/Apple%20logo%20on%20store%20front%20by%20frantic00%20via%20iStock.jpg)

If you don’t recognize the first part of the title, maybe you will feel as aged as I did when I realized that the movie from which that memorable quote was taken, “Good Will Hunting,” was 28 years ago. Wow.

Now consider the price of the third largest stock in the world, Apple (AAPL), which was trading around $252 a share on Wednesday afternoon. Back in 1997, when that movie was released, its high and low for the year, on a split-adjusted basis, was… wait for it… $0.22 to $0.10. I wonder how many investors thought at the time “dang, I top-ticked AAPL this year, you can’t make money doing that.”

AAPL Stock Has Had Something for Everyone

Here in 2025, and an 1,100x move in AAPL later, let’s consider a few types of AAPL holders:

- The “legacy” owners, those who have held the stock in some size for decades. By the way, good for you!

- The long-term gain owners, who entered the stock even as recently as five years ago, when it traded around $120, making it a mere double since that time.

- The traders, who might just now see the latest iPhone launch or a number of other positive events surrounding a company that can probably raise money easier than the U.S. government, and own the stock for what may be possible in the coming weeks or months.

Why AAPL Stock Could Be at Risk

While every trader and investor can provide a unique rationale for being in AAPL stock, they all have one thing in common: If the stock breaks down, even if it is just guilty by association in a market-wide decline, they are at risk. I try to constantly remind people that bad things can happen to good stocks. But with a juggernaut that has the sustainability of AAPL’s business and brand, if someone owns the stock, they can look at the track record and think “this is eventually going to go up and up over time.

Maybe yes, maybe no. That’s investing 101. And as a devout risk manager myself, I feel compelled to point out that AAPL had a more-than-35% drop just this year! And, it dropped more than 15% in each of the two prior years. That’s all since the Covid-19 meltdown, which was also a 35% drubbing for the stock in a matter of weeks.

Today, AAPL is at one of those classic decision-points for we technicians. That’s because the stock has run all the way up to nearly an all-time high.

And while that also means it is down slightly since late last year, this is all to remind us that stocks are volatile, but we don’t have to sit there and just take it. The fact that volatility is still hanging in a very low range is another prompt to explore collaring AAPL,or trying this one other option strategy.

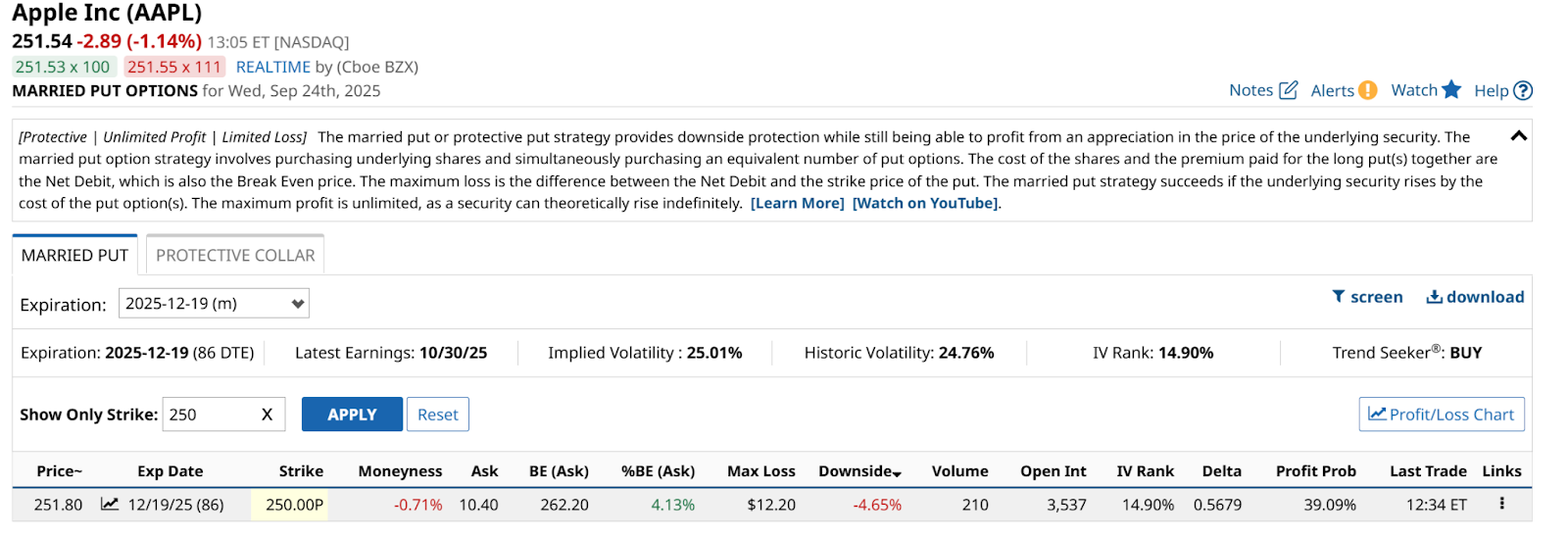

In AAPL’s case, we’re looking at a “married put option,” which is when we own the stock and a put to protect against loss under a specific price. But there’s no covered call option to offset the cost of the puts.

If You Hold Apple, Why Not Marry It? Or Collar It?

Let’s take a look at a recent example of both. I’ll start with the observation that AAPL’s IV rank is just under 15%. That means it is quite low compared to its history (past 12 months), so options on it are relatively cheap.

All markets are different, but in this one, I’m finding that a good starting point is to find a put option with a strike price just under or just over the current price. Also known as an “at the money” put. I see I can get that at $250, to protect 100 shares of AAPL for about 3 months, and lock in a downside worst-case of less than 5% (4.65%).

The put costs $10.40 per contract, or $1,040 per $25,154 of AAPL hedged. That’s a clean, simple example of a married put. If stocks get more volatile, two things likely occur: AAPL’s price sinks and volatility rises, making option buying more expensive. That’s why each investor has to take examples like this and make the additional move of personalizing the strategy for themselves.

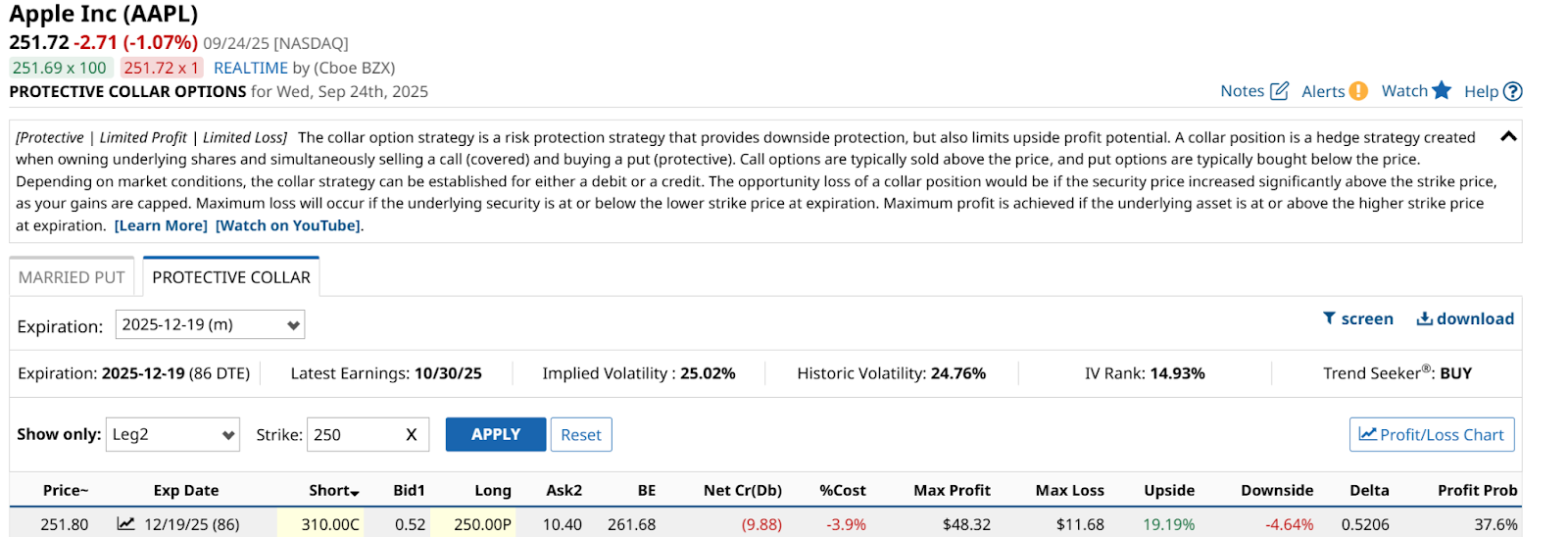

Now, let’s take that same married put example and add a covered call option to it to complete a collar. I don’t have to use that specific one, because as you will see in exploring the Barchart.com options tables, there are literally hundreds of choices. That’s why the screeners here come in very handy!

That same put option is shown below, and I see I can get 19% upside to that 5% downside by selling a call on AAPL to the same 12/19/25 expiration date, struck at $310. That’s a nice up/down ratio of nearly 4:1. And the stock needs to rise to $261.68 to cover my net cost of the options (call premium received minus put premium paid).

OK, so that’s the collar. And, that’s the problem. Not with AAPL, but with the call side of the trade. It is an epidemic of sorts for option sellers right now. That is what low volatility does. It is also why collars are working better right now with extremely volatile stocks, not with established, multi-generational blue chips like AAPL.

The result is that while I’d pay more than $10 for the puts, I’d only bring in $0.52 for the calls. Speaking for myself, I’d pass on that latter part. It is simply not enough compensation for me to give up AAPL’s upside over that period.

One More Way to Play AAPL Stock, Using Options

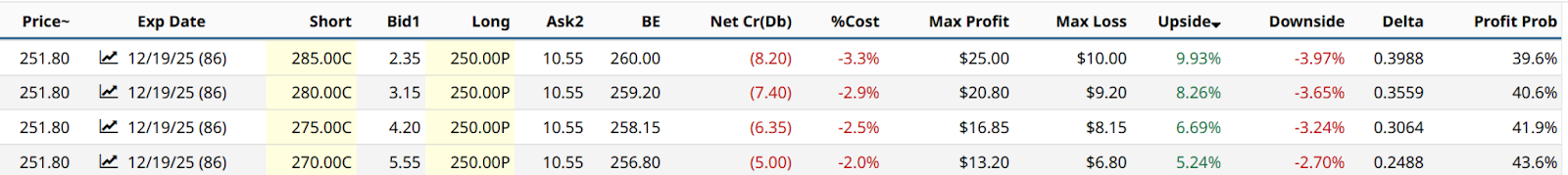

Ah, but there’s one more move to consider. That’s to settle for less upside, since this is only about 12 weeks out. I ran the collar with that same $250 put strike, but analyzed it paired with call strike prices from $270-$285, well below the $310 shown earlier. Here they are.

Taking that first as an example (and allowing for a slight change in the put cost while I was writing this during the trading day), we see that getting more than $2 a contract back for the calls still produces a 2.5:1 upside to downside. And that upside of 10% should be put in context. It’s only 12 weeks from now. So if AAPL were to rise by that much, nearly 1% a week, I’m not upset.

The specifics shown here are more attuned to a trader’s time frame. But long-term AAPL holders can also use collars to go all the way out to January 2028 to explore possibilities. How ‘bout them apples?!