Hedge funds and private equity firms including Winton and Blackstone Inc. helped shatter leasing records for the most expensive London offices last year.

More than 1.3 million square feet of London office space, more than two-and-a-half times the size of the Gherkin skyscraper, was leased at rents higher than £100 ($123) a square foot last year, according to data compiled by broker CBRE Group Inc. Leasing in the West End, home to the Mayfair and St. James’s districts favored by hedge funds, was at its strongest since 2000, the broker’s data show.

“This data shows that there is still appetite for good-quality office space in London’s West End, even in the face of strong economic headwinds,” CBRE executive Director Rob Madden said.

A severe shortage of new workspace that also meets green credentials is forcing businesses to pay up to secure offices. With spiraling inflation and a downturn in commercial real estate markets spooking investors and reducing the amount of available development finance, new office space in the capital is likely to fall short of demand for years to come.

It was also a record year for high-value deals outside traditionally pricier districts. In total, 13 deals outside the West End achieved rents of over £100 a square foot, almost double the seven previously recorded by CBRE in total since it began collecting the data in 1984.

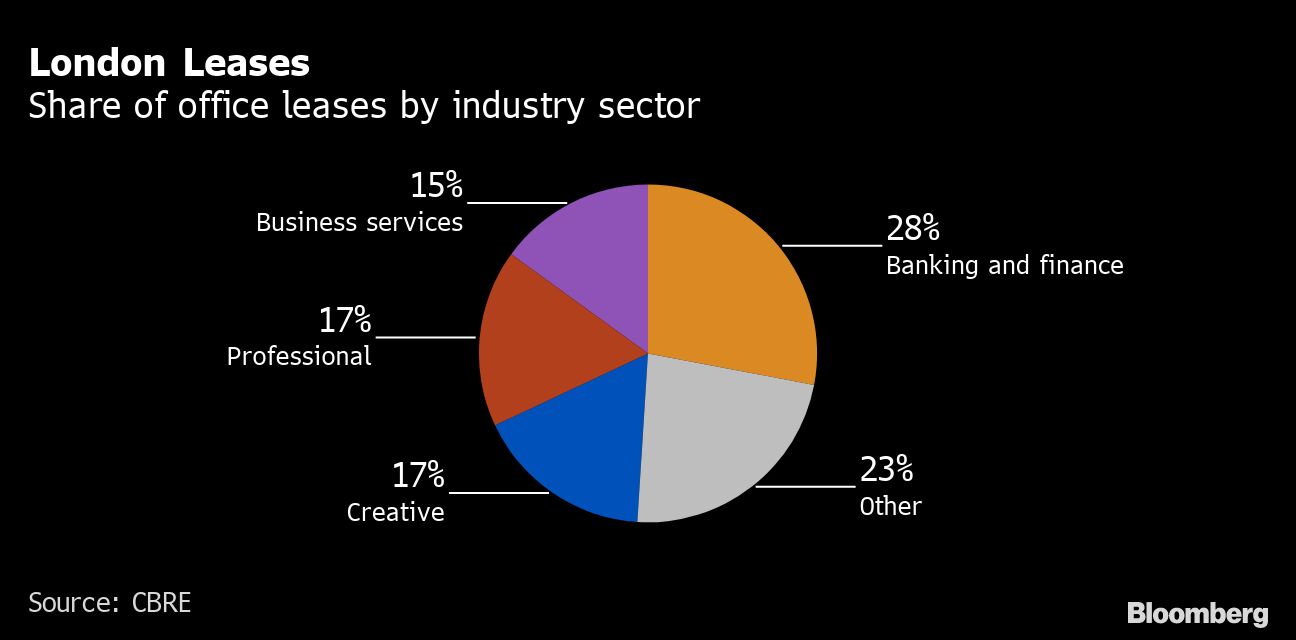

Across London banking and financial firms accounted for 28% of all space, more than any other sector. Professional services like law firms, and the creative industries, each accounted for 17% of the total, according to CBRE.

Some of the biggest hedge funds controlling a bulk of the industry assets produced stellar gains last year, bolstering their ability to compete for top talent and space.

Giants from Citadel to Millennium Management and D.E. Shaw & Co. produced double-digit gains while those betting on macro economic trends, such as Haidar Capital, Rokos Capital Management and Odey Asset Management generated a record year of performance.

Winton will move into its new Knighstbridge headquarters at One Hooper’s Court this year, a new development opposite the Harvey Nichols department store. The group has leased the top two floors of the building at a rent of over £100 a square foot, people with knowledge of the deal said. A spokesperson for Winton declined to comment.

Blackstone, the world’s largest alternative asset manager, agreed a deal last year to rent soon-to-be-redeveloped Landsdown House on Berkeley Square, according to a statement. The private equity firm will lease the 226,000 square feet (20,996 square meters) 10-floor Mayfair building when it is completed in 2028.

©2023 Bloomberg L.P.