Houston, Texas-based Halliburton Company (HAL) operates as one of the world’s largest oilfield service providers. With a market cap of $19.3 billion, the company’s offerings include equipment, maintenance, engineering, and construction services to the energy sector, ensuring efficient and sustainable energy extraction.

Companies worth $10 billion or more are generally described as "large-cap stocks." Halliburton fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the oil & gas equipment & services industry.

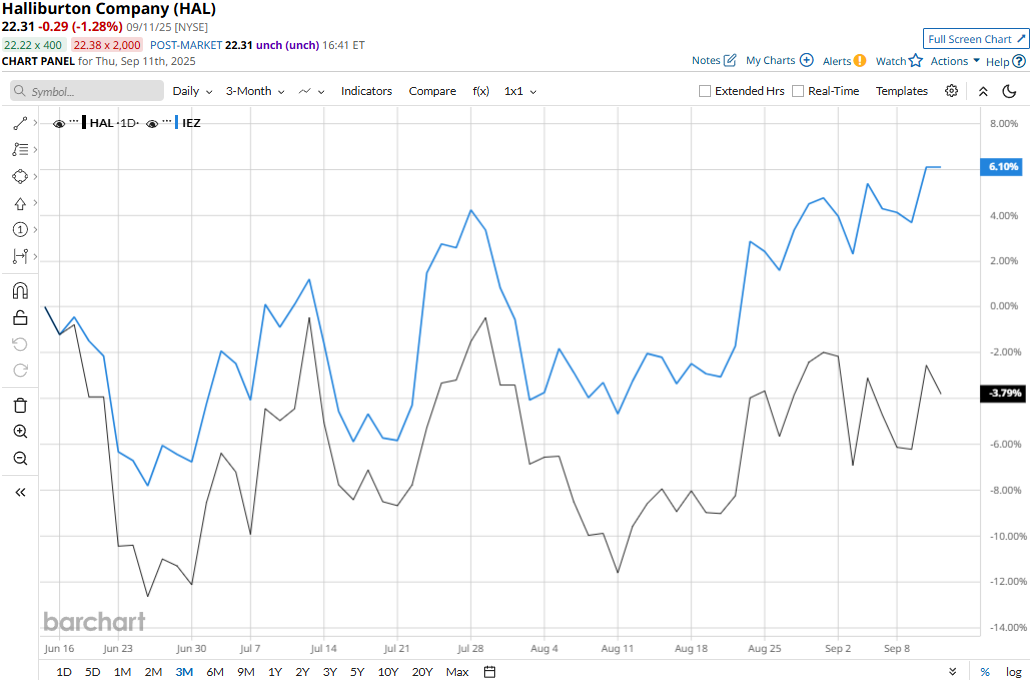

Despite its notable strengths, HAL stock prices have plummeted 31.5% from its 52-week high of $32.57 touched on Nov. 25, 2024. Meanwhile, HAL’s stock prices have observed a marginal 54 bps uptick over the past three months, notably underperforming the industry-focused iShares U.S. Oil Equipment & Services ETF’s (IEZ) 7.3% gains during the same time frame.

Over the longer term, HAL stock has tanked 18% on a YTD basis and 20.2% over the past 52 weeks, notably underperforming IEZ’s 2.5% dip in 2025 and approximately 1% gain over the past year.

HAL stock has remained consistently below its 200-day moving average and traded along its down-trending 50-day moving average over the past year, confirming its bearish movement.

Halliburton’s stock prices gained nearly 1% in the trading session following the release of its Q2 results on Jul. 22 and remained in the positive territory for five subsequent trading sessions. The company’s service revenues dropped by 6.6% and its product sales declined by 2.8% compared to the year-ago quarter. Overall, Halliburton’s topline came in at $5.5 billion, down 5.5% year-over-year. However, this figure surpassed the Street’s expectations by a notable 1.4%. Moreover, its EPS came in at $0.55, matching analysts’ consensus estimates.

Meanwhile, Halliburton has notably underperformed its peer, Baker Hughes Company’s (BKR) 14.5% gains in 2025 and 42.6% surge over the past 52 weeks.

Among the 26 analysts covering the HAL stock, the consensus rating is a “Moderate Buy.” Its mean price target of $27.30 suggests a 22.4% upside potential from current price levels.