Square (SQ Get Square, Inc. Class A Report stock has held up better than most growth stocks, but it hasn’t exactly been thriving.

Some stocks — like Nvidia (NVDA Get NVIDIA Corporation Report — have enjoyed a fresh run to new all-time highs, but most have been languishing most of the summer.

Square enjoyed a run to new highs in August, successfully fighting off the bear-market lows from May.

However, since topping out in August, the stock has been plagued by a series of lower highs, as the stock has continued to trend lower.

The stock is rallying on Tuesday, up almost 3% after some bullish commentary from Atlantic Equities.

With the rally, Square is trying to reclaim a key moving average. Let’s look at the chart.

Trading Square Stock

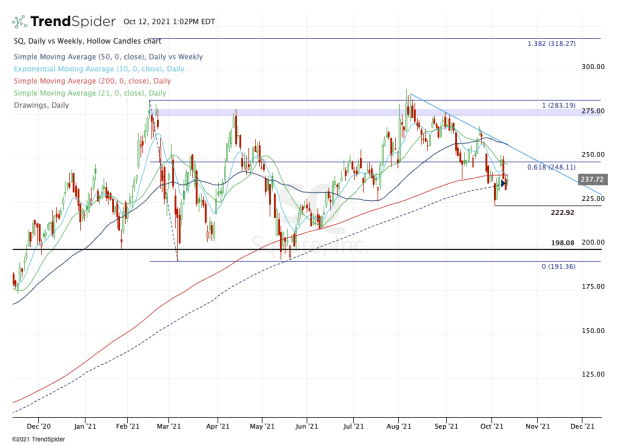

Chart courtesy of TrendSpider.com

As you can see above, Square is trying to reclaim the 200-day moving average with today’s rally. If it can do that, bulls may be able to recapture some momentum.

Above the 200-day moving average and the 61.8% retracement will be on the table, along with the $250 level.

If we zoom out to the start of the year, investors will notice how important this area has been for the stock. It has flip-flopped between support and resistance during that time, acting as a notable pivot depending on the trend.

Reclaiming this area opens the door to a test of the 50-day moving average and downtrend resistance (blue line).

Clearing these measures could put the key $275 resistance area on the table.

On the downside, the 50-week moving average will be important to keep an eye on. This measure was strong support near the bear-market low, although Square stock did waver around this measure earlier this month.

On a weekly basis though, the stock did not close below the 50-week moving average last week.

Should Square take out this week’s low at $232, it could open the door to the October low near $223. Below that could eventually put the $200 area in play.

So do we have the all-clear? No, not yet. Square needs to clear the 200-day moving average, then $250. But if it can do that, it could enjoy a solid fourth-quarter rally.

Nvidia is a holding in the Action Alerts PLUS member club. Want to be alerted before they buy or sell NVDA? Learn more now.

.jpg?w=600)