/Deckers%20Outdoor%20Corp_%20Hoka%20shoe%20by-%20Stefan%20Pinter%20via%20Shutterstock.jpg)

Deckers Outdoor Corporation (DECK), headquartered in Goleta, California, designs, markets, and distributes footwear, apparel, and accessories for casual lifestyle use and high-performance activities. Valued at $17.6 billion by market cap, the company offers its products under the UGG, HOKA, and the Teva brand name.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and DECK perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the footwear & accessories industry. DECK's strengths include a diverse brand portfolio with established brands like UGG and HOKA, direct-to-consumer success, and financial discipline. The company also demonstrates strong financial performance, positioning it as a leader in the footwear and apparel industry.

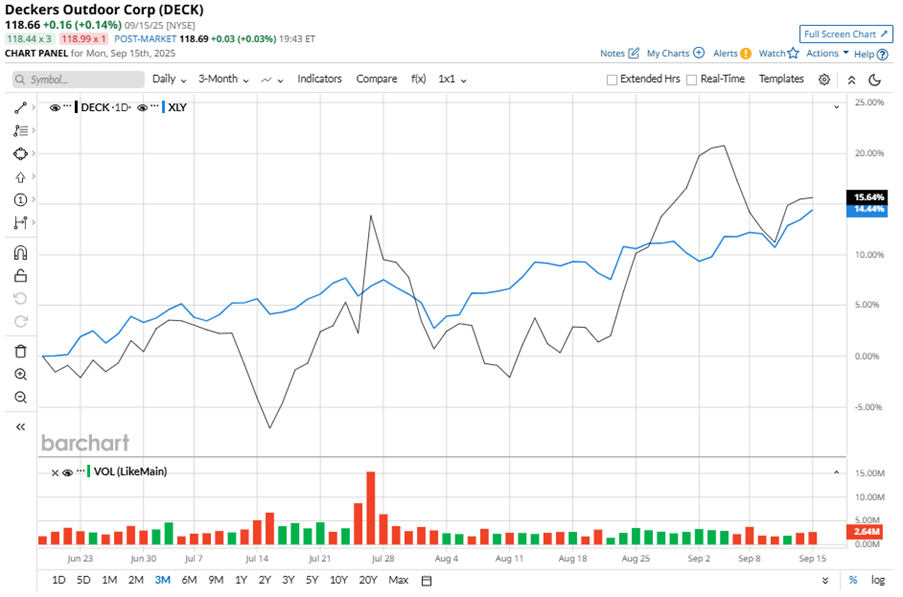

Despite its notable strength, DECK slipped 47% from its 52-week high of $223.98, achieved on Jan. 30. Over the past three months, DECK stock gained 16.9%, outperforming the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 13.7% gains during the same time frame.

In the longer term, shares of DECK dipped 41.6% on a YTD basis and fell 23.9% over the past 52 weeks, considerably underperforming XLY’s YTD gains of 7.3% and 25.1% returns over the same time period.

To confirm the bearish trend, DECK is trading below its 200-day moving average since early February. However, the stock has been trading above its 50-day moving average since late August.

DECK faces challenges, including anticipated $185 million in tariff costs due to potential duty hikes in Vietnam, a 110-basis-point decline in gross margin, and weakness in HOKA's U.S. direct-to-consumer business. Elevated inventory levels and rising SG&A expenses also strain the company.

On Jul. 24, DECK reported its Q1 results, and its shares closed up more than 11% in the following trading session. Its EPS of $0.93 beat Wall Street expectations of $0.68. The company’s revenue was $964.5 million, exceeding Wall Street forecasts of $899 million. For Q2, DECK expects revenue in the range of $1.38 billion to $1.42 billion.

In the competitive arena of footwear & accessories, Crocs, Inc. (CROX) has taken the lead over DECK, showing resilience with a 29.2% downtick on a YTD basis, but lagged behind the stock with 39.8% losses over the past 52 weeks.

Wall Street analysts are reasonably bullish on DECK’s prospects. The stock has a consensus “Moderate Buy” rating from the 24 analysts covering it, and the mean price target of $128.99 suggests a potential upside of 8.7% from current price levels.