/Edwards%20Lifesciences%20Corp%20Irvine%2C%20Ca%20campus-by%20Steve%20Cukrov%20via%20Shutterstock.jpg)

Valued at a market cap of $45.2 billion, Edwards Lifesciences Corporation (EW) provides products and technologies to treat advanced cardiovascular diseases. The Irvine, California-based company is best known for its transcatheter aortic valve replacement (TAVR) products under the SAPIEN line, as well as its rapidly growing transcatheter mitral and tricuspid therapies (TMTT) and surgical heart valve solutions. It is scheduled to announce its fiscal Q3 earnings for 2025 after the market closes on Thursday, Oct. 30.

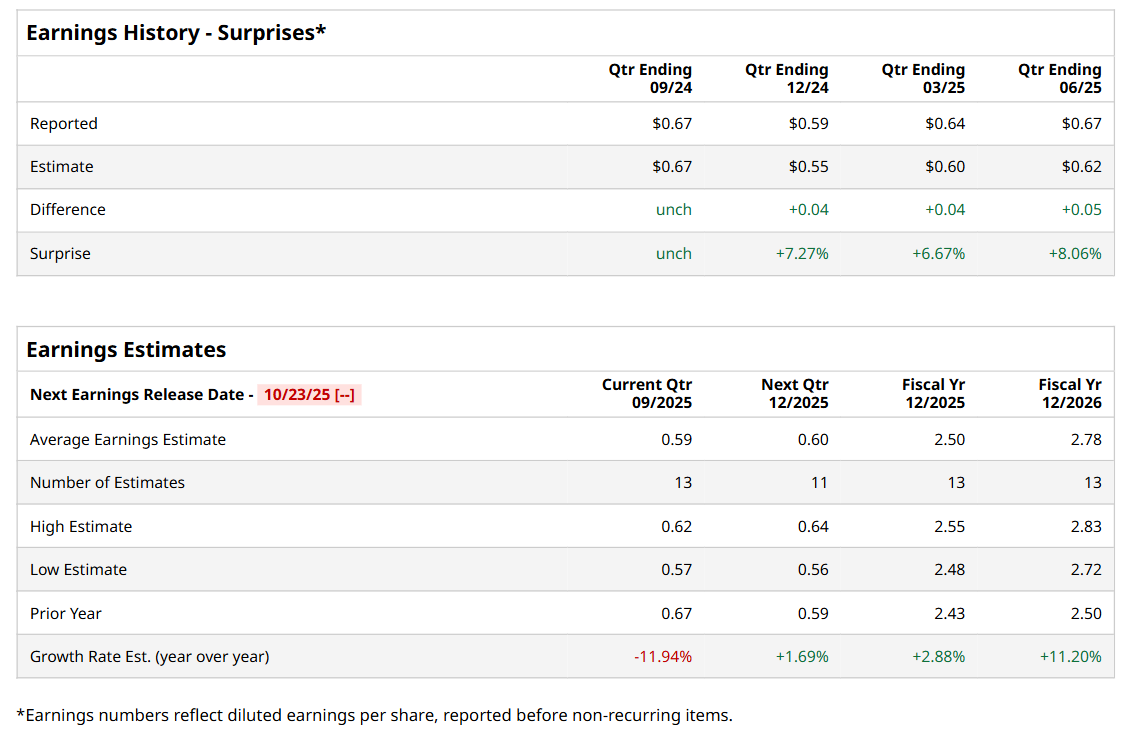

Ahead of this event, analysts expect this healthcare company to report a profit of $0.59 per share, down 11.9% from $0.67 per share in the year-ago quarter. The company has a promising trajectory of consistently beating or matching Wall Street’s earnings estimates in each of the last four quarters. In Q2, EW’s EPS of $0.67 exceeded the forecasted figure by 8.1%.

For fiscal 2025, analysts expect EW to report a profit of $2.50 per share, up 2.9% from $2.43 per share in fiscal 2024. Furthermore, its EPS is expected to grow 11.2% year-over-year to $2.78 in fiscal 2026.

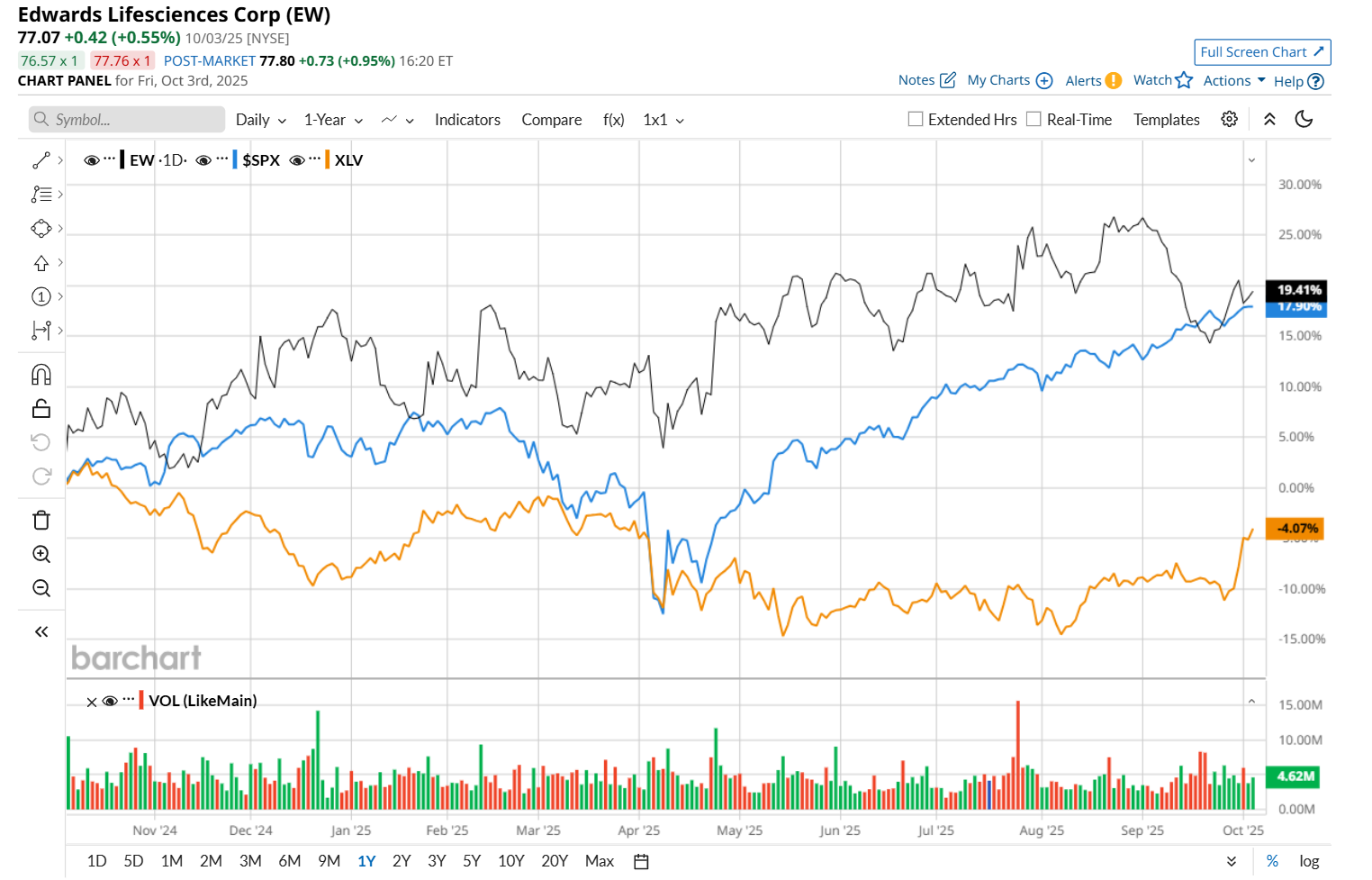

Shares of EW have soared 17.9% over the past 52 weeks, outpacing both the S&P 500 Index's ($SPX) 17.8% uptick and the Health Care Select Sector SPDR Fund’s (XLV) 4.4% loss over the same time frame.

Edwards Lifesciences released better-than-expected Q2 results on Jul. 24, and its shares surged 5.5% in the following trading session. Due to strength across all product groups, the company’s overall revenue improved 11.9% year-over-year to $1.5 billion, surpassing consensus estimates by 2.7%. Moreover, its adjusted EPS of $0.67 advanced 8.1% from the year-ago quarter, topping analyst expectations of $0.62. Additionally, EW raised its fiscal 2025 guidance, further bolstering investor confidence. It now expects sales growth to be between 9% and 10%, and projects adjusted EPS guidance to be at the high end of $2.40 to $2.50.

Wall Street analysts are moderately optimistic about EW’s stock, with a "Moderate Buy" rating overall. Among 31 analysts covering the stock, 15 recommend "Strong Buy," one indicates a "Moderate Buy," 14 suggest "Hold,” and one advises a “Strong Sell” rating. The mean price target for EW is $86.83, implying a 12.7% potential upside from the current levels.