/IQVIA%20Holdings%20Inc%20phone%20and%20site-%20by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $32.2 billion, IQVIA Holdings Inc. (IQV) is a leading global provider of advanced analytics, technology solutions, and clinical research services for the life sciences industry. Based in Durham, North Carolina, the company operates through four segments: Technology & Analytics Solutions, Research & Development Solutions, Contract Sales & Medical Solutions, and Contract Sales & Medical Solutions.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and IQVIA fits this criterion perfectly. IQVIA is positioned for steady growth supported by its diverse offerings and strong backlog, with digital health and AI trends providing long-term tailwinds.

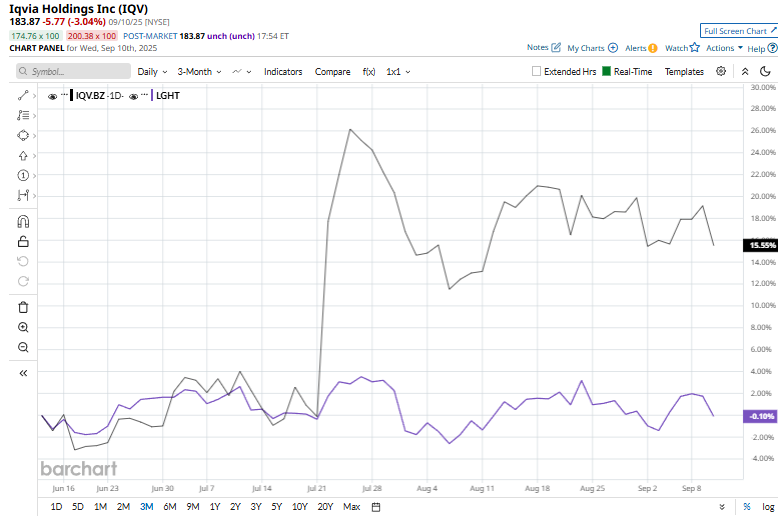

But, its not all sunshine and rainbows for the stock. Shares of IQVIA have dipped 25.9% from its 52-week high of $248.03. IQV stock has surged 15.1% over the past three months, outperforming the Langar Global Healthtech ETF’s (LGHT) 1.3% decrease.

On a YTD basis, IQVIA’s stock has crumbled 6.4%, lagging behind LGHT’s marginal rise. Additionally, over the past 52 weeks, shares of IQV have plunged nearly 21.8%, compared to LGHT’s 2.3% drop.

Indicating an uptrend, the stock has been trading above its 50-day moving average since early June and over its 200-day moving average since mid-July.

On July 22, IQVIA shares jumped 17.9% following the release of its Q2 results, with adjusted EPS of $2.81 topping Wall Street’s estimate of $2.76. Revenue came in at $4.02 billion, also ahead of expectations of $3.96 billion. Looking ahead, the company guided for full-year adjusted EPS between $11.75 and $12.05 and revenue in the range of $16.1 to $16.3 billion.

Moreover, top rival Agilent Technologies, Inc. (A) shares have fallen 7.6% on a YTD basis, lagging behind IQV. However, A shares have dropped 10.1% over the past 52 weeks, surpassing IQV’s drop over the same time frame.

IQV has a consensus rating of “Strong Buy” from the 22 analysts covering the stock, and its mean price target of $213.52 implies an upswing potential of 16.1% from the current market prices.