HOUSING values continue to show signs of recovery across Newcastle and Lake Macquarie, with the majority of those who sold their homes in the three months to September making a profit.

Nearly all homeowners across the region who sold dwellings (units and houses) in the last quarter came out in front, according to CoreLogic's Pain and Gain Report.

However, an increase in short term loss-making resales was also recorded.

The total profits recorded across the housing market in Newcastle and Lake Macquarie were $548 million in the September quarter, up from $527 million in the three months to June.

Homeowners in Newcastle who held on to their homes for a median period of 7.7 years gained a median profit of $350,000.

In Lake Macquarie, the median hold period for homeowners was 8.4 years and a median gain of $401,500.

Earlier this month, CoreLogic's national Home Value Index (HVI) report showed houses and units in the region experienced the strongest growth in NSW in November at 1.3 per cent.

The median house value in Newcastle and Lake Macquarie rose to $878,672 and units hold a median value of $658,633.

According to the Pain and Gain report, short term loss-making resales increased across Newcastle and Lake Macqaurie.

The report showed 3.4 per cent of homeowners in Newcastle sold at a loss, up from 1.7 per cent in the June quarter.

In Lake Macquarie, 2.3 per cent of homeowners sold at a loss, up from 1.3 per cent.

In Newcastle, sellers who lost money on their property held onto their homes for a median of 1.9 years and recorded a median loss of $67,500.

Homeowners who sold at a loss in Lake Macquarie recorded a median loss of $25,000 after holding on to their homes for 1.8 years.

Overall across Australia, profitability from resales continued to rise amid a national recovery in home values in the September quarter.

Approximately 86,000 resales across Australia were observed by CoreLogic through the September quarter, with 93.5 per cent recording a nominal gain, and a median gross profit of $298,000.

This was up from the June quarter's revised 92.9 per cent of profitable sales at a median gross gain of $290,000.

Total nominal profits from resales in the September quarter was estimated to be $27.4 billion, almost $6 billion higher than a low of $21.6 billion in the three months to February this year, which coincides with the trough in national home values.

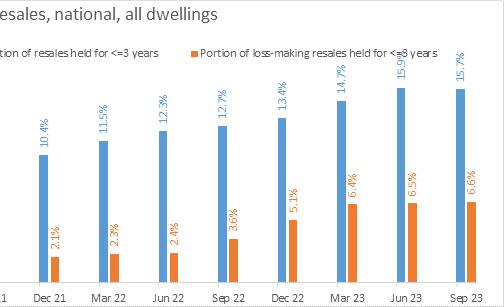

While overall profitability increased, loss-making short term resales (properties held for three years or less) rose to 6.6 per cent, up from 3.6 per cent just 12 months ago.

CoreLogic's head of research, Eliza Owen, said an increase in short term resales was happening amid rapidly rising interest costs, and may be a reflection of higher mortgage stress.

"While the portion of short term reselling dipped marginally quarter-on-quarter, resales with a hold period of three years or less hit a decade high in the year to September," Ms Owen said.

"Another emerging trend in resale analysis is the greater share of loss-making that occurred within a relatively short hold period, as opposed to properties commonly making a loss after being purchased in mining regions around a decade ago."

- Readers can now subscribe to Australian Community Media's free weekly Newcastle Herald property newsletter.

The newsletter will keep you informed about what's currently making headlines in the region's real estate market and beyond.

To sign up, click here, scroll down, enter your details, click the 'property' box and then click 'subscribe'.