/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

On Wednesday, Oracle (ORCL) announced quarterly results that featured the news that the company signed not one, but four multibillion-dollar contracts related to its artificial intelligence capabilities.

Founder Larry Ellison, as a result, has now joined Elon Musk in a battle to see who can be the world’s richest person. A contest I frankly do not care about as an investor.

What I do care about is how to try to exploit this highly unusual, 36% single-day move in a stock that was already worth more than $600 billion.

In more than 30 years of professional market-watching, I cannot recall a situation like this, in which a prominent technology stock has completely transformed overnight.

But that’s what we have here. So what should we do next?

First, let’s chart ORCL, then look into one of the more unusual collar trades I came up with to present here.

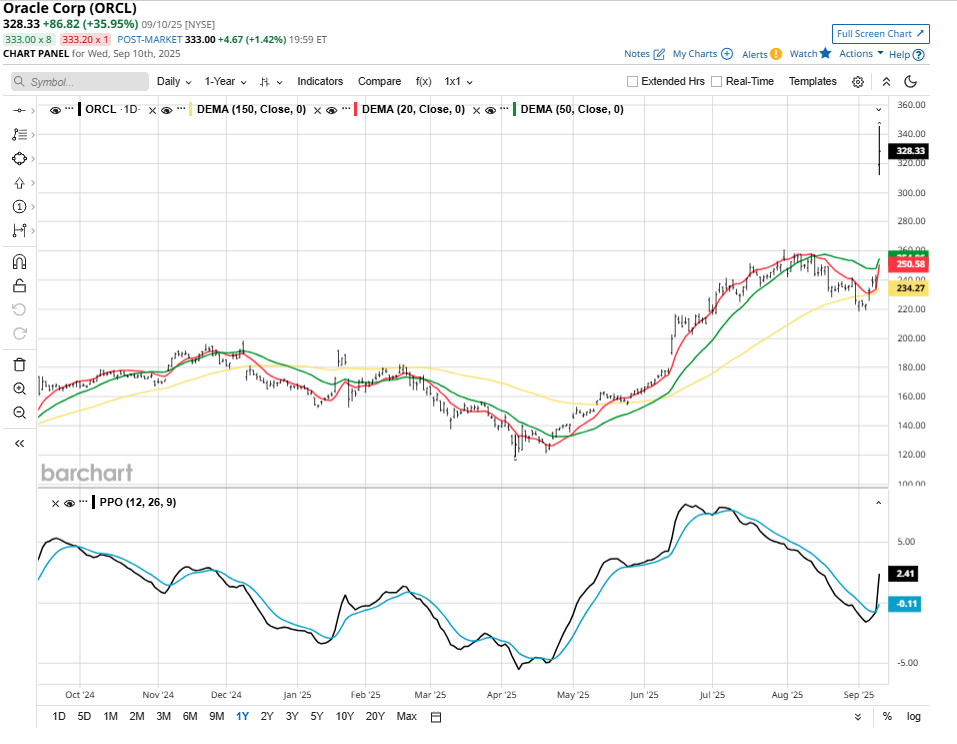

ORCL’s Charts Tell a Long Tale

The daily chart is atypical. ORCL had checked back down in price prior to earnings, then floated higher in recent days before Wednesday’s monster move.

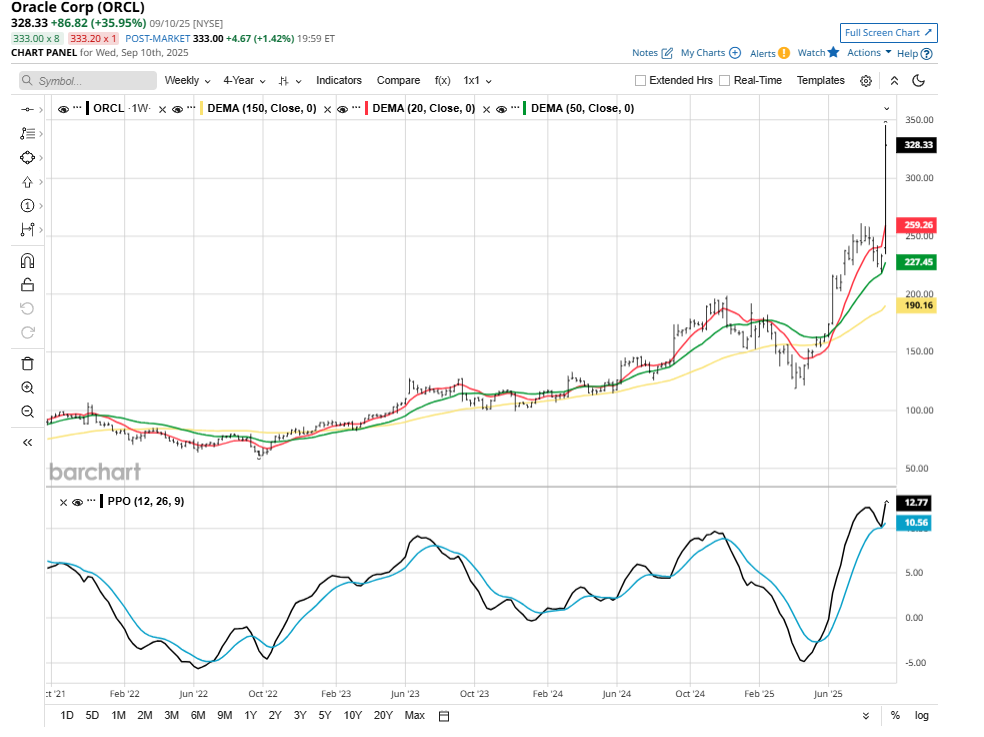

The weekly chart is flat out confusing and without a strong signal, other than the obvious fact that the price has moved much higher. Given the expected chart distortion after such a rally, you can essentially “skip” studying the weekly. No great insight to be found here.

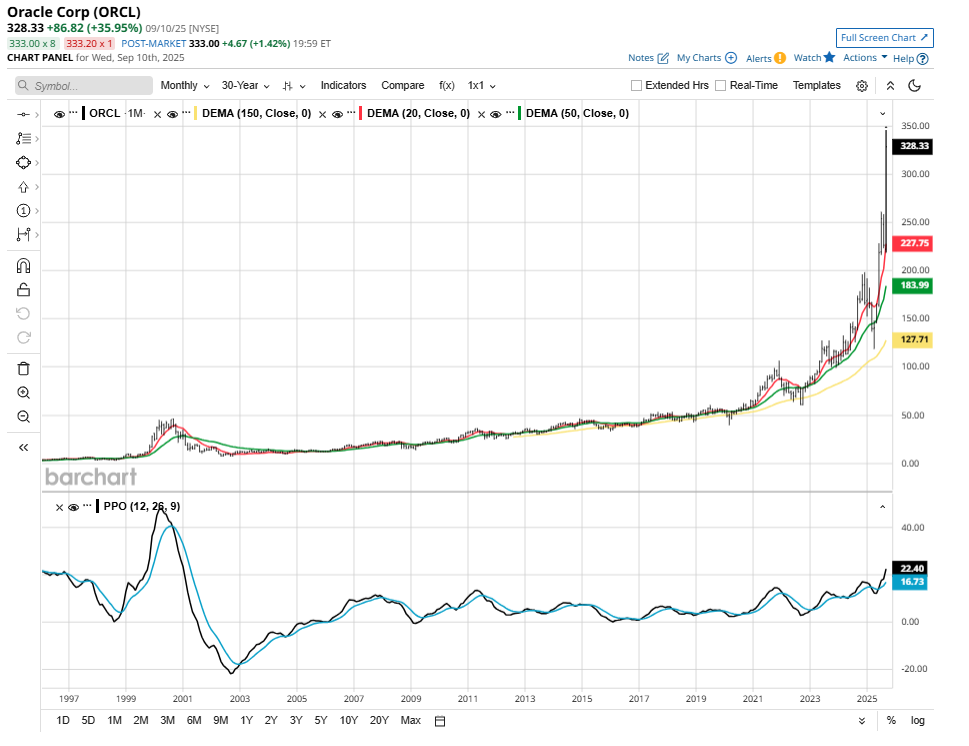

The monthly chart gives us more to go on. I went all the way back to 1995, when Oracle was part of the dot-com boom. And coincidentally, when CEO Safra Catz and I crossed paths while working at the former investment firm DLJ, early in both of our careers.

Two things to point out here. The first is that a very long-term uptrend was already in place before the big move this week. Still, monthly charts allow for a stock to drop 20%-40% without breaking the long-term pattern. So this very long-term view is not for everyone.

The second thing I see in the chart is on the left side, back during that dot-com bubble. The bubble is not hard to see in the PPO indicator at the bottom of the chart. What I note here is that ORCL was so incredibly high on that measure back then, its current level actually looks tame.

How to Trade ORCL Stock Here

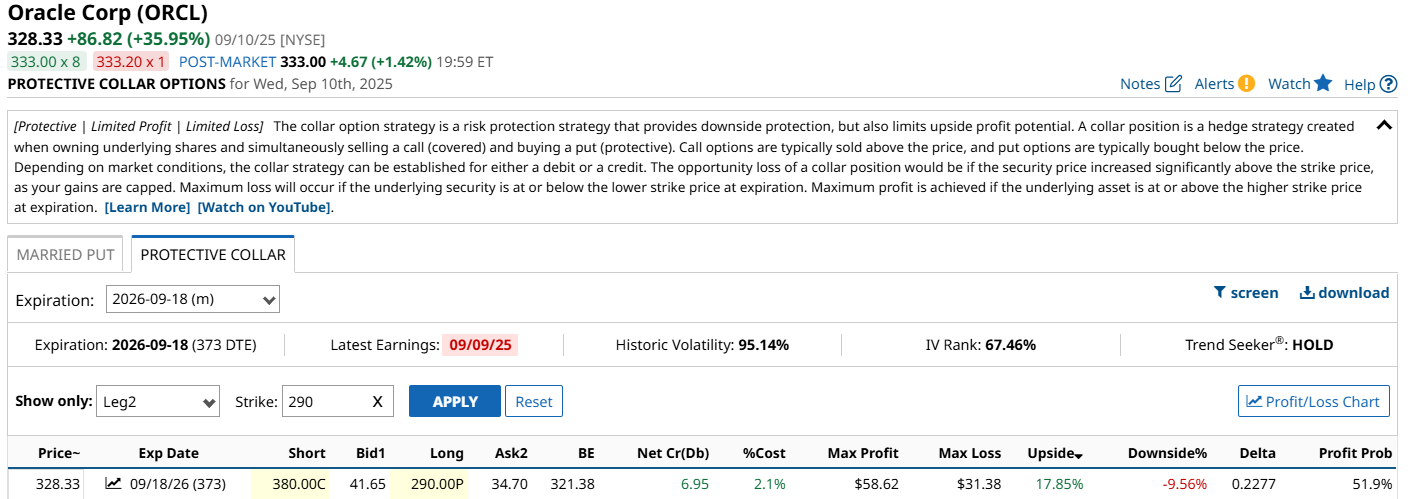

None of that matters if a collar is used. Because with a collar, I choose my best- and worst-case outcomes in advance. Here’s an example of one you could consider.

The basics are as follows. As of Wednesday’s close, a call struck at $380 allows for 18% upside on top of what’s already occurred. The $290 strike on the put option is about 10% downside.

That’s not the type of reward-risk ratio I typically go after. However, there are two missing pieces.

First, there’s the fact that I structured this so that the cost is actually negative. In other words, I’d get paid upon setting up this collar, to the tune of about 2% of the value of the stock. My assumption here is that I’m not bullish on ORCL stock, but I’d be interested in getting some sort of follow-through after what’s just happened.

I’d likely take that 2% upfront “bonus payment” and use it to buy another put option. It won’t be covered, so it’s really just a bet on ORCL stock dropping. Importantly, still having all of that upside.

This article was more about using this “tail” example in a mega-cap stock to show just how many different ways we can use options, and the collar strategy in particular. It’s all about managing risk.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.