/Willis%20Towers%20Watson%20Public%20Limited%20Co%20office%20sign-by%20JHVEPhoto%20via%20iStock.jpg)

With a market cap of $32.6 billion, Willis Towers Watson Public Limited Company (WTW) is a leading global advisory, broking, and solutions company, serving clients worldwide. Through its two segments: Health, Wealth & Career and Risk & Broking, the firm delivers services that help organizations manage risk, optimize benefits, and enhance performance.

Companies valued over $10 billion are generally described as “large-cap” stocks, and Willis Towers Watson fits right into that category. Headquartered in London, the United Kingdom, the company combines deep expertise, data-driven insights, and innovative solutions to support businesses of all sizes.

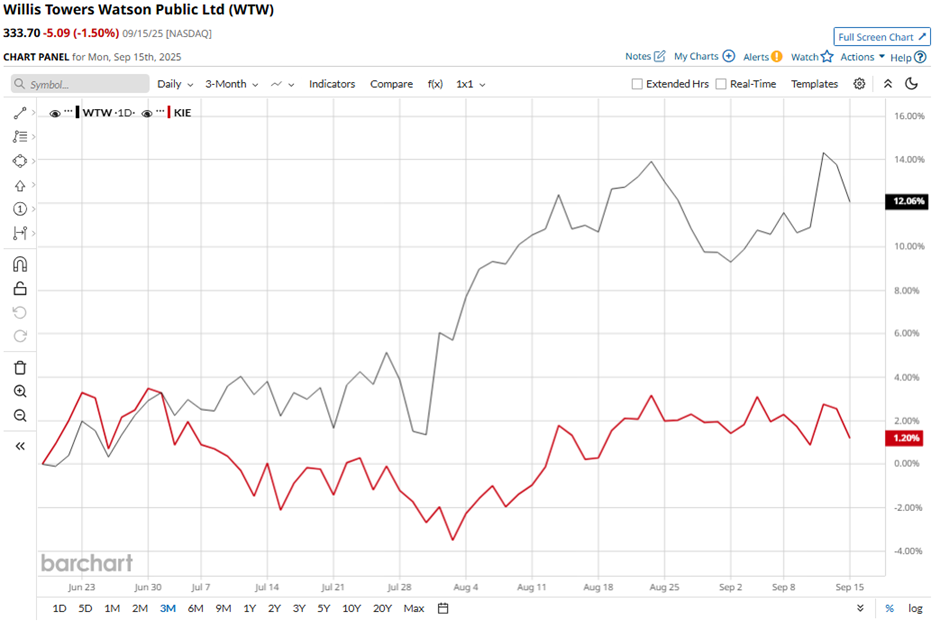

Shares of the advisory, broking and solutions company have dipped over 3% from its 52-week high of $344.14. WTW stock has increased 12.6% over the past three months, outperforming the SPDR S&P Insurance ETF’s (KIE) marginal rise over the same time frame.

In the longer term, the stock has risen 6.5% on a YTD basis, outpacing KIE’s 3.4% gain. Moreover, shares of Willis Towers Watson have soared 14.8% over the past 52 weeks, compared to KIE’s 4.5% return over the same time frame.

WTW stock has been trading above its 50-day and 200-day moving averages since August.

Shares of WTW climbed 4.6% on Jul. 31 after the company reported strong Q2 2025 results, with adjusted EPS of $2.86, beating the consensus estimate and rising 20% year-over-year. Revenue came in at $2.26 billion, topping expectations, driven by solid organic growth in the Risk & Broking segment and improved margins from cost reductions.

Additionally, rival Brown & Brown, Inc. (BRO) has underperformed WTW stock. Shares of Brown & Brown have decreased 10.4% on a YTD basis and 12.2% over the past 52 weeks.

Although the stock has outperformed, analysts remain cautiously optimistic about its prospects. WTW stock has a consensus rating of “Moderate Buy” from 22 analysts' coverage, and the mean price target of $365.31 is a premium of 9.5% to current levels.