Hut 8 Corp (NASDAQ:HUT) shares are surging Tuesday afternoon following the announcement of an expansion plan that will more than double its operational capacity. The energy infrastructure and Bitcoin mining company revealed plans to develop four new sites in Texas, adding over 1.5 gigawatts of power to its portfolio.

What To Know: This expansion comes as the company reports that approximately 90% of its existing 1,330 megawatts (MW) were already contracted as of June 30. The addition of 1,530 MW is a response to growing demand from prospective customers across energy-intensive sectors.

Hut 8 says the new sites are targeted to have between 50 MW and 1,000 MW of utility capacity each and will feature next-generation architecture designed for rapid and efficient deployment.

The company states the expansion will be supported by its capital strategy, which includes over $2.4 billion in available liquidity. This includes a strategic reserve of 10,578 Bitcoin (CRYPTO: BTC), valued at approximately $1.2 billion.

Hut 8 has also secured a new revolving credit facility of up to $200 million and a collateralized loan facility for up to $150 million.

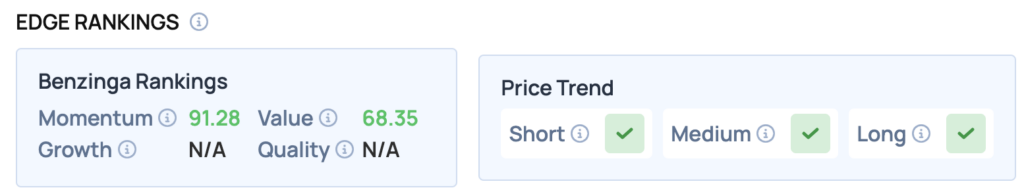

Price Action: According to data from Benzinga Pro, HUT shares are trading higher by 11.43% to $26.14 Tuesday afternoon. The stock has a 52-week high of $31.95 and a 52-week low of $8.73.

Read Also: Why Trump Media Stock Is Gaining Today

How To Buy HUT Stock

By now you're likely curious about how to participate in the market for Hut 8 – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

In the case of Hut 8, which is trading at $25.6 as of publishing time, $100 would buy you 3.91 shares of stock.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock