In a September 2, 2025, Barchart article on silver, I concluded that:

I believe silver will trade to the $50 level in 2025, challenging the 2011 and 1980 highs in 2026. Buying silver on price weakness has been optimal, and I expect that trend to continue.

December silver futures were trading at $41.66 on September 2, 2025, after trading to a high of $41.73 per ounce. The price continued to rise as silver closes in on a challenge of the 2011 and 1980 respective highs of $49.82 and $50.36 per ounce.

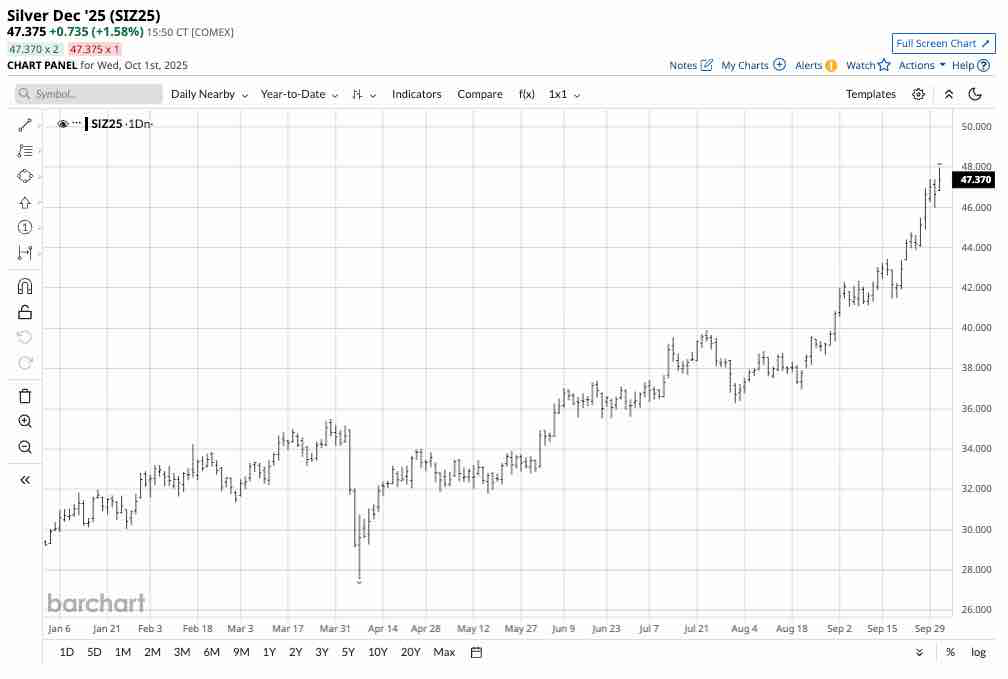

Silver continues to climb

The daily continuous COMEX silver futures contract highlights silver’s steady rise since the April 7, 2025, low of $27.545 per ounce.

The chart shows an over 74% rise to the October 1, 2025, high of $47.975. Silver rose to its most recent peak on the first day of Q4 after rising over 30% in Q3.

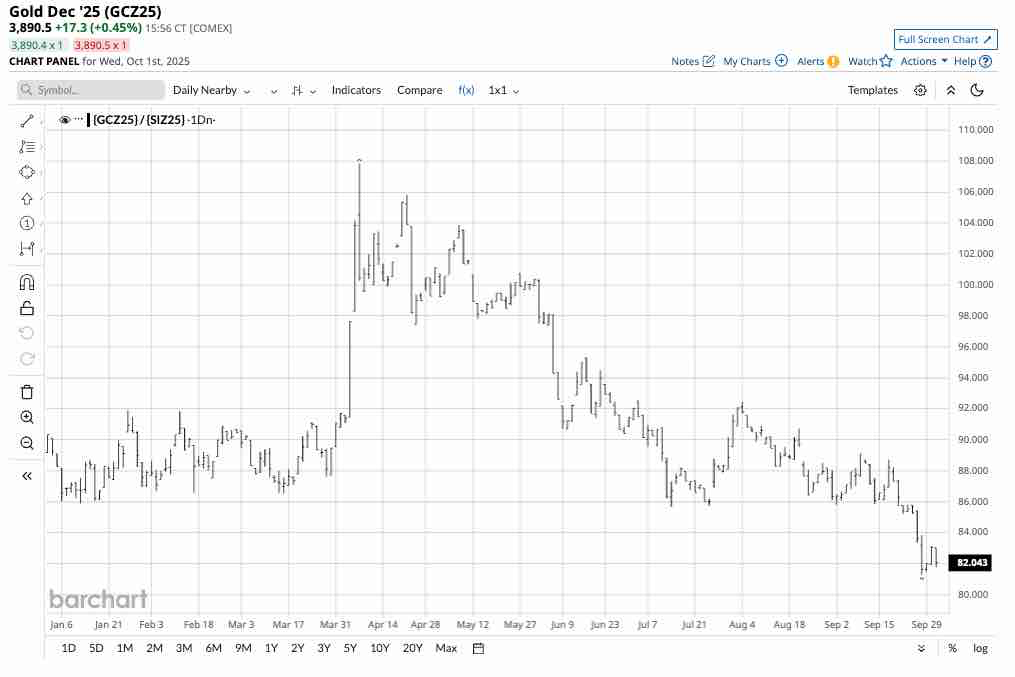

The gold-silver ratio is declining- A bullish sign

In 2025, and at the most recent high, nearby COMEX silver futures were over 74% higher than the closing price at the end of 2024. Silver has outperformed gold futures, which were 48.53% higher at their most recent high of $3,922.70 on October 1, 2025, since the end of last year.

Silver’s outperformance has caused the gold-silver ratio, a metric that indicates silver’s value relative to gold, to decline.

The chart of the daily continuous gold futures divided by continuous silver futures ({GCZ25}/{SIZ25}) shows the drop from 90.315:1 on December 31, 2024, to the 82:1 level in early October. Moreover, the ratio declined from the tariff-inspired high of 107.838:1 on April 7, 2025.

Silver has outperformed gold in 2025, despite gold’s continued bullish and parabolic trend.

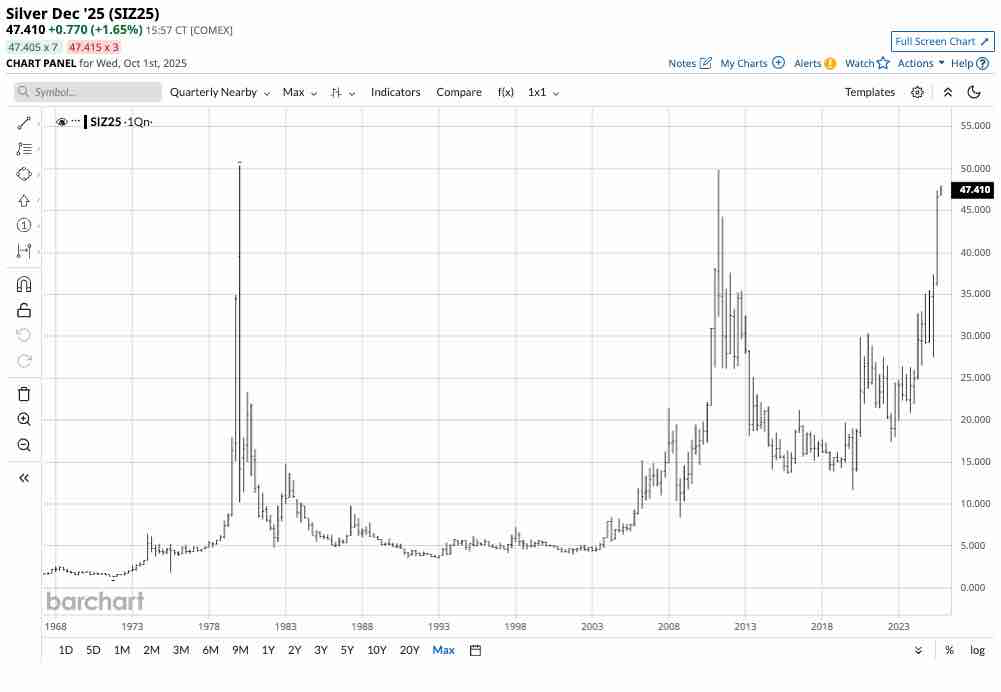

Closing in on two significant technical resistance levels

The long-term quarterly continuous silver chart illustrates the current technical targets.

Silver is now on an express train to challenge the $49.82 high from 2011. Above there, the only upside technical target is the 1980 record high of $50.36 per ounce.

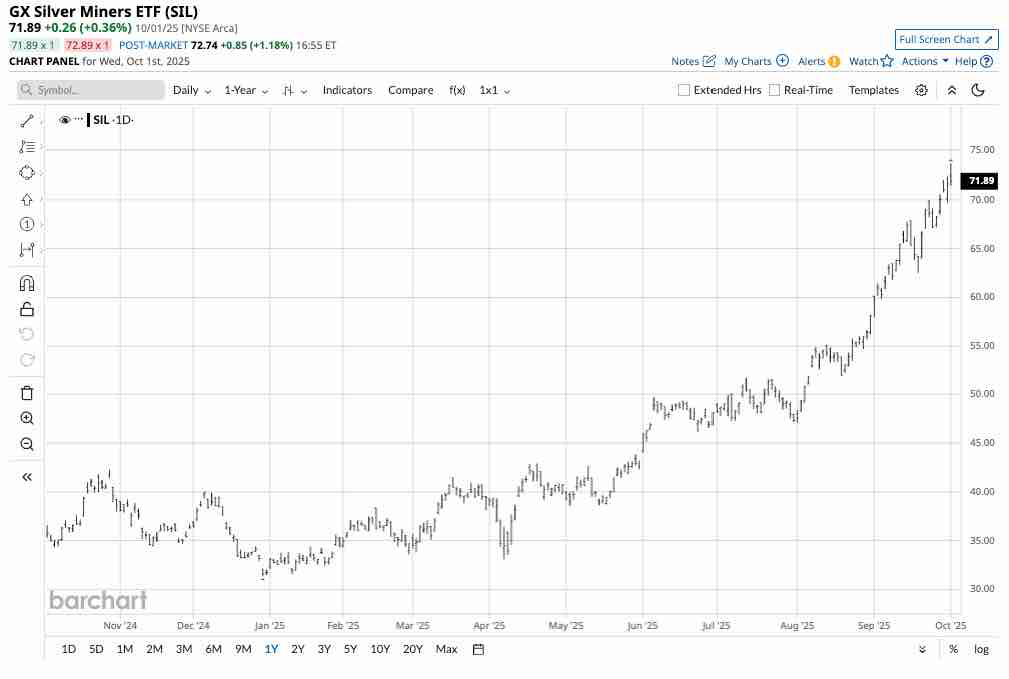

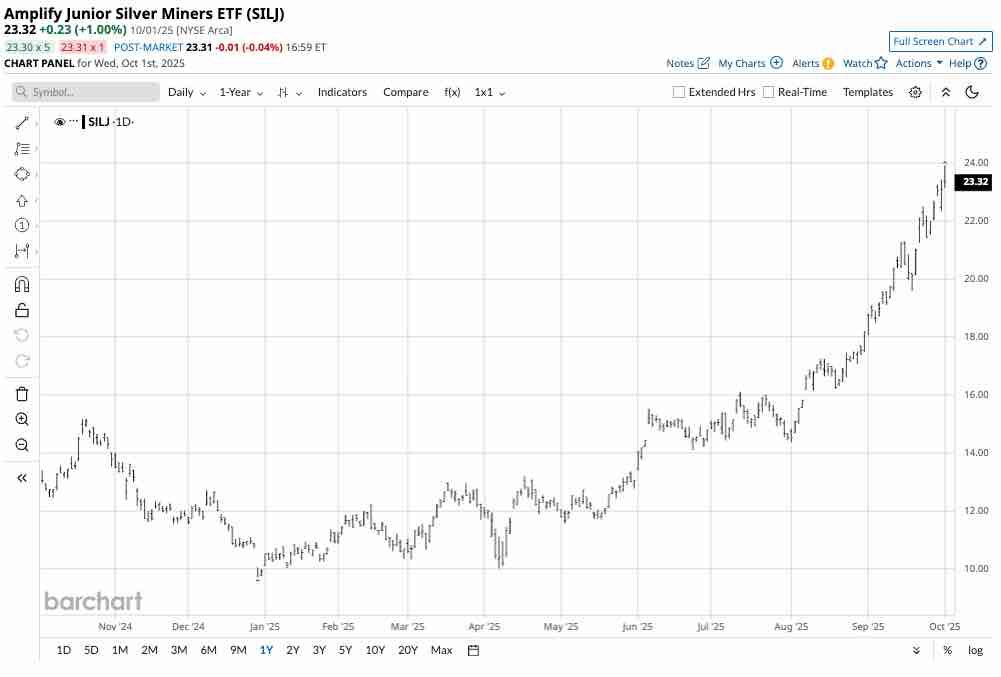

Silver mining stocks have soared

While silver futures rallied 64% from the end of 2024 to the October peak, silver mining shares have done even better on a percentage basis.

The daily chart of the GX Silver Miners ETF (SIL) shows a 131.7% rally from the December 31, 2024, closing price of $ 31.77 to the high of $73.60 per share on October 1, 2025. SIL is a diversified senior silver mining ETF that owns shares in the leading silver mining companies.

The daily chart of the Amplify Junior Silver Miners ETF (SILJ) shows a 140.8% rally from the December 31, 2024, closing price of $ 9.93 to the high of $23.91 per share on October 1, 2025. SILJ is a diversified junior silver mining ETF that owns shares in the leading junior silver mining and exploration companies.

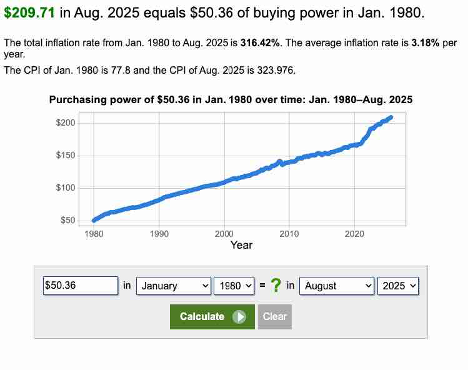

A new all-time high could take silver’s price much higher

Silver is on a bullish path in early October 2025, and while higher prices increase the odds of an eventual correction, the trend indicates that the nearing technical resistance levels will give way to new record peak prices. While silver is likely to rise above the 1980 $50.36 per ounce high, adjusted for inflation, that level could be only a short-term barrier for silver’s ascent to another, perhaps incredible peak.

While the high of $50.36 per ounce in January 1980 is a nominal target, adjusted for inflation, the 1980 high is over $200 per ounce in August 2025. The bottom line is that silver has upside room, and a price over $60 or even $70 would not approach 50% of the high from 1980, adjusted for inflation.