Austin, Minnesota-based Hormel Foods Corporation (HRL) develops, processes, and distributes a range of meat, nuts, and other food products to foodservice, convenience store, and commercial customers. Valued at $13.7 billion by market cap, the company markets its products around the world under a variety of branded names like HORMEL, ALWAYS TENDER, APPLEGATE, AUSTIN BLUES, BLACK LABEL, BURKE, CAFÉ H, CHI-CHI'S, and more.

Companies worth $10 billion or more are typically classified as “large-cap stocks,” and HRL fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the packaged foods industry. HRL's strong brand portfolio, including Planters and Jennie-O, drives its market presence and financial performance. The company's focus on operational excellence through its Transform and Modernize initiative has improved efficiencies, contributing to increased profitability and better positioning to navigate market fluctuations.

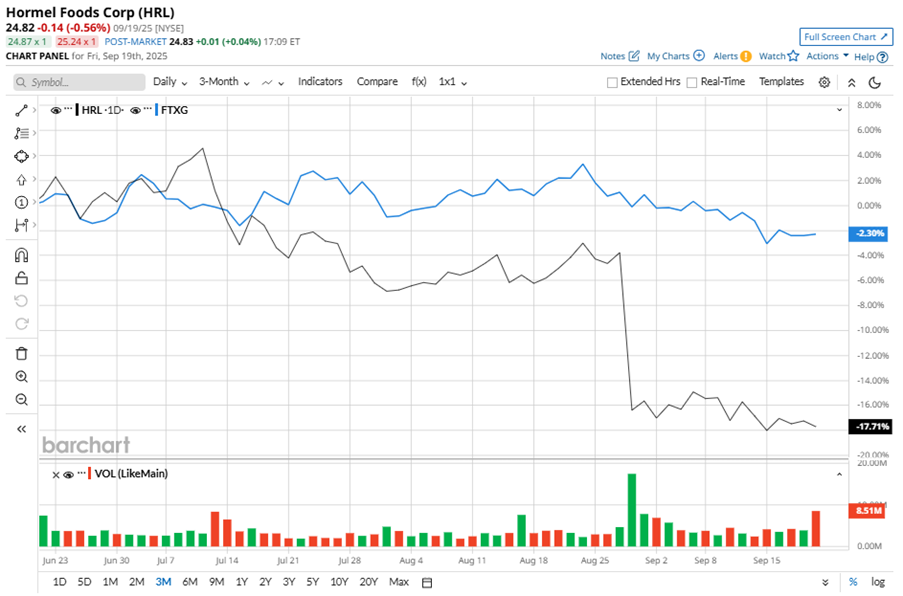

Despite its notable strength, HRL shares have slipped 26.6% from their 52-week high of $33.80, achieved on Dec. 11, 2024. Over the past three months, HRL stock has declined 17.7%, underperforming the First Trust Nasdaq Food & Beverage ETF’s (FTXG) 2.3% losses during the same time frame.

In the longer term, shares of HRL dipped 20.9% on a YTD basis and fell 22.8% over the past 52 weeks, underperforming FTXG’s YTD losses of 5.4% and 15.8% over the last year.

To confirm the bearish trend, HRL has been trading below its 50-day and 200-day moving averages over the past year, with some fluctuations.

On Aug. 28, HRL shares closed down more than 13% after reporting its Q3 results. Its adjusted EPS of $0.35 did not meet Wall Street expectations of $0.41. The company’s revenue was $3.03 billion, beating Wall Street forecasts of $2.98 billion. HRL expects full-year adjusted EPS in the range of $1.43 to $1.45.

HRL’s rival, Conagra Brands, Inc. (CAG), has lagged behind the stock, with a 33.2% loss on a YTD basis and 42.8% downtick over the past 52 weeks.

Wall Street analysts are cautious on HRL’s prospects. The stock has a consensus “Hold” rating from the 10 analysts covering it, and the mean price target of $28.71 suggests a potential upside of 15.7% from current price levels.