/Truist%20Financial%20Corporation%20%20sign-%20by%20Brett%20Hondow%20via%20Shutterstock.jpg)

Truist Financial Corporation (TFC), headquartered in Charlotte, North Carolina, is a leading financial services provider specializing in banking and trust services. Valued at $60 billion by market cap, the company provides a diverse array of services, encompassing retail, small business, and commercial banking, asset management, capital markets, commercial real estate, corporate and institutional banking, insurance, mortgage, payments, and specialized lending and wealth management solutions.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and TFC perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the banks - regional industry. TFC’s strong brand and client-first approach have secured its leading market share in high-growth U.S. markets. By prioritizing client needs, TFC fosters loyalty among consumers and small businesses, driving revenue diversification and profitability. Its strategic investments in digital platforms further enhance its competitiveness, meeting evolving client expectations in a digital landscape.

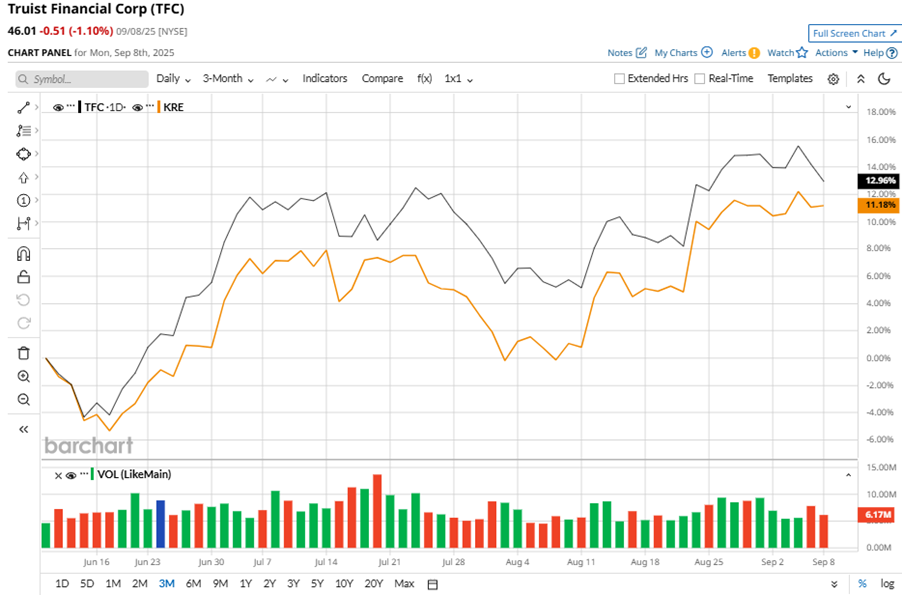

Despite its notable strength, TFC slipped 6.2% from its 52-week high of $49.06, achieved on Nov. 25, 2024. Over the past three months, TFC stock gained 13.2%, outperforming the SPDR S&P Regional Banking ETF’s (KRE) 12.9% gains during the same time frame.

In the longer term, shares of TFC rose 6.1% on a YTD basis and climbed 9.4% over the past 52 weeks, underperforming KRE’s YTD gains of 8.6% and 19.5% returns over the last year.

To confirm the bullish trend, TFC has been trading above its 50-day moving average since mid-May, with minor fluctuations. The stock has been trading above its 200-day moving average since late June, with slight fluctuations.

TFC's underperformance is due to higher net interest income and total non-interest income, as well as lower expenses. In addition, elevated expenses and weak asset quality in a challenging operating environment are major challenges for the company.

On Jul. 18, TFC shares closed down more than 1% after reporting its Q2 results. Its adjusted EPS of $0.91 missed the consensus estimate by a penny. The company’s total revenues were $4.99 billion, marginally beating the consensus estimate of $4.98 billion.

TFC’s rival, Fifth Third Bancorp (FITB) shares have taken the lead over the stock, with a 7.6% uptick on a YTD basis and 11.8% returns over the past 52 weeks.

Wall Street analysts are reasonably bullish on TFC’s prospects. The stock has a consensus “Moderate Buy” rating from the 23 analysts covering it, and the mean price target of $49.12 suggests a potential upside of 6.8% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.