After breaching $190 early this month, Nvidia’s stock price has settled back to around $181 amidst profit-taking and a surprise tariff announcement on China. CEO Jensen Huang recently said that “we are 100% out of China,” which is not exactly the news many investors were hoping for.

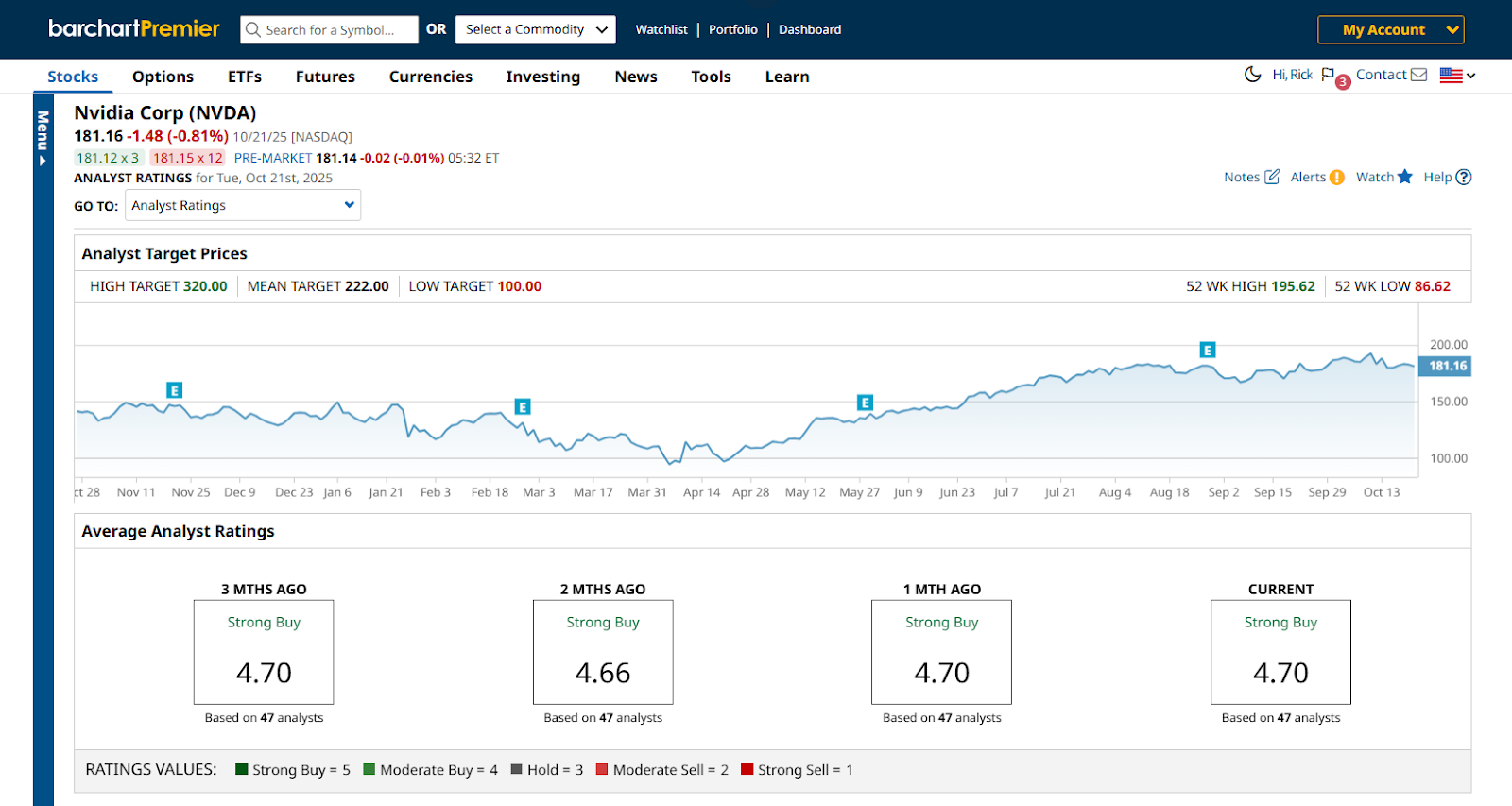

However, the company still has a lot going for it. Nvidia is still the go-to name when it comes to AI chips, while the stock is up 35% year-to-date and analysts are still bullish, rating it an average 4.70 (out of 5) and a lofty $320 high target price over the next twelve months.

If you believe the analysts, you might do well buying deep ITM LEAPS calls on Nvidia.

What Are Deep ITM LEAPS Calls?

Call options are contracts that give the buyer the right to buy an underlying asset at a pre-determined price (known as the strike price), on or before the expiration date. For this strategy, I’m speculating that Nvidia’s price will increase over time.

Long-term equity anticipation securities, or LEAPS, are option contracts that have extended expiration dates, ranging from one year to up to three years.

Deep in-the-money (ITM) calls, on the other hand, involve buying a call option with a strike price below the underlying’s current trading price, giving the option built-in intrinsic value, high delta, and low time decay.

Let me break down these three concepts quickly.

Option premiums are composed of intrinsic value, or the actual value of the option, and extrinsic value, which is the perceived market value of the option based on different factors.

Delta, meanwhile, is the options Greek that indicates the relationship between the option premium and the underlying asset. A higher delta means the option’s price moves close to the pace of the underlying asset. Delta can also be used as a probability of the option expiring in the money. That’s another benefit of deep ITM LEAPS calls.

Lastly, time decay, or theta, is the options Greek that tracks how much time eats away at the option’s value as it gets closer to expiration. Since options are timed derivatives and some value can be gained from an option’s active “lifespan,” as it were, minimizing time decay on long positions should be a consideration.

Deep ITM LEAPS calls are option contracts that offer the whole package: they combine the advantages of long-term duration and high intrinsic value, giving investors leveraged exposure to the stock’s potential upside while minimizing time decay.

Looking For Deep ITM LEAPS Calls on NVDA

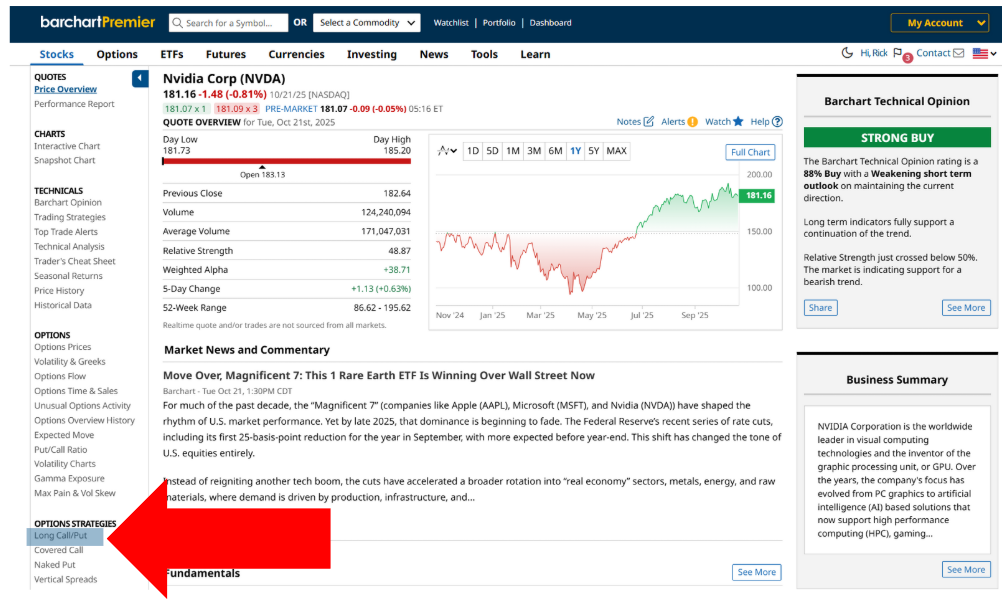

You can use Barchart’s intuitive options screener to look for deep ITM LEAPS calls on Nvidia. Just go to Nvidia’s stock profile page and click Long Call/Put under Option Strategies.

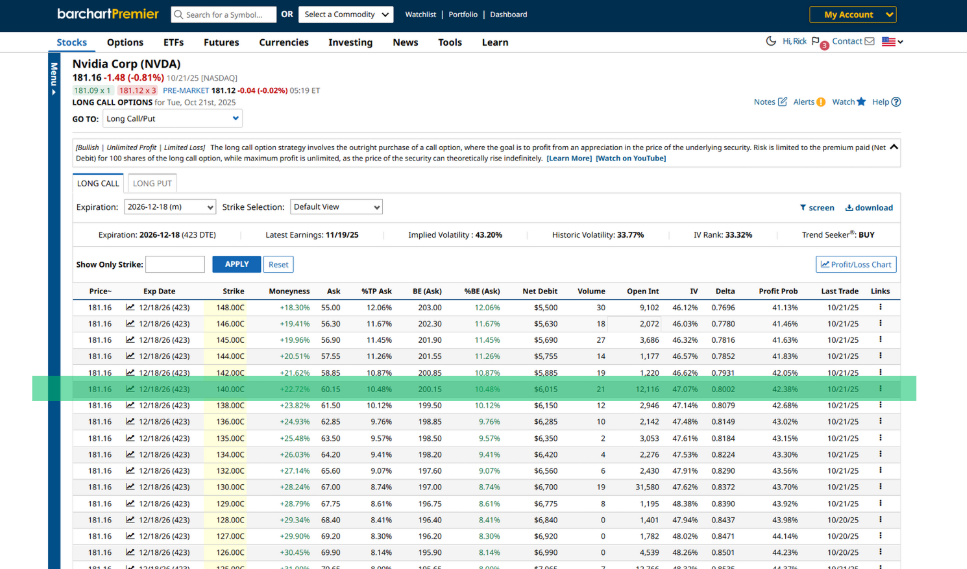

From there, you’ll be brought to the Long Call Screener page for Nvidia, where you’ll immediately see potential trading opportunities for the closest expiration date. For this example, I’ll change the expiration date to December 18, 2026, 423 days away.

Then, let’s pick a strike price. Deep ITM calls typically have a delta of 0.80 or more, giving them close to stock-like exposure - but at a fraction of the price. In this case, a 140-strike call fits the description, as it has a delta of 0.80.

Trade Breakdown

For this trade, let’s look at buying an in-the-money 140-strike call on Nvidia for $60.15 per share or $6,015 total per contract. Breaking down the trade, this long call has $41.16 in intrinsic value (trading price minus strike price) and $18.99 of extrinsic value (option premium minus intrinsic value).

Since you’re paying $60.15 per share at the start of the trade, your breakeven price will be:

$140 + $60.15 = $200.15

That means Nvidia will need to trade above $200.15 before or at expiration for the trade to break even.

Remember, you’re in this for the long haul, and this contract has 423 days to work in your favor. If Nvidia stock exceeds $200 within that time frame, your call option premium will likely be higher, which means you can potentially sell the contract on the market for more than what you paid for it.

If NVDA stock does reach $320 before December 18, 2026, your call will have $180 of intrinsic value per share. Then, your extrinsic value - which depends on the remaining time until expiration, implied volatility, and interest rates - will add more. Long story short, if the analysts are right, this deep ITM LEAPS call could be wildly profitable.

Final Thoughts

Deep ITM LEAPS calls can be a great way to get leveraged exposure to your favored stocks using options. However, they are not without risks. While most of their value is intrinsic, you still face the possibility of losing your entire premium if the stock fails to move as expected. That’s why careful planning, extensive due diligence, and patient monitoring of news and the Greeks are non-negotiable when trading options.