With a market cap of $51.7 billion, Public Storage (PSA) is the largest owner and operator of self-storage facilities. Structured as a REIT, the company acquires, develops, owns, and operates storage properties that provide month-to-month leasing options for personal and business use.

Companies valued at more than $10 billion are generally considered “large-cap” stocks, and Public Storage fits this criterion perfectly. As of June 30, 2025, Public Storage managed 3,432 facilities across 40 states, along with a 35% equity interest in Shurgard Self Storage Limited, which operates 321 facilities in Western Europe.

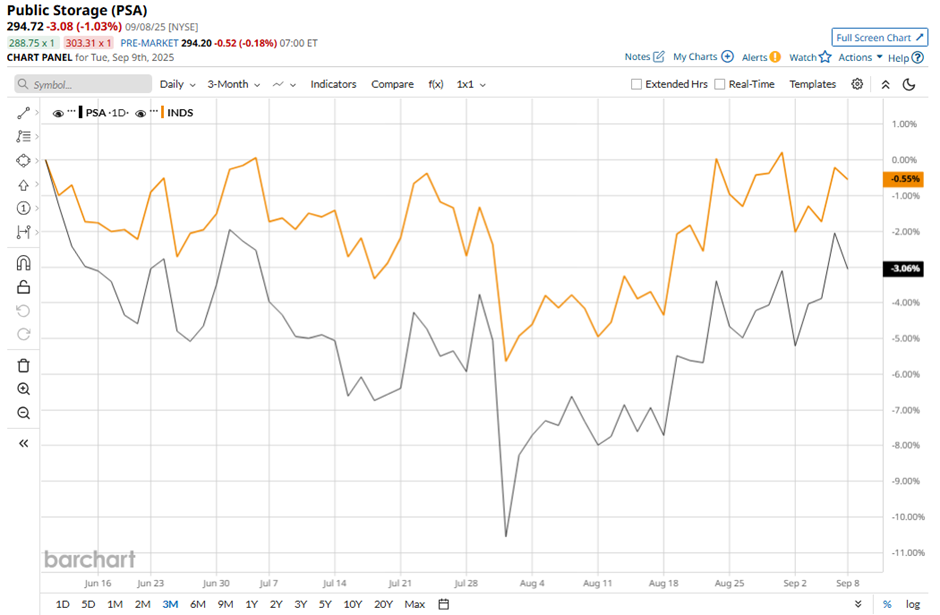

Despite this, shares of the Glendale, California-based company have dipped 20.5% from its 52-week high of $369.99. PSA stock has decreased 2.8% over the past three months, lagging behind the Pacer Benchmark Industrial Real Estate SCTR ETF’s (INDS) 1.1% rise during the same period.

Longer term, Public Storage’s shares have fallen 1.8% on a YTD basis, underperforming INDS' 5.8% gain. Moreover, the self-storage facility REIT stock has dropped 16.3% over the past 52 weeks, compared to INDS's nearly 12% decline over the same time frame.

The stock has been trading below its 200-day moving average since mid-December last year.

Despite Public Storage's better-than-expected Q2 2025 core FFO of $4.28 per share and revenues of $1.2 billion on Jul. 30, same-store occupancy declined 0.4% year over year to 92.6%, same-store NOI slipped 0.6%, and expenses rose 2.9%, signaling margin pressure. Additionally, management’s updated guidance implied muted same-store growth and highlighted higher costs, which overshadowed the earnings beat and drove the 5.8% share drop the next day.

In comparison, its rival, Extra Space Storage Inc. (EXR), has shown less pronounced decline than PSA stock. EXR stock has dipped 1.7% on a YTD basis and 15.9% over the past 52 weeks.

Despite the stock’s underperformance, analysts are moderately optimistic, with a consensus rating of "Moderate Buy" from 22 analysts. The mean price target of $323.31 is a premium of 9.7% to current levels.