/Henry%20Schein%20Inc_%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shuttestock.jpg)

With a market cap of $9 billion, Henry Schein, Inc. (HSIC) is a global provider of healthcare products and services for office-based dental and medical practitioners, as well as alternate sites of care worldwide. The company offers a comprehensive range of dental and medical supplies, equipment, pharmaceuticals, and technology solutions, including practice management software and digital services.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Henry Schein fits this criterion perfectly. Henry Schein serves dental practices, laboratories, physician offices, ambulatory surgery centers, and institutional health care providers.

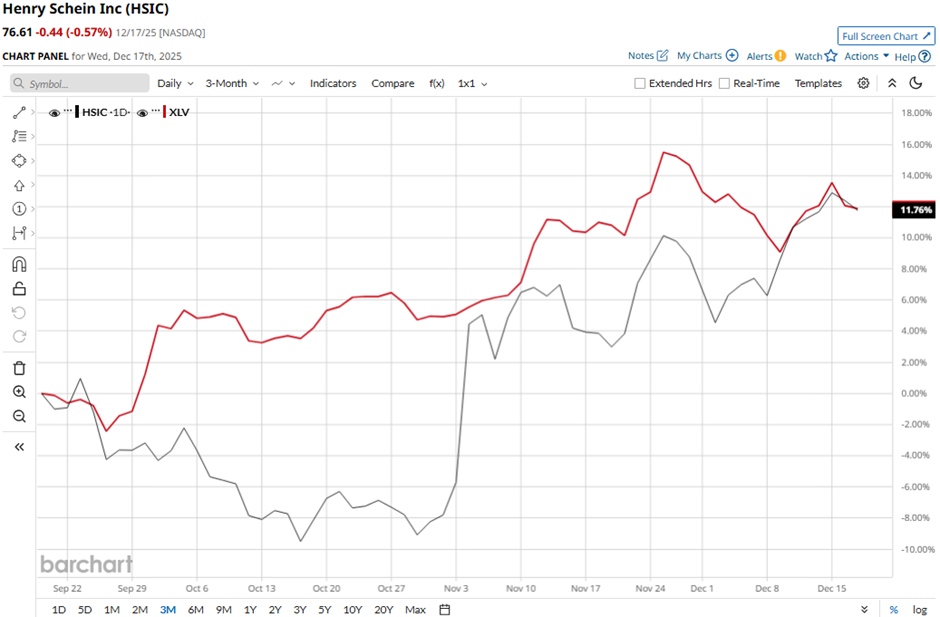

Shares of the Melville, New York-based company have decreased 7.1% from its 52-week high of $82.49. HSIC stock has soared 13.7% over the past three months, slightly outpacing the Health Care Select Sector SPDR Fund’s (XLV) 12.1% gain over the same time frame.

Longer term, HSIC stock is up 10.7% on a YTD basis, slightly lagging behind XLV’s 11.8% increase. Moreover, shares of the company have risen 4.7% over the past 52 weeks, compared to XLV’s 10.5% return over the same time frame.

However, the stock has been trading above its 50-day and 200-day moving averages since November.

Shares of Henry Schein climbed 10.8% on Nov. 4 after the company reported strong Q3 2025 results, with adjusted EPS of $1.38 beating expectations and rising from $1.22 a year earlier, while revenue of $3.34 billion exceeded forecasts. Investors also reacted positively to the company raising its full-year 2025 adjusted EPS guidance to $4.88 - $4.96 and increasing expected sales growth to 3% - 4%.

In comparison, rival Quest Diagnostics Incorporated (DGX) has outpaced HSIC stock. DGX stock has returned 18.7% on a YTD basis and 15.2% over the past 52 weeks.

Despite HSIC’s underperformance relative to its peers, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from 16 analysts in coverage, and the mean price target of $77.64 is a premium of 1.3% to current levels.