/Jacobs%20Solutions%20Inc%20logo%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $17.6 billion, Jacobs Solutions Inc. (J) is a global leader in providing professional services, including consulting, technical, scientific, and project delivery solutions. Headquartered in Dallas, Texas, Jacobs operates across various sectors, delivering end-to-end services in advanced manufacturing, cities and places, energy, environmental, life sciences, transportation, and water.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and Jacobs Solutions perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the engineering & construction industry. With its diverse service offerings and focus on innovation, the company is well-positioned to address the complex challenges of its clients globally.

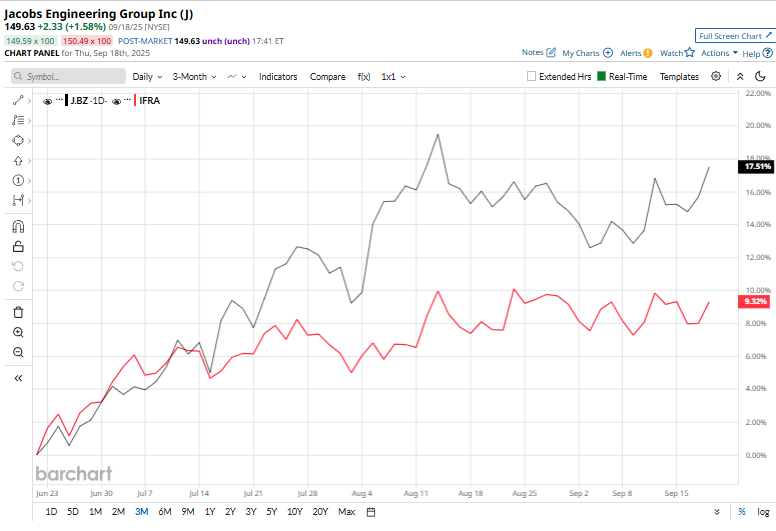

J shares have fallen 1.8% from their 52-week high of $152.40, achieved on Aug. 13. Over the past three months, J stock has gained 17.5%, substantially outpacing the iShares U.S. Infrastructure ETF’s (IFRA) 8.9% rise over the same time frame.

Shares of J have surged 12% on a YTD basis but climbed 23.4% over the past 52 weeks, compared to IFRA’s YTD gains of 12.5% and 12.9% returns over the last year.

To confirm the bearish trend, J has been trading over its 50-day moving average since late April, and has remained above its 200-day moving average since early July.

On Aug. 5, Jacobs shares popped 3.8% after releasing its third-quarter earnings. Revenue jumped 5.1% year-over-year to $3 billion, comfortably beating analyst expectations of $2.2 billion. Its adjusted EPS surged 24.6% to $1.62, surpassing Wall Street estimates. The company also reported a 14% increase in its backlog, reaching a record high and highlighting robust forward demand.

Buoyed by these results, management raised its fiscal 2025 guidance for the second time, now anticipating adjusted net revenue growth of approximately 5.5% year over year and adjusted EPS in the range of $ 6.00 to $6.10.

Key rival, TopBuild Corp. (BLD), has taken the lead over J in 2025, showing resilience with a 34.5% return on a YTD basis. However, BLD shares lagged behind the stock with a 5.2% gain over the past 52 weeks.

Wall Street analysts are moderately bullish on J’s prospects. The stock has a consensus “Moderate Buy” rating from the 17 analysts covering it, and the mean price target of $157 suggests a potential upside of 4.9% from current price levels