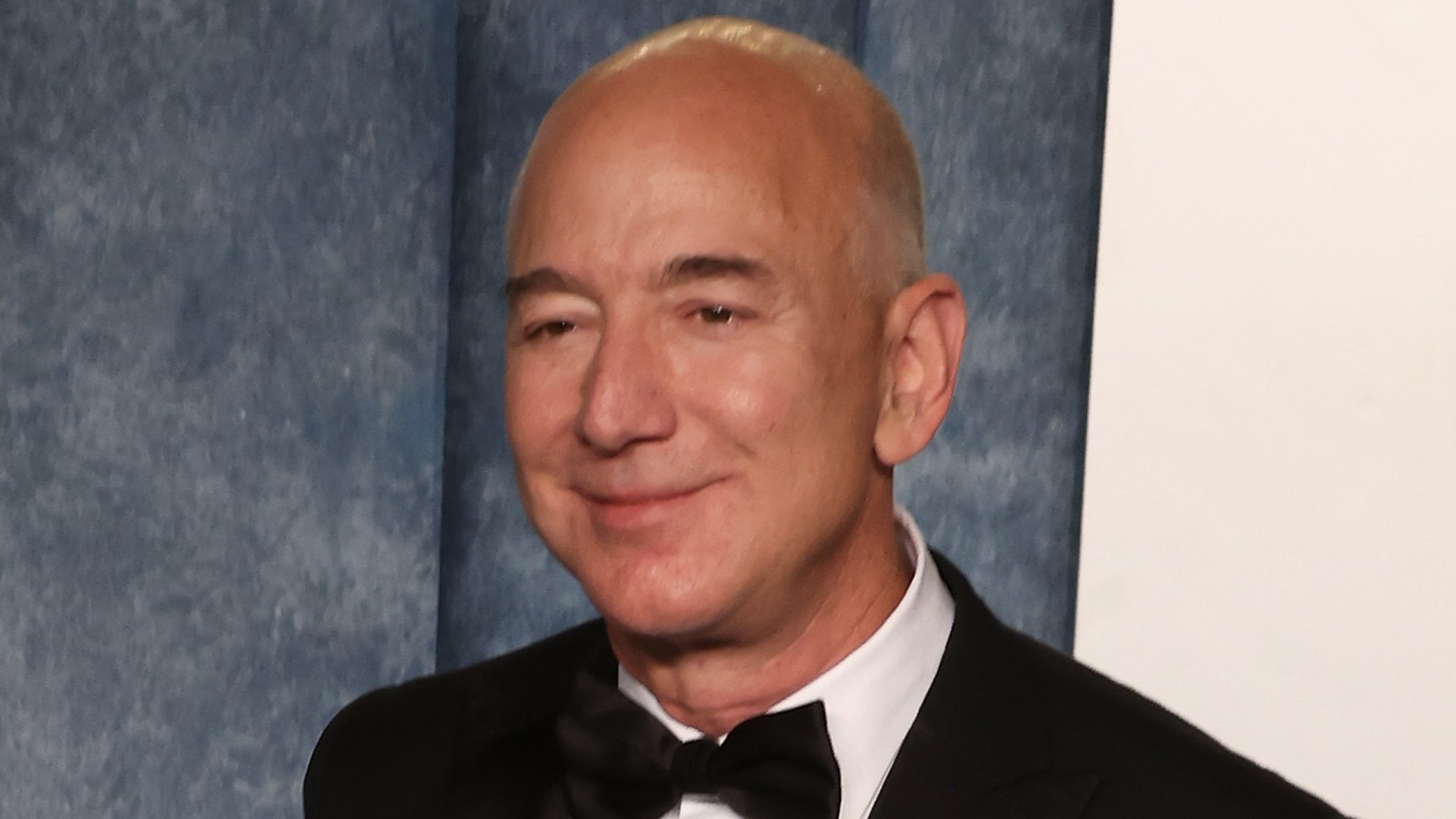

Jeff Bezos’ wealth is so massive that even 1% of it could generate life-changing monthly income. With a net worth of approximately $240.9 billion (as of late September), just 1% equals $2.409 billion — enough to create a monthly income that most people can’t even imagine.

Find Out: If Wealth Was Evenly Distributed Across America, How Much Money Would Every Person Have?

Read Next: 25 Places To Buy a Home If You Want It To Gain Value

Let’s break down what that kind of money could actually grow to in monthly income and how far it would go in America’s biggest cities.

The Monthly Income Calculation

Using conservative investment assumptions, $2.409 billion could generate major monthly income through a few different strategies:

Conservative Bond Portfolio (3% annual return): Monthly income: $6.02 million

Balanced Investment Portfolio (5% annual return): Monthly income: $10.04 million

High-Dividend Stock Portfolio (7% annual return): Monthly income: $14.05 million

Even the most conservative approach would make over $6 million per month in passive income. The higher-yield strategies could generate more than $14 million monthly without touching the principal amount. Not too shabby.

Learn More: If Bezos’ Wealth Was Evenly Distributed Across the US, How Much Would We Get?

What $6 Million Monthly Could Buy

The monthly income from 1% of Bezos’ wealth would be enough to afford almost anything imaginable. Here’s what $6 million per month could cover:

Luxury Real Estate: You could afford mortgage payments on a $150 million mansion. In fact, you could buy a different $6 million home every single month and never run out of money.

Transportation: Purchase a new Lamborghini every week and still have money left over. Buy a private jet every few months. Charter private flights anywhere in the world daily.

Daily Living: Eat at Michelin-starred restaurants for every meal. Hire full-time personal chefs, trainers, drivers and household staff. Shop for designer clothing without ever checking prices.

Charitable Giving: Donate $1 million per month to charity while still living an incredibly luxurious lifestyle on the remaining $5 million.

How This Income Compares to City Living Costs

See how this income would fair in various locations.

New York City

- Manhattan’s median household income is about $101,078 annually. Your monthly income of $6 million would be roughly 59 times that amount.

- Luxury penthouses can rent for around $50,000+ per month, so you could theoretically afford 120 such properties at once.

- The priciest restaurants may charge $300-$500 per person. Even dining three times daily at $400 per person would cost under $440,000 per year, which is still far below your monthly income.

San Francisco

- The median household income in San Francisco is approximately $141,446 annually, making your $6 million per month equal to almost 42 1/2 years of earnings for the average household.

- High-end rental homes may run about $40,000 per month, allowing you to lease 150 of them simultaneously.

- A Tesla Model S costs around $100,000, meaning you could purchase 60 of them each month.

Los Angeles

- In Los Angeles, the median household income is around $80,366 annually, so your monthly income equals about 74 1/2 years’ worth.

- Beverly Hills mansion rentals can range from $100,000 to $200,000 per month — you could afford 30 to 60 at once.

- Premium Lakers season tickets (courtside) costing $50,000 annually imply you could buy 120 tickets per year at that rate.

Miami

- The median household income in Miami is approximately $59,390 per year, making your monthly income equivalent to about 101 years’ income.

- Oceanfront luxury condos that rent for $20,000 to $30,000 per month could be leased — 200 to 300 at a time.

- A 100-foot yacht charter costing $50,000 per week would allow you to charter more than 24 yachts per month.

The Spending Challenge

Interestingly, spending $6 million monthly would actually be challenging. Here’s why:

Physical Limitations: You can only eat so many meals, live in so many homes or drive so many cars. After covering luxury housing, transportation, food and entertainment, you’d still have millions left over each month.

Investment Growth: If you only spent $3 million monthly and reinvested the other $3 million, your wealth would continue growing faster than you could spend it.

Time Constraints: Enjoying expensive experiences takes time. Private jet travel, luxury dining and entertainment can only fill so many hours per day.

What This Money Could Fund Beyond Personal Spending

With monthly income exceeding what most people need for ultimate luxury, the money could fund significant projects:

Business Ventures: Start multiple companies each month with million-dollar funding rounds. Launch restaurants, tech startups or real estate developments without worrying about returns.

Social Impact: Fund scholarships for 1,000 students annually at $50,000 each. Build homeless shelters, food banks or community centers in different cities each month.

Research and Development: Finance medical research, clean energy projects or space exploration initiatives. Your monthly income could fund entire university research departments.

The Reality of Extreme Wealth

This exercise reveals the almost incomprehensible scale of Jeff Bezos’ wealth. Even 1% of his net worth generates more monthly income than most people could practically spend on themselves.

The calculation also highlights wealth inequality in America. While the average American household earns around $70,000 annually, 1% of one person’s wealth could generate 100 times that amount every single month.

More From GOBankingRates

- 5 Luxury SUVs That Will Have Massive Price Drops in Fall 2025

- I Help People Retire Every Day -- Here's the Most Common Retirement Mistake People Make

- How Much Money Is Needed To Be Considered Middle Class in Your State?

- 6 Popular SUVs That Aren't Worth the Cost -- and 6 Affordable Alternatives

This article originally appeared on GOBankingRates.com: How Much Monthly Income Could You Get From 1% of Jeff Bezos’ Wealth?