The Hershey Company (HSY), headquartered in Hershey, Pennsylvania, manufactures and sells confectionery products and pantry items. Valued at $37.6 billion by market cap, the company's principal products include chocolate and sugar confectionery products, gum and mint refreshment products, and pantry items, such as baking ingredients, toppings, and beverages.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and Hershey perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the confectioners industry. Hershey's strength lies in its robust brand portfolio, which includes popular names such as Hershey's, Reese's, and Kit Kat. With a 45% share of the U.S. chocolate market, Hershey's dominant market position provides pricing power and competitive advantage.

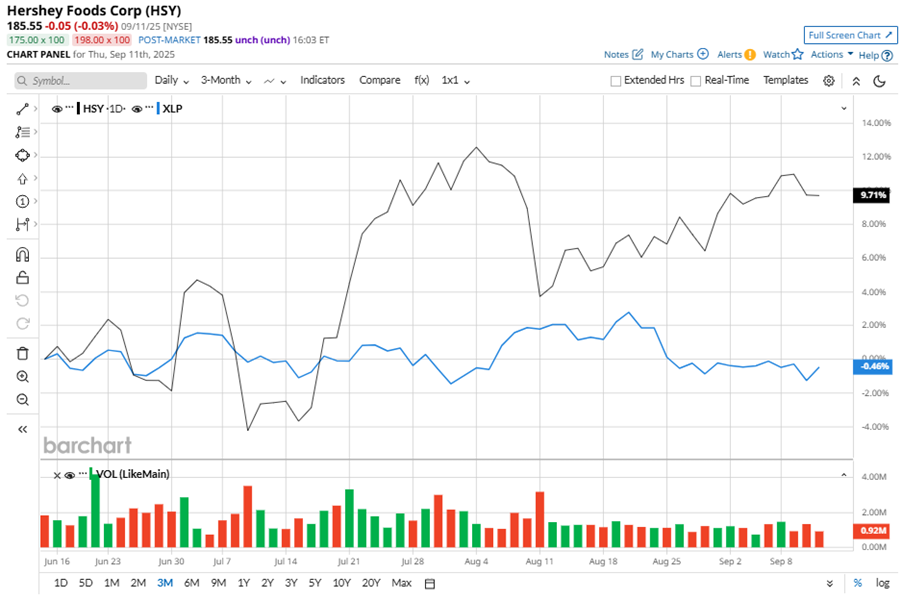

Despite its notable strength, HSY slipped 10.8% from its 52-week high of $208.03, achieved on Dec. 9, 2024. Over the past three months, HSY stock gained 10.4%, outperforming the Consumer Staples Select Sector SPDR Fund’s (XLP) 1.1% dip during the same time frame.

In the longer term, shares of HSY rose 9.6% on a YTD basis, outperforming XLP’s YTD gains of 2.5%. However, the stock has fallen 6.6% over the past 52 weeks, underperforming XLP’s 2.7% losses during the same time frame.

To confirm the bullish trend, HSY has been trading above its 50-day moving average since early June, with slight fluctuations. The stock is trading above its 200-day moving average since mid-July.

On Jul. 30, HSY shares closed up more than 1% after reporting its Q2 results. Its adjusted EPS of $1.21 surpassed Wall Street expectations of $1.01. The company’s revenue was $2.61 billion, topping Wall Street forecasts of $2.55 billion. HSY expects full-year adjusted EPS in the range of $5.81 to $6.

HSY’s rival, Mondelez International, Inc. (MDLZ) shares lagged behind the stock, gaining 3.9% on a YTD basis and 16.5% losses over the past 52 weeks.

Wall Street analysts are cautious on HSY’s prospects. The stock has a consensus “Hold” rating from the 22 analysts covering it, and the mean price target of $185.67 suggests a marginal potential upside from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.