With a market cap of $31 billion, NRG Energy, Inc. (NRG) is a leading energy company primarily engaged in the generation and sale of electricity and related energy services. Founded in 1989, the Texas-based company operates a diverse portfolio of power generation assets, including natural gas, coal, nuclear, solar, and wind facilities, serving both residential and commercial customers across the United States.

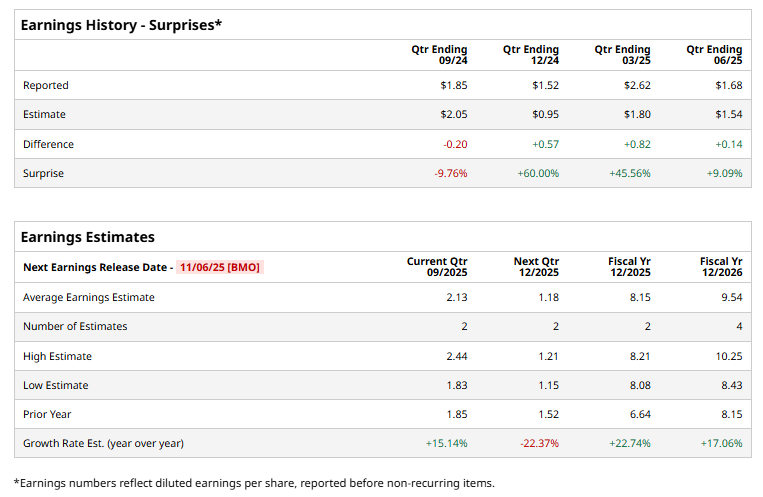

The company is set to report its Q3 earnings before the market opens on Thursday, Nov. 6. Ahead of the event, analysts expect NRG to report an EPS of $2.13 per share, up 15.1% from $1.85 per share reported in the year-ago quarter. It has exceeded analysts' earnings estimates in three of the past four quarters, while missing the mark in the other quarter.

For fiscal 2025, analysts expect NRG to report an EPS of $8.15, up 22.7% from $6.64 in fiscal 2024. Moreover, in fiscal 2026, its EPS is expected to grow 17.1% year over year to $9.54.

Over the past year, NRG shares have surged 86.7%, substantially outpacing the S&P 500 Index’s ($SPX) 16.2% gains and the Utilities Select Sector SPDR Fund’s (XLU) 10% rally over the same time frame.

On Sept. 26, NRG shares popped 3.4% after its subsidiary, NRG Cedar Bayou 5 LLC, secured a $561.9 million credit agreement to finance 60% of a new 721 MW natural gas power plant in Chambers County, Texas. The agreement includes covenants on loan-to-cost ratios, commercial operation deadlines by December 1, 2028, and prepayment/default provisions.

Moreover, analysts remain very bullish about NRG stock’s prospects, with a "Strong Buy" rating overall. Among 11 analysts covering the stock, eight recommend a “Strong Buy” and three recommend a “Hold.” NRG’s mean price of $203.11 implies a premium of 24% from its prevailing price level.