/Paycom%20Software%20Inc%20online%20payment%20stock%20phone-by%20Tevarak%20via%20iStock.jpg)

Oklahoma City-based Paycom Software, Inc. (PAYC) is a $12.7 billion market-cap company providing a cloud-based human capital management (HCM) platform for small to mid-sized businesses. Its SaaS solution integrates payroll, HR, talent management, and time tracking into a single, comprehensive platform.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Paycom Software fits this description perfectly. It stands out in the HCM sector due to its unified, cloud-based platform that integrates payroll, HR, talent management, and time tracking, eliminating the need for multiple systems and streamlining operations.

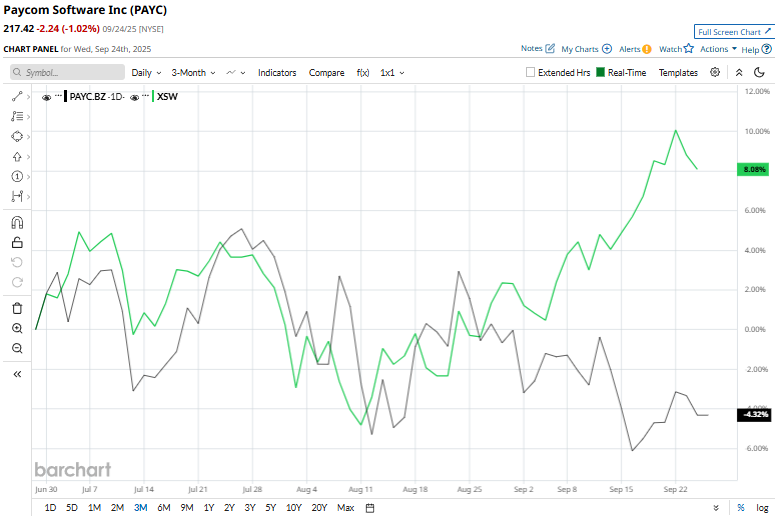

However, it’s not all sunshine and rainbows for the Paycom Software stock. It has dipped 18.8% from the 52-week high of $267.76. PAYC stock has decreased 7.5% over the past three months, underperforming the SPDR S&P Software & Services ETF’s (XSW) 8.6% uptick during the same time frame.

In the long term, Paycom Software’s stock has risen 6.1% on a YTD basis, whereas XSW has returned 6.7%. Moreover, over the past 52 weeks, shares of PAYC have soared 25.2%, slightly trailing the ETF’s 26.1% rise.

The stock has been trading below its 50-day moving average since mid-June and has slipped below its 200-day moving average since early September.

On August 6, Paycom shares jumped 4.5% after the company reported Q2 2025 results that beat expectations, delivering an adjusted EPS of $2.06 and revenue of $483.6 million. The company also raised its full-year revenue guidance to $2.05–$2.06 billion and upped its core profit forecast to $872–$882 million. Investor enthusiasm was further fueled by strong demand for Paycom’s new AI-driven features, which streamline HR processes and elevate employee management, highlighting the company’s innovation edge in the HCM space.

In comparison, rival Autodesk, Inc. (ADSK) has lagged behind PAYC stock. ADSK stock has gained 20% over the past 52 weeks.

PAYC stock has a consensus rating of “Moderate Buy” from the 19 analysts covering the stock. Its mean price target of $250.71 represents a potential upside of 15.3% from the current market prices.