Valued at a market cap of $184.4 billion, Burbank, California-based The Walt Disney Company (DIS) is a global entertainment powerhouse with operations spanning film, television, streaming, publishing, and theme parks. It produces and distributes content through well-known brands such as Disney, Pixar, Marvel, Lucasfilm, National Geographic, and ESPN.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and Walt Disney fits this criterion perfectly. The company also operates popular direct-to-consumer streaming services, including Disney+ and Hulu, alongside its extensive theme parks and resort experiences worldwide.

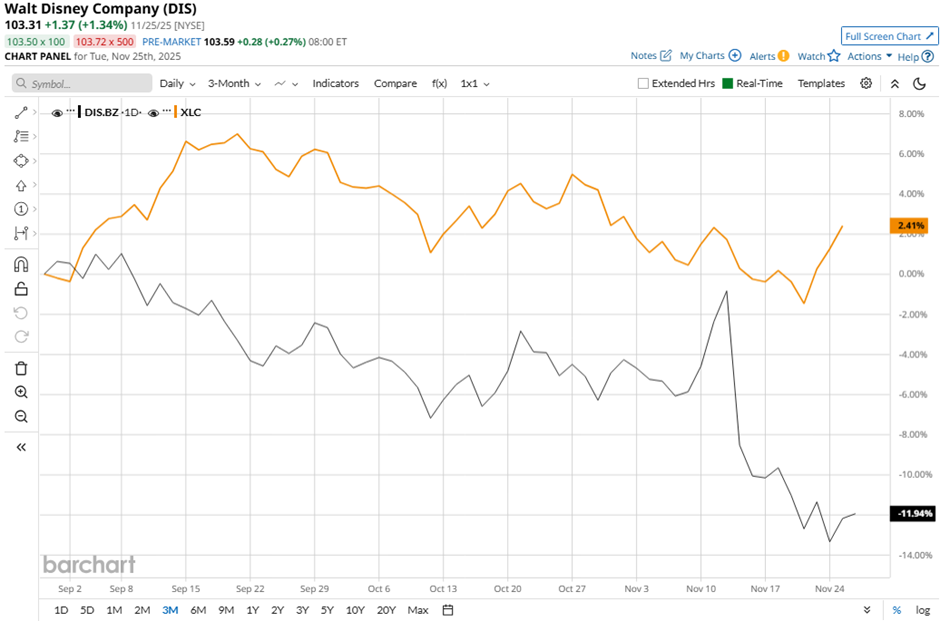

However, shares of the company have fallen 17.3% from its 52-week high of $124.69. Walt Disney shares have declined 12.2% over the past three months, underperforming the broader Communication Services Select Sector SPDR ETF Fund's (XLC) 2.5% rise during the same period.

In the long term, DIS stock has decreased 7.2% on a YTD basis, lagging behind XLC's 18.1% surge over the same period. Moreover, shares of Walt Disney have dropped 10.9% over the past 52 weeks, compared to XLC's 17.4% gain.

The stock has been trading below its 50-day moving average since August.

Despite posting better-than-expected Q4 2025 adjusted EPS of $1.11, Disney shares tumbled 7.8% on Nov. 13 as the company missed revenue expectations with $22.46 billion. Investors were alarmed by the YouTube TV blackout, which threatens a major distribution channel with about 10 million subscribers, and Morgan Stanley estimated a 14-day outage could cost Disney $60 million in revenue.

Ongoing weakness in the traditional TV unit, where profit fell 21% to $391 million, along with a one-third drop in entertainment operating income, overshadowed strength in streaming and parks.

In contrast, rival Netflix, Inc. (NFLX) has outperformed Walt Disney stock. Netflix shares have increased 20.6% over the past 52 weeks and 17.1% on a YTD basis.

Despite DIS' underperformance over the past year, analysts remain moderately optimistic about its prospects. Among the 30 analysts covering the stock, there is a consensus rating of “Moderate Buy,” and the mean price target of $133.73 is a premium of 29.4% to current levels.