Richmond, Virginia-based Dominion Energy, Inc. (D) produces and distributes energy products. Valued at $51.2 billion by market cap, the company offers natural gas and electric energy transmission, gathering, and storage solutions. The company provides electricity and natural gas to 7.5 million customers in 18 states.

Companies worth $10 billion or more are generally described as “large-cap stocks.” D effortlessly fits that bill, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the utilities - regulated electric industry. D's strengths lie in its diversified portfolio of regulated utility businesses, economies of scale, and strong brand equity, which provide a stable revenue base and predictable cash flows. Its commitment to innovation in grid modernization and renewable energy positions it favorably in the evolving energy landscape.

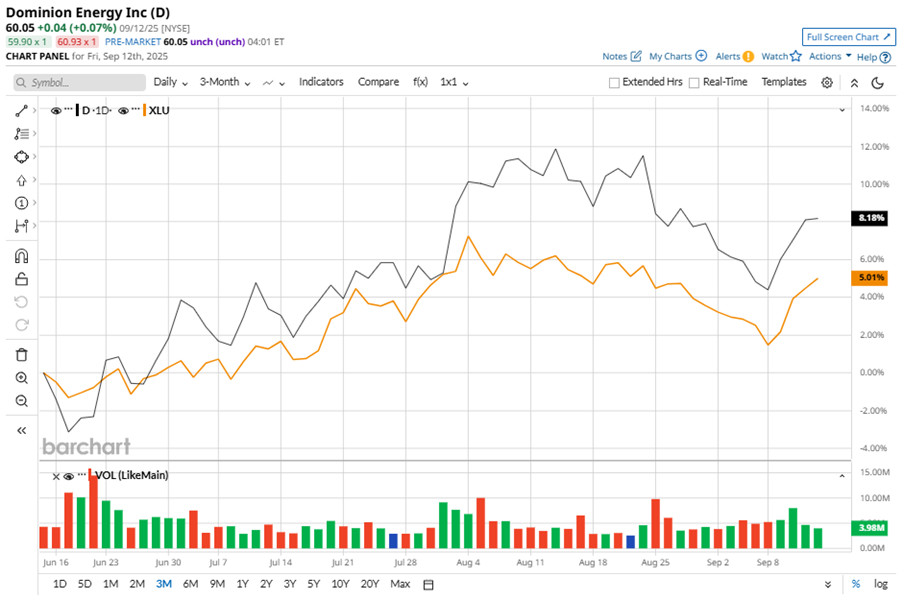

Despite its notable strength, D slipped 3.9% from its 52-week high of $62.46, achieved on Aug. 20. Over the past three months, D stock has gained 7.4%, outperforming the Utilities Select Sector SPDR Fund’s (XLU) 4.4% gains during the same time frame.

In the longer term, shares of D rose 11.5% on a YTD basis and climbed 5% over the past 52 weeks, underperforming XLU’s YTD gains of 13% and 10.4% returns over the last year.

To confirm the bullish trend, D has been trading above its 200-day moving average since late June, with slight fluctuations. The stock has been trading above its 50-day moving average since early May, experiencing minor fluctuations.

On Aug. 1, D shares closed up more than 3% after reporting its Q2 results. Its adjusted EPS increased 15.4% year-over-year to $0.75. The company’s revenue stood at $3.8 billion, up 9.3% from the same quarter last year. D expects full-year adjusted EPS in the range of $3.28 to $3.52.

In the competitive arena of utilities - regulated electric, NextEra Energy, Inc. (NEE) has lagged behind D, showing resilience with a marginal downtick on a YTD basis and 14.2% losses over the past 52 weeks.

Wall Street analysts are cautious on D’s prospects. The stock has a consensus “Hold” rating from the 17 analysts covering it, and the mean price target of $61.45 suggests a potential upside of 2.3% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.