/Humana%20Inc_%20logo%20on%20laptop-by%20monticello%20via%20Shutterstock.jpg)

Louisville, Kentucky-based Humana Inc. (HUM) is a healthcare plan provider, committed to helping people lead healthy and happy lives. With a market cap of $37.3 billion, Humana offers medical and specialty insurance products in the United States, and operates through Insurance and CenterWell segments.

Companies worth $10 billion or more are generally described as "large-cap stocks." Humana fits this bill perfectly. Given that the company operates as one of the largest health insurance providers in the United States, its valuation above this mark is not surprising. The company provides millions of medical memberships annually.

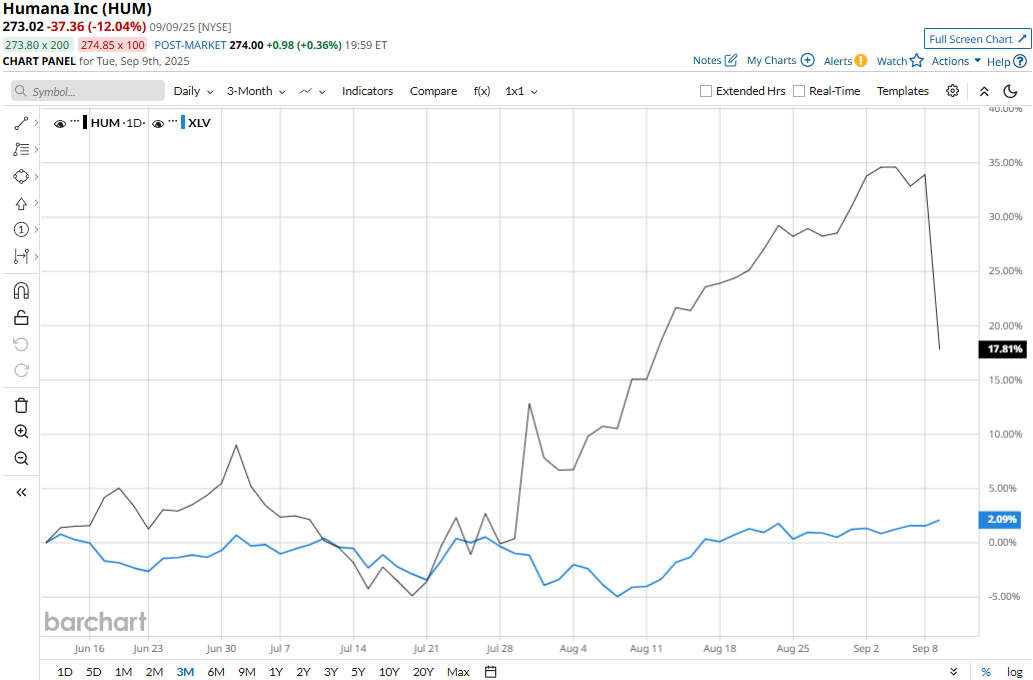

Despite its notable strengths, HUM stock has plummeted 21.6% from its 52-week high of $348.24 touched on Oct. 9, 2024. Meanwhile, HUM has gained 17.2% over the past three months, outperforming the Health Care Select Sector SPDR Fund’s (XLV) 3.3% uptick during the same time frame.

Over the longer term, HUM stock has gained 7.6% on a YTD basis and plunged 20.6% over the past 52 weeks, outperforming XLV’s marginal 74 bps uptick in 2025, but underperforming XLV’s 10.6% decline over the past year.

To confirm the recent upturn, HUM stock has traded above its 200-day and 50-day moving averages since early August.

Humana’s stock prices shot up 12.4% in a single trading session following the release of its better-than-expected Q2 results on Jul. 30. The company’s results experienced a notable boost driven by membership growth in the company’s state-based contracts and stand-alone PDP business. Also, Medicare and state-based contract premiums observed a hike driven by increased direct subsidies due to the Inflation Reduction Act. Overall, Humana’s adjusted revenues grew 10.2% year-over-year to $32.4 billion, surpassing the consensus estimates by 1.9%.

However, the company’s adjusted EPS observed a 9.9% dip compared to the year-ago quarter to $6.27. Nonetheless, Humana raised its full-year adjusted EPS guidance from the previous $16.25 to $17, boosting investor confidence.

When compared to its peer, HUM stock has lagged behind, Cigna Group’s (CI) 9.4% gains on a YTD basis and 15.6% decline over the past year.

Among the 24 analysts covering the HUM stock, the overall consensus rating is a “Moderate Buy.” Its mean price target of $294.18 suggests a modest 7.8% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.