HSBC‘s (HKG: 0005) (NYSE:HSBC) (LSE: HSBA) Hong Kong shares dropped over 7% on Thursday, after the European lender announced plans to privatize its majority-owned local unit, Hang Seng Bank (HKG: 0011), in a deal valued at HK$106.1 billion (about $13.63 billion).

They were last down to HK$103 per share, as the bank said it would refrain from share buybacks in the coming three quarters in order to restore its capital ratio to its operating range.

HSBC Offers HK$155 Per Share Amid Restructuring

HSBC, which already owns 63% of Hang Seng Bank, proposed to acquire the remaining shares at HK$155 per share, marking a 30% premium to Hang Seng’s closing share price on Wednesday. That values the bank at HK$290 billion (over $37 billion).

UK-headquartered HSBC, Europe’s largest lender, took control of Hang Seng during a banking crisis in 1965. The bank had already kicked off a restructuring at Hang Seng, which has been dragged down by Hong Kong’s recent property slump. Its new CEO, Maggie Ng, just took the helm this month.

Hang Seng Bank’s shares surged 26.3% to HK$150.70 following the announcement on Thursday.

"Our offer is an exciting opportunity to grow both Hang Seng and HSBC. We will preserve Hang Seng's brand, heritage, distinct customer proposition, and a branch network," said HSBC Chief Executive Officer Georges Elhedery.

"Our offer also represents a significant investment into Hong Kong's economy, underscoring our confidence in this market and commitment to its future as a leading global financial center, and as a superconnector between international markets and mainland China.”

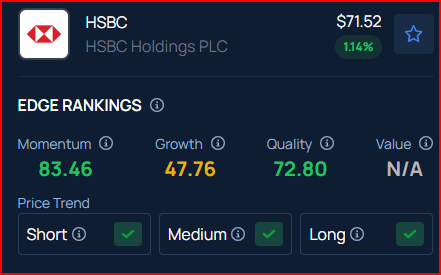

Benzinga's Edge Rankings place HSBC in the 83rd percentile for momentum and the 73rd percentile for quality, reflecting its strong performance in both areas. Check the detailed report here.

READ NEXT:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.