/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

Advanced Micro Devices (AMD) stock has had heavy, unusual trading in short-term out-of-the-money call options today. Based on the company's strong earnings results yesterday, it could be a bullish signal for AMD stock.

AMD is at $201.72 in morning trading, down over 16% after the results release after the market closed yesterday. This heavy call options activity today could potentially indicate that some investors feel this is overdone.

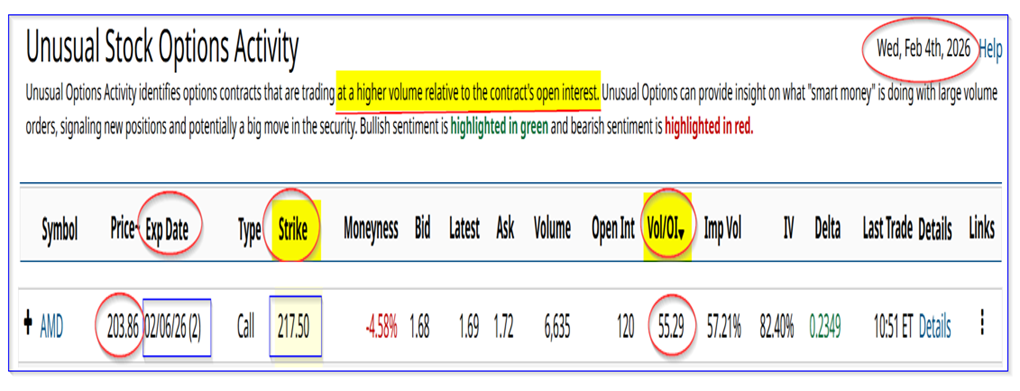

This activity can be seen in today's Barchart Unusual Stock Options Activity report. It shows that over 6,600 call options have traded at the $217.50 strike price for expiry this Friday on Feb. 6, 2026.

At the time of the Report, the premium was $1.69, but now it is down to $1.39 per call contract, as AMD has continued to fall.

This may indicate that some investors are selling short covered calls to collect this high premium. After all, the yield is 0.69% ($1.39/$201.72) for just 2 days until expiry. That works out to a monthly yield of about 3.0%, assuming it could be repeated 4.33 times (i.e., 2 days per week for 4.33 weeks per month).

On the other hand, buyers of these calls may believe that today's sell-off has been overdone. They may feel, on a speculative basis, that AMD stock could recover in the next few days.

In that regard, this type of play is a speculative gamble that the premium will rise over $1.39, even if AMDe stock stays below below the $217.50 strike price.

That is because options typically have some extrinsic value, albeit declining, up until they expire, even if they remain out-of-the-money (i.e., have no intrinsic value).

That could be due to the strong nature of AMD's earnings results. Let's look at that.

Strong AMD Results

Advanced Micro Devices, the semiconductor company, reported yesterday that its Q4 revenue rose 34.1% YoY and was up +11% Q/Q. Moreover, its full revenue rose 34.34% in 2025, slightly higher than the 34.18% last 12 months (LTM) gain in Q3, according to Stock Analysis.

In addition, AMD's margins stayed strong. Its gross margin was 54%, up from 51% last quarter. And its operating margin was 17%, vs. 11% in Q3 and 14% last year.

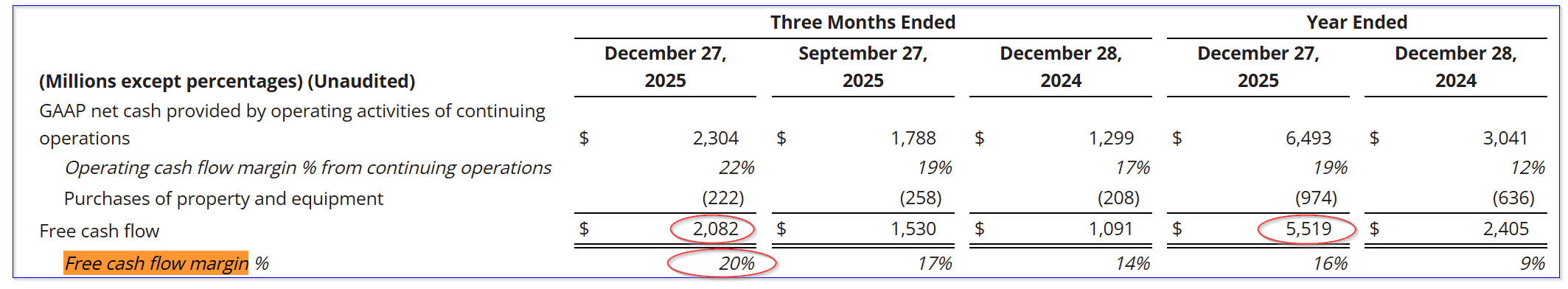

More importantly, its free cash flow (FCF) was very strong, despite much higher capex spending. This can be seen in the table AMD provided in its earnings release.

It shows that FCF was $2.082 billion, representing 20% of revenue in Q4, up from 17% last quarter and 14% a year ago. For the full year, it hit 16% vs. 9% last year.

However, AMD may have low-balled its figures to make them comparable. They deducted the discontinuing operations results from operating cash flow.

Stock Analysis shows that the actual FCF was higher, resulting in a 22.79% FCF margin in Q4, vs. 20.56% last quarter, and 14.25% last year. Moreover, its full-year FCF margin was 19.33%, vs. 17.01% in Q3 on a TTM basis and 9.33% in 2024.

The point is that the company is squeezing out more cash from its operations on both a Y/Y and a sequential basis.

That implies its market value could have significant upside.

Forecasting FCF and a Price Target

For example, analysts are projecting revenue will rise to $46.62 billion in 2026 (up 34.3% over 2025) and $64.25 billion by 2027. So, over the next 12 months (NTM) it could average $55.435 billion.

So, assuming Advanced Micro Devices continues to improve its FCF margin with higher revenue, it could make $12.75 billion in FCF:

$55.435 billion NTM revenue x 23% FCF margin = $12.75 billion FCF

That is 90% more than the $6.697 billion in FCF that Stock Analysis reports AMD made in 2025.

Just to be conservative, let's call it $12 billion. Using a 2.0% FCF yield metric, here is what AMD stock would be worth:

$12b / 0.02 = $600 billion mkt value

That is 83.7% higher than today's market cap of $326.683 billion, according to Yahoo! Finance.

Just to be even more conservative, let's lower the FCF margin estimate to 20%. That still results in an estimate of $11.1 billion, and using a 2% FCF yield metric, the market value would be:

$11.1b / 0.02 = $555 billion mkt value

This is still 70% over today's value, and implies AMD's next 12 month (NTM) price target could be 70% higher:

$201.72 x 1.7 = $342.92 per share

Other analysts agree that AMD is undervalued. Yahoo! Finance's survey PT is $289.70, Barchart's is $288.56, and Anachart is at $273.36.

The bottom line is that AMD stock looks deeply undervalued here.

So, no wonder investors are buying call options, or selling short covered call options at much higher prices.

However, investors should be careful in following this speculative 2-day trade. It might make sense for most investors to take a longer-term period in which to invest in AMD call options.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.