/Ralph%20Lauren%20Corp%20sign%20and%20logo%20by-%20Robert%20Way%20via%20iStock.jpg)

With a market cap of $18.6 billion, Ralph Lauren Corporation (RL) is a global leader in premium lifestyle products, renowned for its luxury apparel, accessories, fragrances, home furnishings, and hospitality services. Founded in 1967 by Ralph Lauren in New York City, the company has evolved from a modest necktie line into a diversified brand portfolio that includes Polo Ralph Lauren, Ralph Lauren Purple Label, Lauren, Chaps, Double RL, and Ralph Lauren Home.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and RL fits right into that category with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the apparel manufacturing industry.

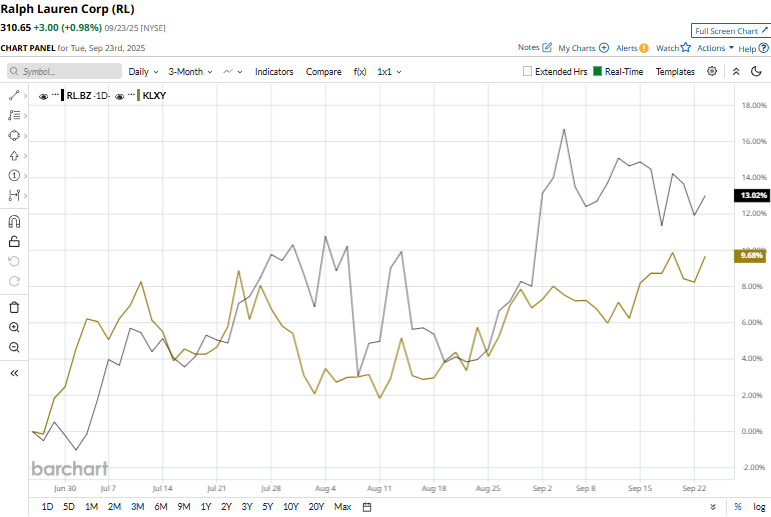

RL shares recently touched their 52-week high of $321.77 on Sept. 5, and are currently trading 3.5% below the peak. Over the past three months, RL stock rose 14.8%, outperforming the Kraneshares Global Luxury Index ETF’s (KLXY) 10% rise over the same time frame.

In the longer term, shares of RL rose 34.5% on a YTD basis and climbed 67.1% over the past 52 weeks, outperforming KLXY’s YTD 10.1% gain and 12.1% returns over the last year.

To confirm the bullish trend, RL has been trading above its 200-day moving average since the end of April and above its 50-day moving average since early May.

On September 16, Ralph Lauren shares fell over 1% after the company forecasted mid-single-digit annual sales growth through fiscal 2028, signaling a slowdown compared to recent quarterly performance.

RL’s rival, V.F. Corporation (VFC) shares have lagged behind the stock, with 30.9% losses on a YTD basis and a 19.2% downtick over the past 52 weeks.

Wall Street analysts are moderately bullish on RL’s prospects. The stock has a consensus “Moderate Buy” rating from the 19 analysts covering it, and the mean price target of $340.06 suggests a potential upside of 9.5% from current price levels.