There’s an epidemic that has infected the stock market, in a way that is wreaking havoc on those of us who like to write options as part of a broader strategy. To be clear, I said epidemic, not pandemic. And, this one could be vanquished fairly soon.

But ironically, that would actually be worse for the stock market.

OK, enough of the cryptic chatter. I’m talking about the epidemic that has appeared in the form of low volatility. In particular, the CBOE Volatility Index ($VIX), which measures the expected price range of the S&P 500 Index ($SPX) over the next 30 days. In other words, the VIX measures how volatile the market will be.

Generally speaking, low volatility translates to stable or upwardly mobile stock prices, and high volatility is typically present at the scene of market declines.

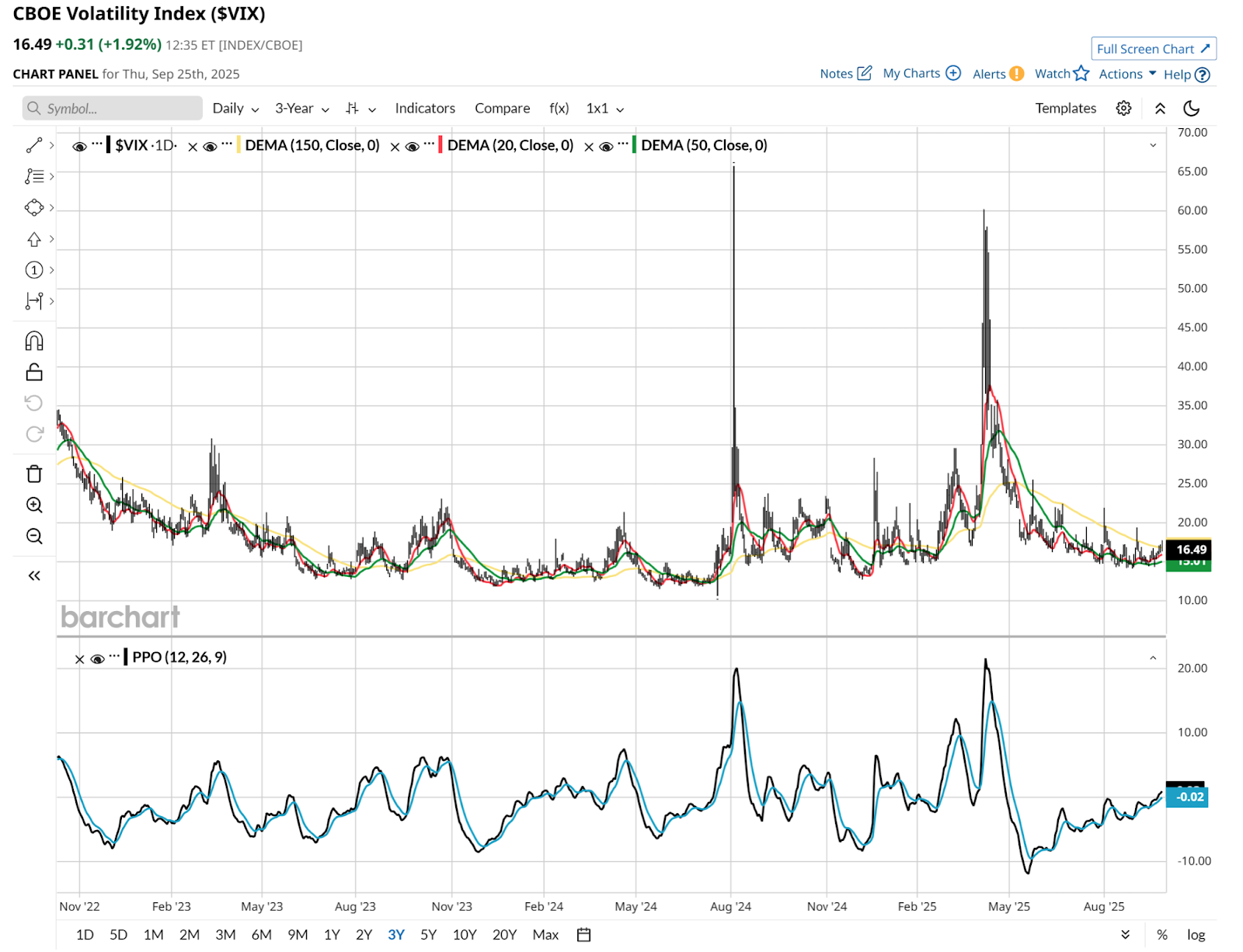

As the chart above shows, $VIX has been quite low over the past three years, yet also prone to quick, violent spikes. We saw that during the Japanese Yen “event” in August 2024, and again this past March and April, before and after “Liberation Day” in the U.S.

How Low Volatility Affects Selling Options

That a rising VIX is synonymous with a falling S&P 500 Index, and the opposite also being true, is more obvious than actionable. So let’s talk about how this can impact options sellers. That includes everything from:

- Covered call writing on stocks or ETFs we own,

- Covered call ETFs, and their ability to deliver high income payouts,

- Selling puts below the current price to get paid while daring a security to fall, while obligating yourself to buy it at that price during a set time frame,

- And the strategy I’ve written about here the most, which is using covered calls as the other side of an option collar strategy. And by doing so, knocking down the cost of the put options I purchased to set a “line in the sand” below which I am not exposed to a drop in the price of the underlying security.

Simply said, a persistently low VIX, a VIX “epidemic” such as we’ve had for much of this year, does not eliminate those option-selling trades. But it does two things that should concern investors.

- You are getting paid less to either cap your upside, or for taking downside risk. Neither is a good thing in my book.

- Your expectations for how those strategies, especially covered call ETFs, will work, are likely severely inflated.

The good news, I suppose, is that the market is showing hints that volatility is bottoming. That’s my take in looking at the daily chart above, particularly through the eyes of the Percentage Price Oscillator (PPO) indicator, which is trying to nudge into positive territory and remain there.

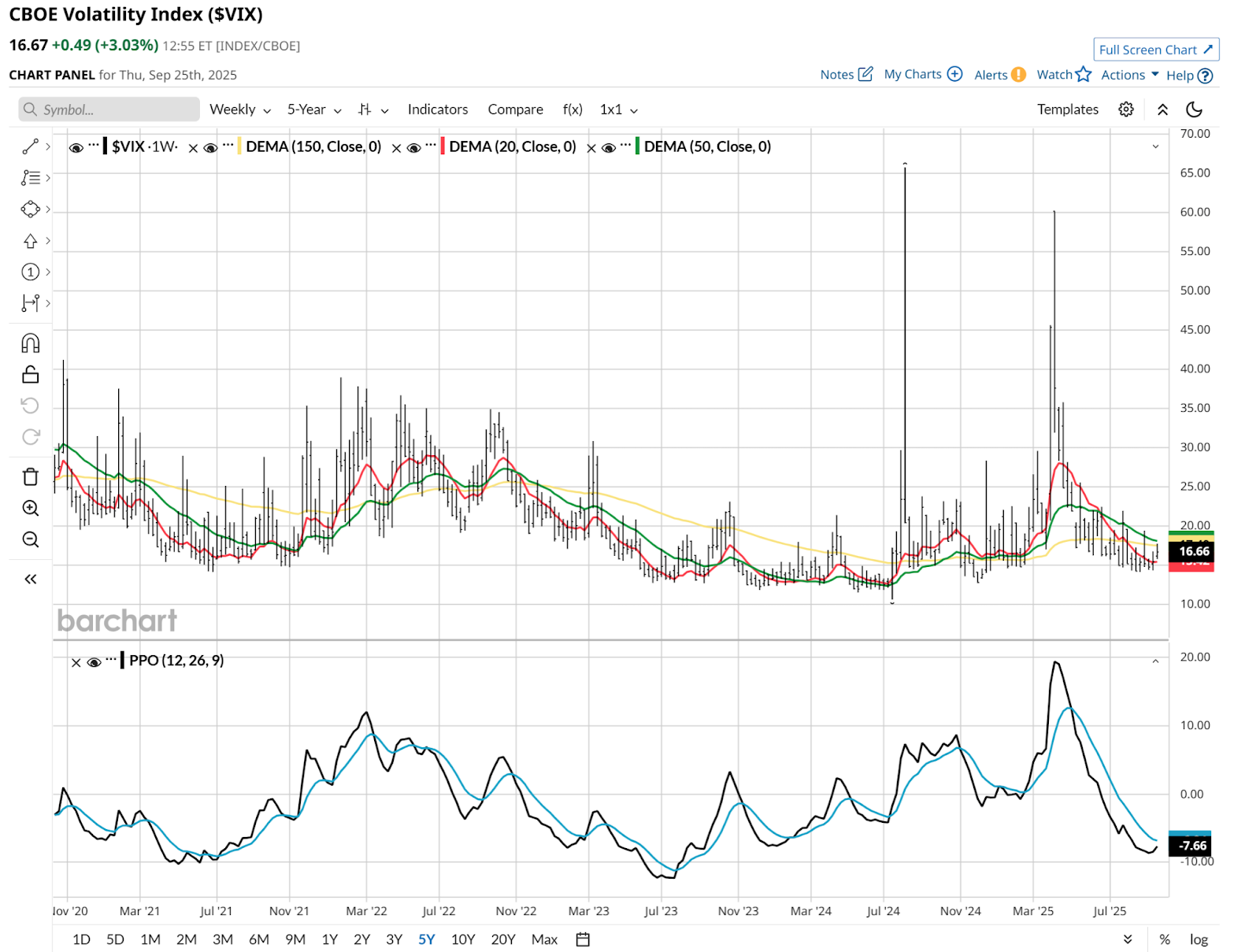

However, it’s early. That’s what this weekly chart below indicates to me.

Still, the nature of volatility, as shown plainly below, is that it often does not send a flare up to warn us that it is about to spike. So this is one of those market indicators that I tend to try to “front run” when trading it directly. That is, buy it when it is “overdue” to spike, and not commit too much capital to it.

The goal: Win big, or lose small.

However this continues to mess with those options strategies that pay us up front. Here’s a quick example, using a collar on the SPDR S&P 500 ETF (SPY), which I have made a central “anchor” in my broader trading.

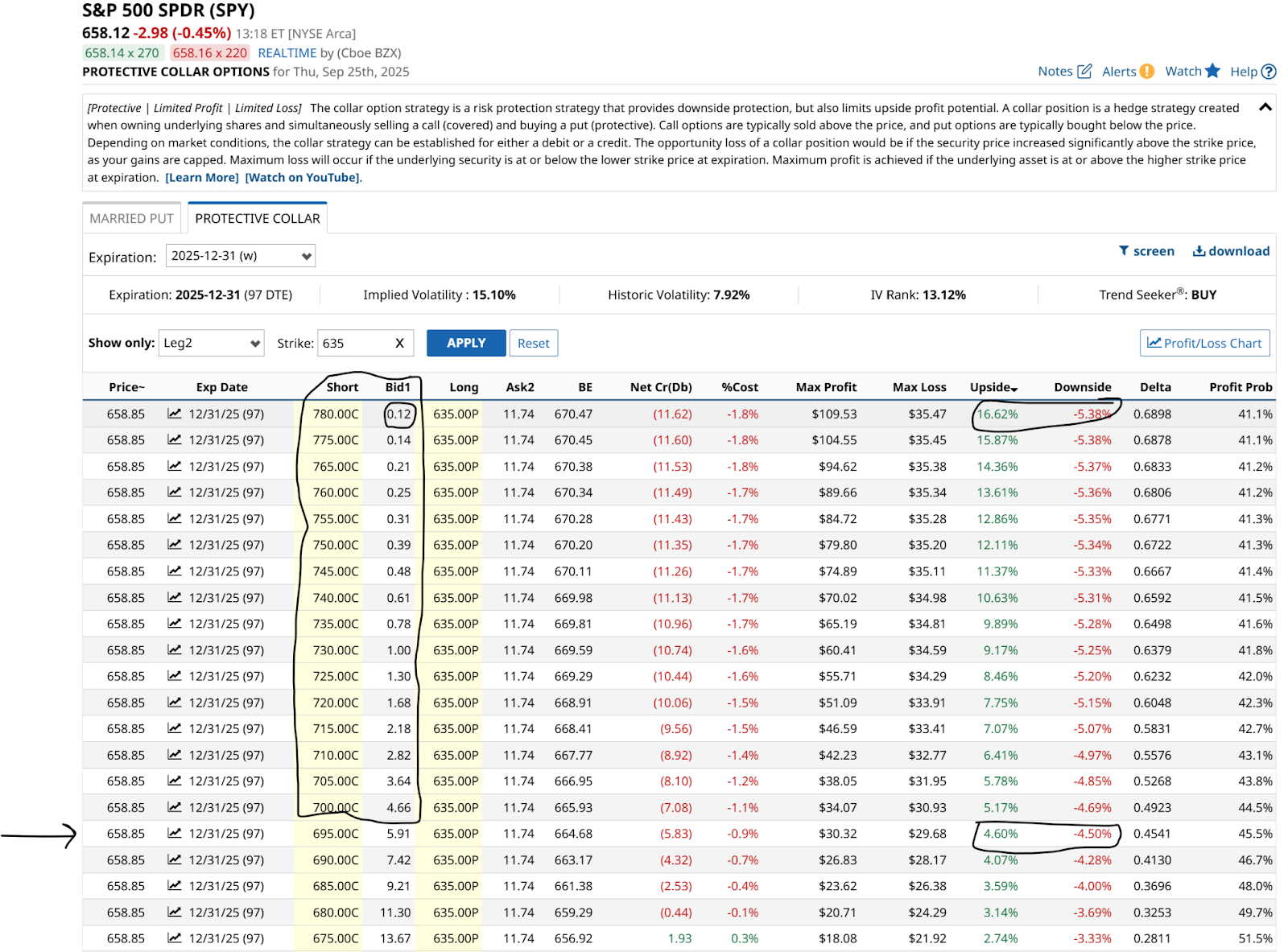

Below, I’m showing you a marked up, extended version of what I usually post when providing an option collar sample. Why show so many call option selling possibilities versus a $635 strike price put option through year-end? Because it clearly illustrates the low-VIX issue.

At first glance, doesn’t that top one look nice? 5% downside versus more than 16% upside over the next three months. Not bad. Except for one thing.

Is It Low V?

That low volatility in the SPY (IV Rank is 13%, meaning it is toward the low end of its 12-month range) makes it so that if I want to get that nice up/down ratio, I have to accept a mere $0.12 a share. In other words, I’d be about as well off just skipping the call side of the collar. Which is exactly what I’ve been doing for a while now.

Finally, as we move down the page, I’m looking for a point at which I can offset the $11.74 cost for the put. Not entirely, but maybe half of it. That does not occur until way down at the $695 strike price. Yikes! If you look to the right, I’ve circled where it shows that by doing that put/call strike combination, I am down to a 1:1 collar tradeoff. Which I’m not inclined to do. Ever.

So if you like selling options, perhaps you should be rooting for a rise in the VIX. Higher volatility will pay you more. Or, you can trade stocks or ETFs with higher volatility, since the market does not trade entirely in sync with S&P 500 volatility.

But be careful what you wish for, since a rising VIX is essentially Wall Street’s fear gauge rising. And that presents a host of other issues for us to grapple with.