The Williams Companies, Inc. (WMB) is a leading U.S. energy infrastructure company headquartered in Tulsa, Oklahoma. It primarily operates natural-gas pipelines and processing facilities, transporting and processing natural gas across the country. With a market cap of $74.4 billion, the company owns and operates midstream gathering and processing assets and interstate natural gas pipelines.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and WMB perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the oil & gas midstream industry. As a major midstream operator, Williams plays a key role in supplying natural gas for power generation, heating, and industrial use, with a business model that generates stable, fee-based revenue and lower exposure to commodity-price volatility.

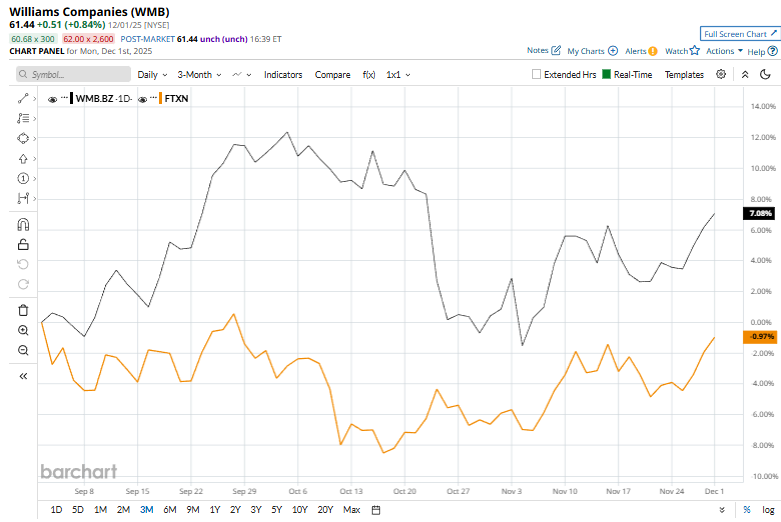

Despite its notable strength, WMB slipped 6.3% from its 52-week high of $65.55, achieved on Oct. 2. Over the past three months, WMB stock surged 6.2%, outperforming the First Trust Nasdaq Oil & Gas ETF (FTXN), which has dropped marginally during the same time frame.

In the longer term, shares of WMB rose 13.5% on a YTD basis and 5% over the past 52 weeks, outperforming FTXN’s marginal YTD gain and a 9.3% drop over the last year.

The stock has experienced some fluctuations recently and has climbed over the 200-moving average since early November and has remained below its 50-day moving average since late October.

WMB shares rose 2% on Nov. 3 following the release of its third-quarter results. Williams reported adjusted earnings of $0.49 per share, just shy of the $0.51 expected by analysts, while revenue totaled $2.9 billion, slightly below the $3 billion forecast. The company maintained its full-year guidance, projecting adjusted EPS between $2.01 and $2.19.

WMB’s rival, Kinder Morgan, Inc. (KMI) shares lagged behind the stock, with a marginal downtick on a YTD basis and a 3.5% drop over the past 52 weeks.

Wall Street analysts are reasonably bullish on WMB’s prospects. The stock has a consensus “Moderate Buy” rating from the 22 analysts covering it, and the mean price target of $68.75 suggests a potential upside of 11.9% from current price levels.