World-leading fast-food chain McDonald's (MCD) reported a second-quarter earnings victory that helped alleviate investor concerns about the strength of the brand in a tough environment for consumers. With the help of promotional crossovers, new menu items, and worldwide demand, the Golden Arches notched its biggest same-store sales increase in close to two years. Its shares climbed over 2% in early trading on the back of the Street's positive response to the figures.

Nevertheless, executives took a cautious line on U.S. low-income consumer trends, where traffic continues under pressure. With inflation-fatigued consumers cutting back on expenditure, McDonald's is relying on value-driven promotions and global expansion to keep the pedal to the floor. The figures come as the overall quick-service restaurant segment fights for share of the market with slowing traffic and changing expenditure trends.

About McDonald's Stock

McDonald's has a market cap of $218 billion and has over 40,000 restaurants and franchise locations globally, with about 69 million daily customers. Based in Chicago, Illinois, the $219 billion company dominates the world's quick service restaurant sector with a combination of company-owned restaurants and a massive franchise network in over 100 countries worldwide.

Over the past 52 weeks, MCD shares have traded between $271.85 and $326.32, recently changing hands at $304.89, modestly above their yearly lows and trailing the S&P 500’s ($SPX) roughly 25% gain over the same period.

Its stock has a forward price-earnings (P/E) ratio of 24.72, slightly higher than the restaurant chain average, in line with investor optimism about the pricing power and brand sustainability of the company. The price-sales (P/S) ratio of 8.40 and the price-cash flow ratio (P/CF) of 20.71 indicate a premium multiple, but steady free cash flow (FCF) and resilient margins support the multiple.

With over four decades of annual dividend increases, McDonald's is a Dividend Aristocrat, and the stock provides a payout of to 2.29%, with quarterly payments underpinned by a 31.73% profit margin and healthy cash generation. The next dividend payout will come in September.

McDonald’s Beats on Earnings

In Q2 2025, McDonald’s reported adjusted EPS of $3.19, beating the $3.15 consensus estimate, and revenue of $6.84 billion, topping the $6.7 billion forecast. Net income rose 11% year-over-year to $2.25 billion, driven by a 3.8% global same-store sales increase, the largest in nearly two years. U.S. comparable sales rose 2.5%, reversing two straight quarters of declines, supported by promotions like the $5 meal deal, the Minecraft movie tie-in, and the launch of McCrispy Chicken Strips.

Management expects stronger results in the second half of 2025, citing easier year-over-year comparisons and continued international momentum. International Operated Markets posted 4% same-store sales growth, while International Developmental Licensed Markets surged 5.6%, led by Japan, China, and the UK.

Soon after the quarter closed, the comeback of Snack Wraps to a $2.99 promotional pricing level met with “encouraging” initial response, with franchisees opting for the year-end continuation of the offer. Company executives also highlighted the company's loyalty program, which generated $9 billion in quarterly system-wide sales by members.

What Do Analysts Expect for McDonald’s Stock?

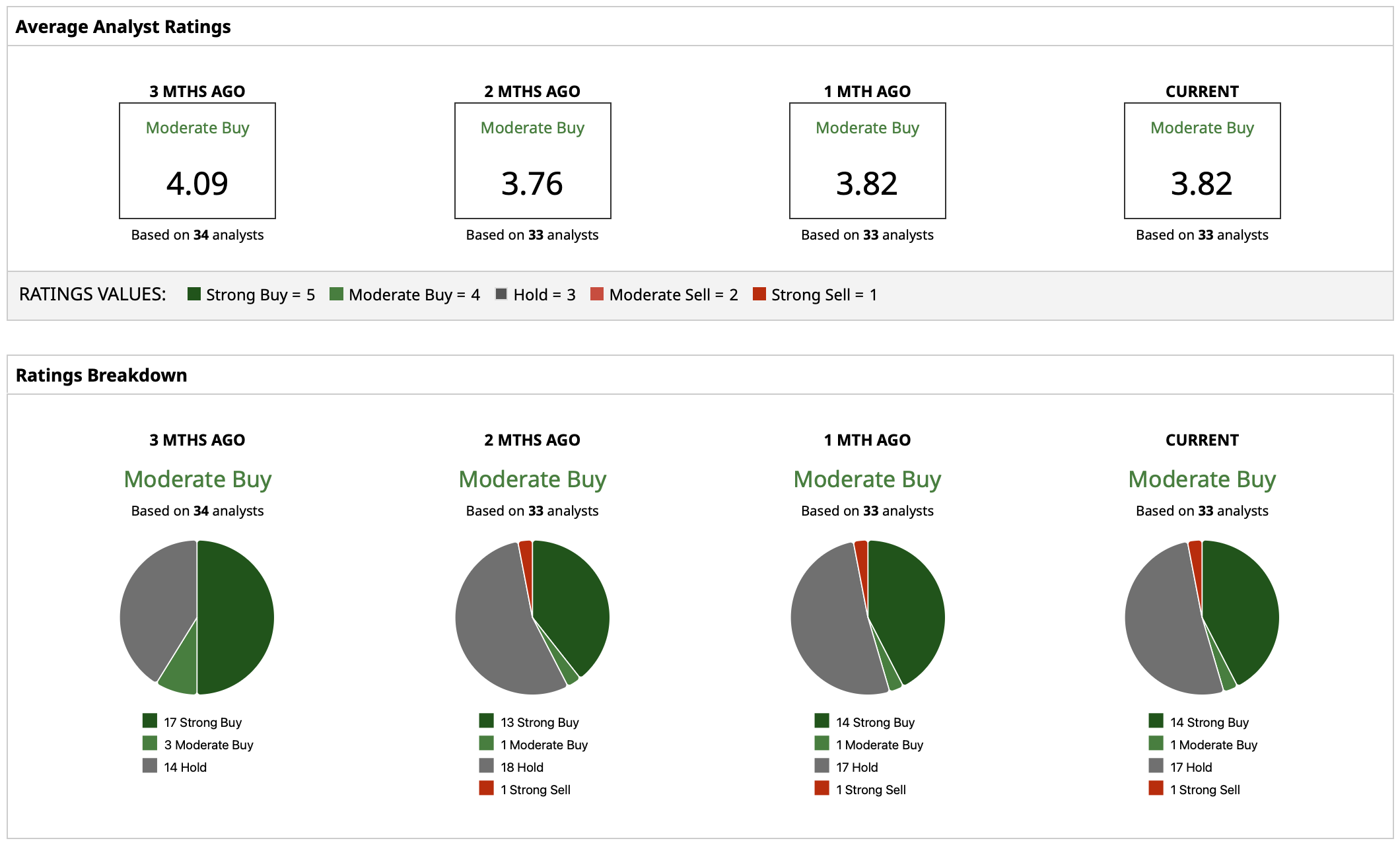

Barchart data shows that MCD stock has a “Moderate Buy” rating consensus based on the strength of the brand, scale benefits, and pricing opportunities as the primary long-term strengths. Though some analysts have reduced near-term expectations in response to U.S. traffic headwinds, the overall sentiment remains positive.

Its average target of $337.43 offers about 10.7% potential upside from the recent close. The top target of $373 offers upside potential of approximately 22%, and the bottom target of $260 indicates possible downside risk of roughly 14.7%. Analysts' primary catalysts for ongoing earnings growth and shareholder returns include international expansion, menu innovation, and digital engagement.