With a market cap of $43.4 billion, Xcel Energy Inc. (XEL) is a leading regulated utility holding company. Through its subsidiaries, the company provides electricity and natural gas to residential, commercial, and industrial customers across eight states, including Colorado, Minnesota, Texas, and Wisconsin.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and Xcel Energy fits this criterion perfectly. Xcel generates power from a diverse mix of sources ranging from wind, solar, hydro, and nuclear to coal and natural gas, while advancing initiatives to deliver cleaner, more sustainable energy.

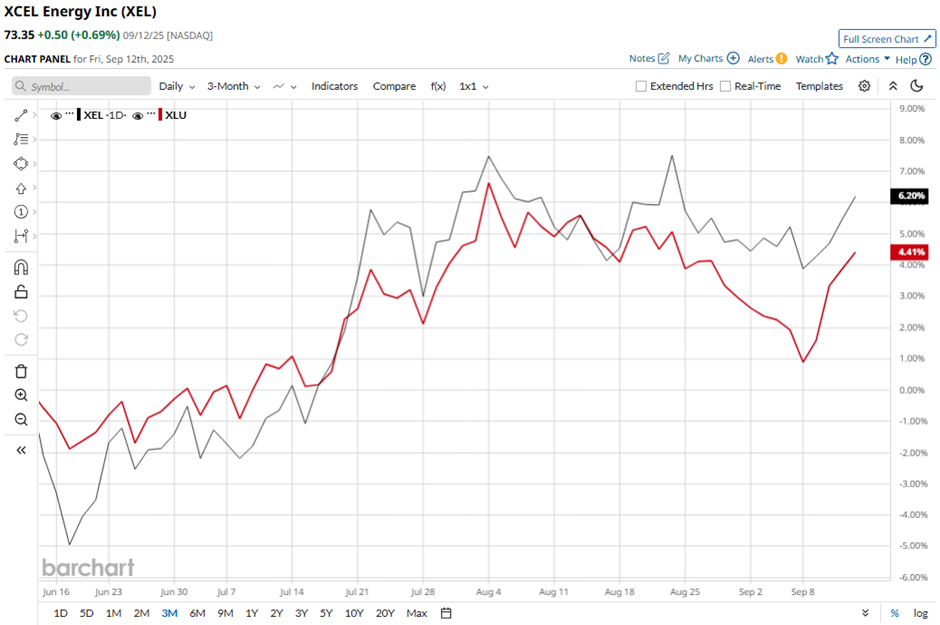

Shares of the Minneapolis, Minnesota-based company have dipped 1.6% from its 52-week high of $74.57. Shares of Xcel Energy have risen 6.2% over the past three months, outperforming the Utilities Select Sector SPDR Fund's (XLU) 5.2% gain during the same period.

Longer term, XEL stock has returned 14.8% over the past 52 weeks, outpacing XLU's 9.1% increase over the same time frame. However, the utility company’s shares have gained 8.6% on a YTD basis, lagging behind XLU's 13.2% rise.

Yet, the stock has been trading above its 200-day moving average since last year.

Shares of Xcel Energy rose 1.5% on Jul. 31 after the company posted strong Q2 2025 results, with EPS of $0.75 beating the consensus estimate and improving 38.9% year-over-year. Investors were encouraged by an 8.6% revenue increase to $3.3 billion, driven by higher electric segment revenues of $2.9 billion and natural gas revenues of $396 million. Confidence was further supported by Xcel reaffirming its 2025 EPS guidance of $3.75 - $3.85 and outlining a $45 billion investment plan for 2025 - 2029 to enhance infrastructure and growth.

Nevertheless, Xcel Energy stock has underperformed its rival WEC Energy Group, Inc. (WEC). WEC stock has returned 16.3% over the past 52 weeks and 17.5% on a YTD basis.

Despite XEL’s underperformance relative to its industry peers, analysts are moderately optimistic with a consensus rating of "Moderate Buy" from 15 analysts. The mean price target of $78.54 is a premium of 7.1% to current levels.