/amazon%20holiday%20delivery%20boxes%20by%20Cineberg%20via%20iStock.jpg)

Amazon (AMZN) will release its third-quarter 2025 financial results on Thursday, Oct. 30. Despite being one of the top players in the cloud and e-commerce spaces, Amazon stock has underperformed the broader markets and its big tech peers so far in 2025.

So far in 2025, Amazon shares have risen just 3.9%, a negligible increase compared with the S&P 500 Index’s ($SPX) 16.5% advance. The gap looks even wider next to other tech heavyweights as Microsoft (MSFT) stock has surged about 25.8% year-to-date, while Alphabet (GOOGL) has rocketed ahead with a 40.3% gain.

Much of the market’s lukewarm response to Amazon stock comes from slower-than-expected growth in its cloud business, Amazon Web Services (AWS). While AWS grew about 17% in the first half of 2025, investors expected faster progress given the surge in AI-led demand and non-generative AI workloads. Further, competition from Microsoft Azure and Google Cloud is also adding pressure.

With Amazon’s stock lagging behind the broader market this year, will the company’s Q3 earnings give its shares a boost?

Amazon Q3: Core Businesses to Sustain Momentum

Amazon’s Q3 could once again reflect the steady momentum in its core businesses, including e-commerce, cloud, and digital advertising. Management has guided revenue between $174 billion and $179.5 billion, implying more than 11% year-over-year growth at the midpoint.

Its e-commerce sales could continue to benefit from its broad product selection, competitive pricing, and increasingly efficient delivery network. The company’s logistics overhaul, positioning goods closer to customers, has shortened delivery times and lowered fulfillment costs. These network efficiencies, combined with strong Prime member engagement and steady consumer spending, should help Amazon sustain healthy retail sales and margin growth in the quarter.

However, it’s the AWS segment that investors will be paying the most attention to. In Q2, AWS posted revenue of $30.9 billion, up 17.5% year-over-year, with an annualized run rate exceeding $123 billion. Demand for both traditional cloud infrastructure and generative AI workloads remains strong.

As companies modernize operations and migrate from on-premise systems to the cloud, AWS stands to capture a significant share of that transformation. Still, capacity constraints and intensifying competition from Microsoft Azure and Google Cloud could pose challenges.

Amazon’s advertising segment is likely to contribute strongly to its quarterly numbers. The company’s ad revenue reached $15.7 billion in Q2, marking a 22% year-over-year increase. This momentum will likely sustain in Q3, driven by the strength of Amazon’s multi-channel ad ecosystem. The Amazon Demand-Side Platform (DSP) could continue to drive the segment due to its precision targeting and privacy-safe data environment.

While Amazon’s revenue expansion is likely to remain in double digits, its bottom line could face short-term pressure from elevated investments in AI and cloud infrastructure. Notably, these investments are essential for sustaining long-term margins and competitiveness. At the same time, Amazon’s profits are expected to grow as it improves its transportation network and leverages robotics and automation to make its fulfillment process more efficient. Together, these operational improvements, technology investments, and rising ad revenues position Amazon for strong long-term profitability.

Wall Street expects Amazon to post third-quarter earnings per share (EPS) of $1.57, up 9.8% from the prior year. The company has exceeded EPS expectations in each of the past four quarters, including a substantial 26% beat in Q2.

The Bottom Line

Amazon could witness steady growth across its business segments in Q3. However, the cloud unit’s performance will likely be the key determinant of how the market reacts post-earnings, given its role in driving profitability, especially amid the accelerating AI transformation across industries.

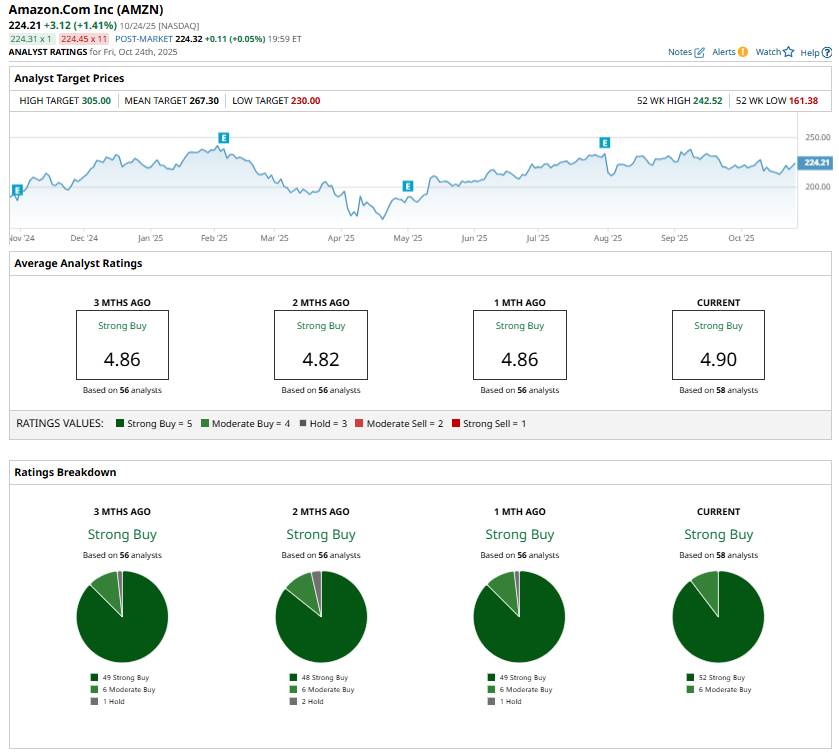

Wall Street analysts are bullish about Amazon stock ahead of Q3 earnings and maintain a “Strong Buy” consensus rating.