/Darden%20Restaurants%2C%20Inc_%20Olive%20Gardern%20by-%20Sundry%20Photography%20via%20Shutterstock.jpg)

With a market cap of $22.5 billion, Darden Restaurants, Inc. (DRI) is one of the largest full-service restaurant operators in North America. The company manages more than 1,700 locations across the United States and Canada under well-known brands such as Olive Garden, LongHorn Steakhouse, The Capital Grille, and Ruth’s Chris Steak House.

Companies valued over $10 billion are generally described as “large-cap” stocks, and Darden Restaurants fits right into that category. Its diverse portfolio spans Italian, steakhouse, fine dining, and casual dining concepts, offering a wide variety of freshly prepared meals to guests.

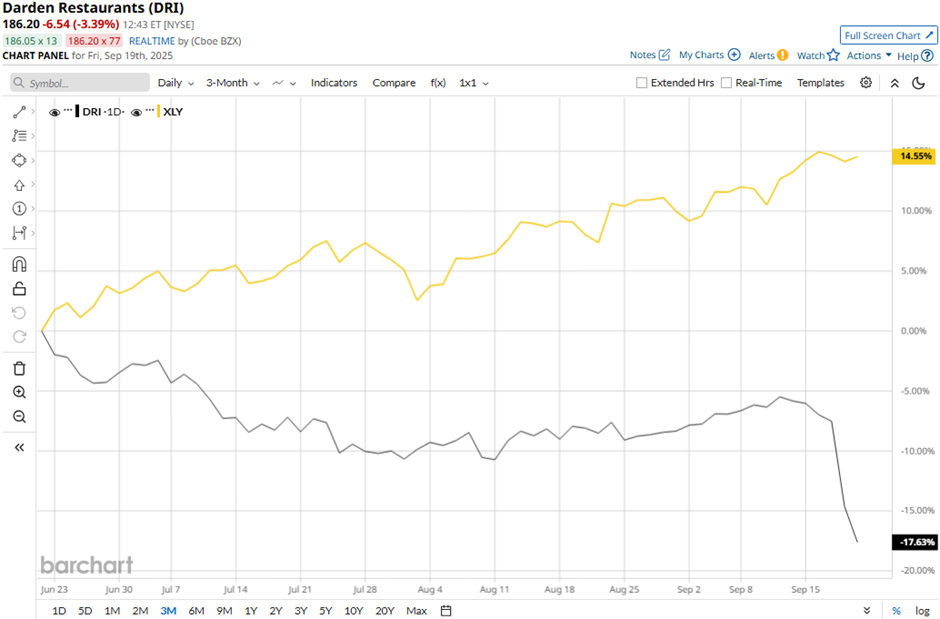

Shares of the Orlando, Florida-based company pulled back 18.4% from its 52-week high of $228.27. Darden Restaurants’ shares have decreased 16.4% over the past three months, lagging behind the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 14.7% increase over the same time frame.

Longer term, DRI stock is down marginally on a YTD basis, underperforming XLY’s 7.6% rise. Moreover, shares of Olive Garden parent company have gained 8.1% over the past 52 weeks, compared to XLY’s 22.5% return over the same time frame.

Despite recent fluctuations, the stock has been trading above its 200-day moving average since last year.

Shares of Darden Restaurants tumbled 7.7% on Sept. 18 after the company reported Q1 2026 adjusted EPS of $1.97, missing Wall Street estimates. Despite quarterly sales of $3.04 billion meeting forecasts, operating costs surged 8.8% to $2.71 billion, driven by higher ingredient and marketing expenses. Additionally, while management raised its annual sales growth outlook to 7.5% - 8.5%, the midpoint of the range fell slightly below analysts’ average expectation, dampening investor sentiment.

In comparison, rival Yum! Brands, Inc. (YUM) has outpaced DRI stock. Shares of Yum! Brands have soared 11.5% over the past 52 weeks and 8.9% on a YTD basis.

Despite the stock’s underperformance, analysts remain moderately optimistic about its prospects. DRI stock has a consensus rating of “Moderate Buy” from 29 analysts in coverage, and the mean price target of $234.64 is a premium of 26.2% to current levels.