. The U.S. government shutdown is in its 22nd day, which means there continues to be a dearth of important U.S. economic data. That means keener uncertainty in the marketplace, and that’s bullish for the safe-haven metals.

Lower global interest rates are likely in the coming months. The marketplace thinks the Federal Reserve will make at least two more, and possibly three, quarter-point rate cuts in this rate-cutting cycle, including one next week. Recent weaker economic data out of China has the Chinese government saying it will ease its monetary policy in the coming weeks and months. Other countries, including Canada, the United Kingdom, and Australia have also lowered interest rates.

Central banks continue to stock up on gold as many countries are moving away from holding the U.S. dollar in their reserves and opting to hold more gold.

What Gold and Silver Bears Should Do Here

So, if after these big price downdrafts you are now a bear, buying well-out-of-the-money put options on gold/silver futures may be your ticket.

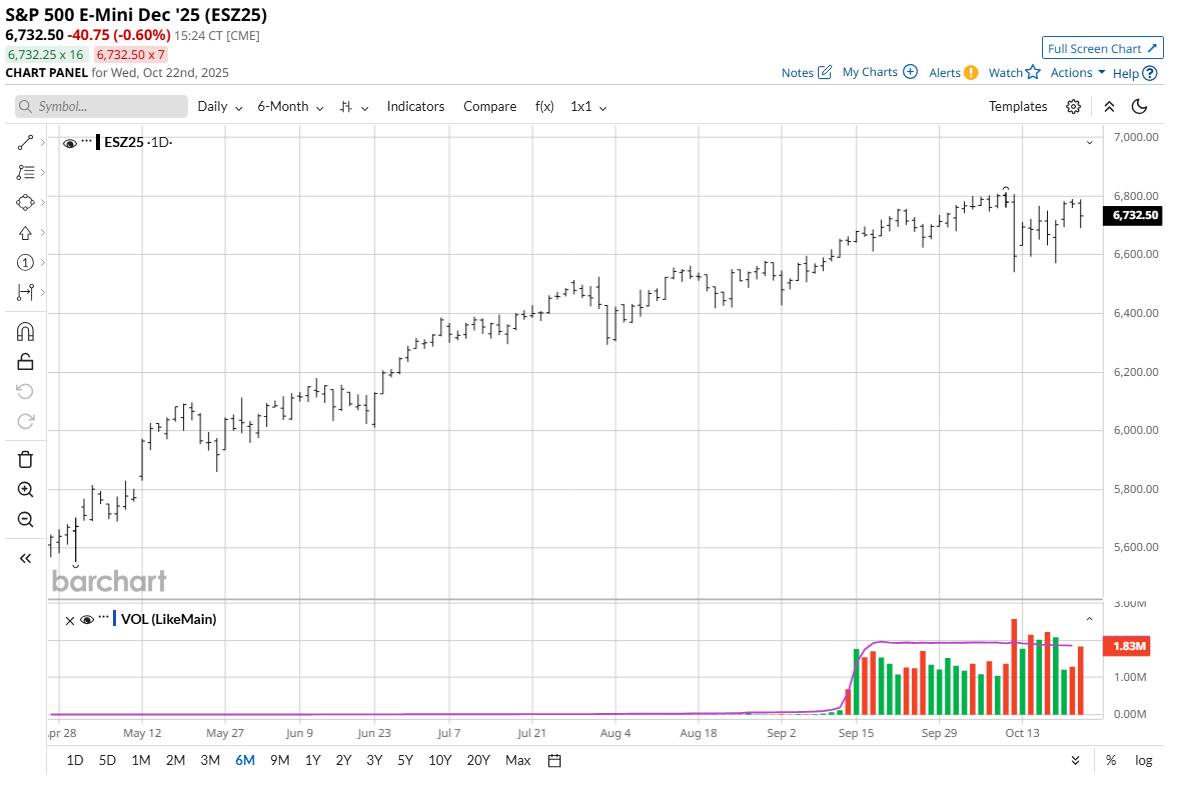

Fundamentally, the U.S. stock indexes have made solid rebounds and are now very close to their record highs. The stock market is a competing asset class with safe-haven metals. The stock indexes not far below their record highs suggest better risk appetite in the marketplace, which is bearish for gold and silver.

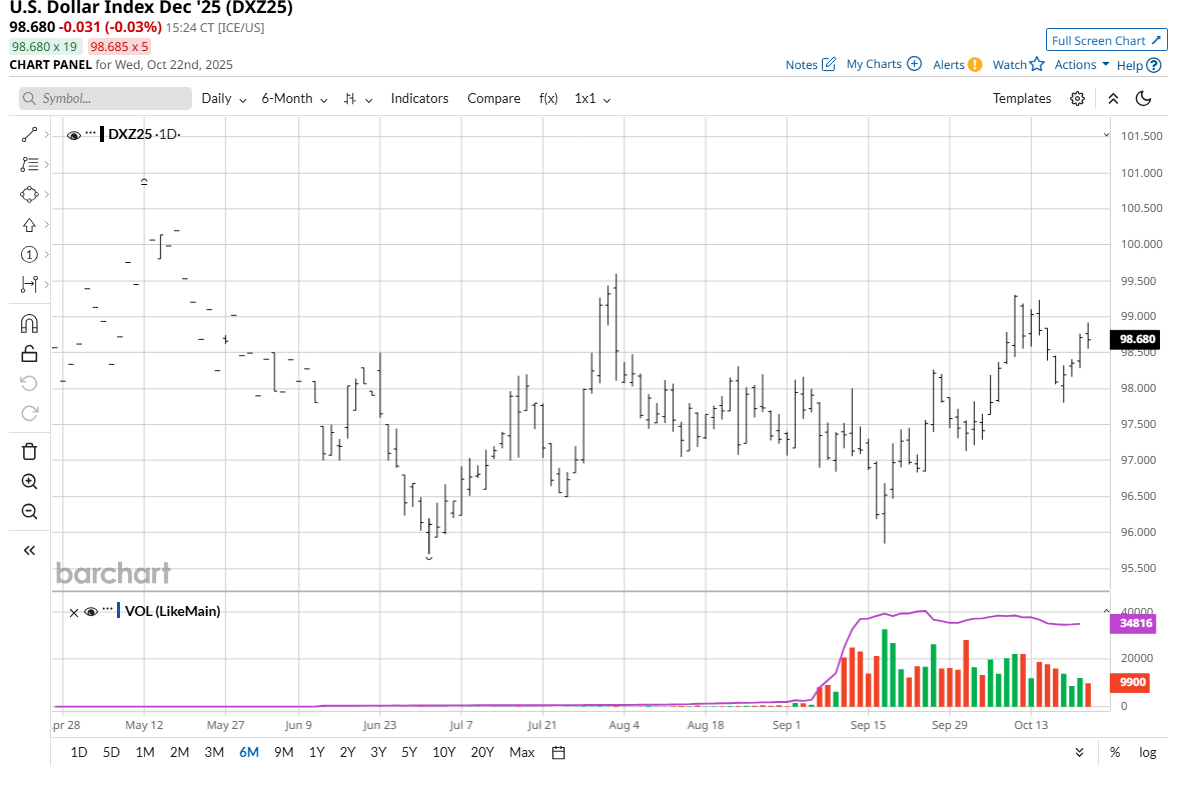

The U.S. dollar index ($DXY) has been trending higher since mid-September. Generally, a rallying U.S. dollar index is a bearish element for the gold and silver markets.

The geopolitical front is calmer.

The recent extreme volatility at higher price levels (bigger daily price bars on the daily bar charts) suggests the already very mature bull market runs for gold and silver are in their final stages.

$50 Silver Is Not Holding…

Last week, I told you that from a time perspective, I believed the major bull runs in gold and silver were in the eighth or ninth inning. This week, I’ll change that to the ninth inning with two outs. Here’s what I also said last week:

“Probably the most important factor that I think will determine where gold and silver prices are headed: Silver above $50.00. Reason: Price history over the past 50 years shows that when silver prices reach $50, or get close to it, which has occurred three times now, the first two times saw silver trade above $50 for only a short period of time. Two weeks from now, if silver prices are above $50 an ounce, then the marketplace can start to believe both gold and silver are entering new, longer-term price ranges that will continue well above what price history of the past 50 years has shown. And if silver drops back below $50 in the next couple weeks, history will again repeat itself--and that would suggest gold and silver are due for extended downside price corrections and even bear markets farther down the road, to continue the historical cycle of boom and bust seen in all raw commodity markets.”

Right now, it appears silver prices are going to have a difficult trek to get back above that key $50.00 level. I think daily trading action the rest of this week will be extra important for both gold and silver prices’ trajectories in the coming weeks/months.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.