/L3Harris%20Technologies%20Inc%20NY%20office%20building-by%20JHVEPhoto%20via%20iStock.jpg)

With a market cap of $45.8 billion, L3Harris Technologies, Inc. (LHX) is a leading global aerospace and defense contractor, formed in 2019 through the merger of L3 Technologies and Harris Corporation. Headquartered in Melbourne, Florida, the company provides mission-critical systems across air, land, sea, space, and cyber domains.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and L3Harris Technologies fits this criterion perfectly. Its market leadership stems from its diversified defense portfolio, strong operational execution, and strategic positioning in high-demand sectors like communications, space, and missile propulsion.

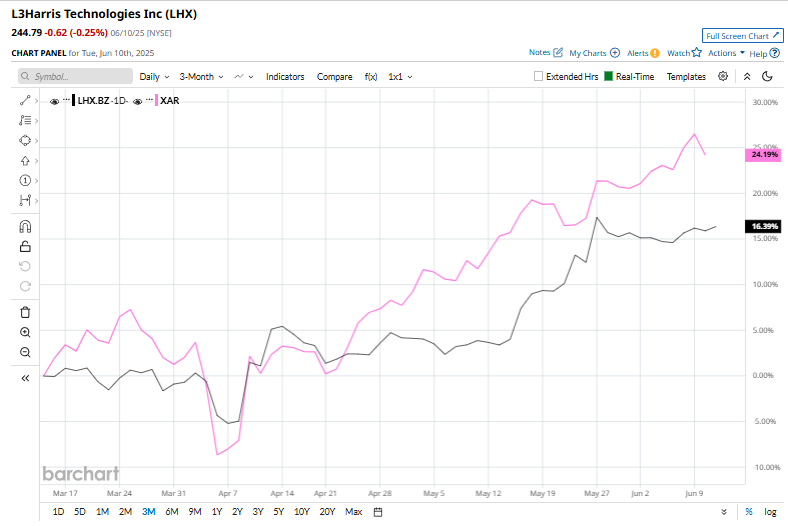

However, LHX shares are currently down 7.9% from their 52-week high of $265.74 reached on Nov. 11. Shares of the defense giant have surged 12.4% over the past three months, surpassing the SPDR S&P Aerospace & Defense ETF’s (XAR) 24.9% return over the same time frame.

LHX stock is up 16.4% on a YTD basis, outperforming XAR’s 18.8% decline. However, shares of L3Harris have climbed 10.6% over the past 52 weeks, lagging behind XAR’s 38.8% rise in the same time frame.

Nevertheless, LHX has been trading above its 50-day moving average since early April and over its 200-day moving average since mid-May, indicating an uptrend.

Following the release of its Q1 earnings on April 24, L3Harris Technologies saw a marginal dip in its share price. Revenue came in at $5.1 billion, falling short of analyst expectations by 1.9%, largely due to weaker sales in Integrated Mission Systems and a drop in Space & Airborne Systems revenue. But, its adjusted EPS rose 7.1% year-over-year to $2.41, exceeding forecasts.

Due to the recent divestiture of its Commercial Aviation Solutions business, the company has revised its full-year 2025 guidance downward, now expecting revenue to be between $21.4 billion and $21.7 billion, with adjusted EPS projected to be in the $10.30 to $10.50 range.

In the dynamic defense and aerospace landscape, LHX has underperformed its key rival, GE Aerospace (GE). GE has skyrocketed 48.6% over the past year and 45.1% in 2025.

The stock has a consensus rating of “Strong Buy” from 20 analysts' coverage, and its mean price target of $262.24 implies an upswing potential of 7.1% from the current market prices.