My Q1 2023 quarterly report on precious metals on Barchart highlighted the 5.97% decline in 2022 and the 18.35% drop over the first three months of 2023. Nearby NYMEX palladium futures fell to a $1,336 per ounce low in March 2023 after rising to a $3,380.50 high in March 2022. The move to the record peak came after Russia invaded Ukraine, igniting supply concerns.

Meanwhile, nearby palladium prices closed Q1 at the $1,466 level and moved higher in April. In early May 2023, the price was back near the Q1 closing level, but palladium may have found a significant bottom in March 2023 at $1,336 per ounce.

The Aberdeen Physical Palladium ETF (PALL) does an excellent job tracking palladium prices.

Palladium is the least liquid of the four precious metals in the futures market

Palladium futures on NYMEX reached the lowest price since June 2019 in March 2023 at $1,336.

The five-year chart highlights the bounce from the March low that took the nearby futures to a $1,639.60 high in mid-April before pulling back below the $1,420 level on May 4.

The explosive move to the March 2022 high and implosive price action that took palladium to the March 2023 occurred as palladium is the least liquid precious metal traded on the CME’s NYMEX and COMEX divisions. On May 3, NYMEX palladium futures had a total open interest, the total number of open long and short positions, of 13,488 contracts. At $1420 per ounce, with each contract containing 100 ounces, the total value of the palladium futures market was $1.915 billion. Meanwhile, the average daily volume of palladium futures tends to be below 5,000 contracts or $710 million.

- On May 3, NYMEX platinum’s open interest was 72,885 contracts. With each contract containing 50 ounces and the price at $1,050, the platinum futures market’s value was $3.826 billion, nearly twice the value of the palladium futures market. The average daily volume in platinum futures is around 20,000 contracts, worth $1.05 billion.

- COMEX silver’s open interest was 142,490 contracts. With each contract containing 5,000 ounces and the price at $26, the silver futures market’s value was over $18.524 billion. The average daily volume in silver futures is around 100,000 contracts, worth $13 billion.

- COMEX gold’s open interest was 504,204 contracts. With each contract containing 100 ounces and the price at $2,060, the gold futures market’s value was over $103.8 billion. The average daily volume in gold futures is around 200,000 contracts, worth $41.2 billion.

Palladium is an illiquid precious metal, only exacerbating the price variance.

Low liquidity tends to lead to high volatility

Markets suffering from low open interest and volume levels tend to experience far higher price volatility. During rallies, markets with low participation can experience periods where offers to sell disappear, causing significant price spikes and gaps to the upside. Conversely, bids to buy during selloffs can evaporate in illiquid conditions, causing volatile price plunges.

In liquid markets, hedgers, speculators, arbitrageurs, and a broad range of market participants create an environment with buying and selling interest at each price point. Illiquid markets do not experience the same activity, leading to sudden price gaps higher and lower. Palladium is the least liquid metal in the precious metals sector, leading to the most significant price variance. The move to over $3,380 per ounce in March 2022 and the correction to below $1,350 one year later exemplify how illiquidity can create wild price swings, exacerbating highs and lows.

Supply concerns can return in the blink of an eye

Palladium rose to its all-time peak in March 2022 as the world’s leading producer invaded Ukraine.

The chart highlights that Russia produced 41.9% or 88 metric tons of the 210-ton annual worldwide output in 2022. Russia and South Africa dominate worldwide palladium production, with 80% of the global output.

Russian aggression in Ukraine, sanctions on Moscow, and Russian retaliation against “unfriendly” countries supporting Ukraine ignited significant supply concerns in March 2022, pushing palladium to its $3,380.50 record high. War and international turmoil can distort prices, and illiquid commodity prices can experience wide price variance as it impacts cross-border trade.

Palladium is a critical green and industrial metal with low annual production

North America and Europe consumed 43% of the world’s palladium supplies in 2021.

The chart highlights that Russian refusal to supply palladium to the regions would create significant supply disruptions.

Meanwhile, Vantage Market Research forecasts the global palladium market value at $16.5 billion in 2022, which will grow to $24 billion by 2030, at a compound annual growth rate of 5.5% from 2023-2030. Increasing demand for palladium in automotive catalytic converters and a stable rise in palladium jewelry requirements will accelerate market growth. The bottom line is palladium’s density and heat resistance make it a critical metal for green energy initiatives.

PALL is the palladium ETF product

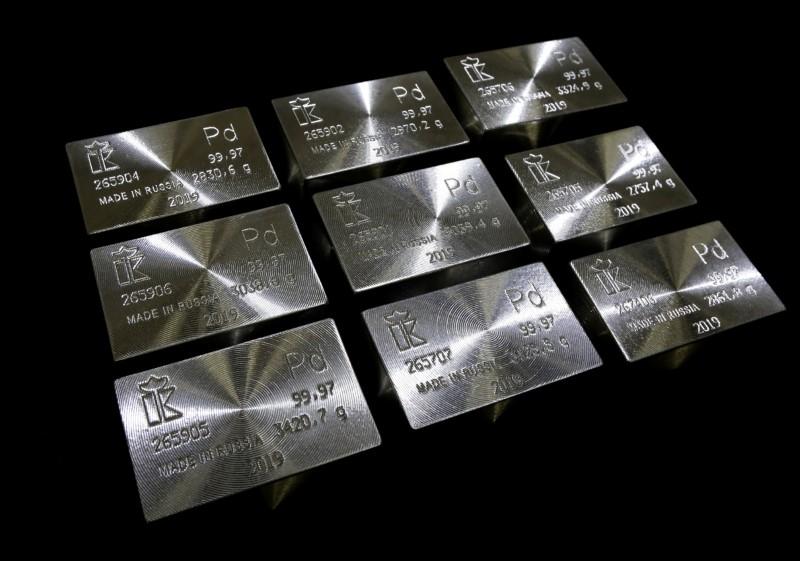

The most direct route for a risk position in palladium is via the physical market for bars and coins. The futures trading on the CME’s NYMEX division provides an alternative as they have a delivery mechanism on expiration. Meanwhile, those seeking palladium exposure without holding the physical metal or venturing into the volatile, leveraged, and margined futures arena can turn to the Aberdeen Physical Palladium ETF (PALL). PALL is available to any market participant with a standard stock account.

At $132.16 on May 4, PALL had $259.35 million in assets under management. PALL trades an average of 38,515 shares daily and charges a 0.60% management fee. The latest rally in palladium took the price of nearby futures 23.7% higher from $1,333 in early March to $1,649 in mid-April before correcting.

The chart shows that PALL moved from $125.59 to $152.45 per share over the same period, or 21.4% higher. PALL holds 100% of its assets in physical palladium bullion but only trades during U.S. stock market hours. Since palladium futures trade around the clock, the ETF can miss highs or lows when the stock market is not operating.

At the $1,420 level on May 4, palladium is 58% below its all-time March 2022 high. The low annual production level, supply concerns created by the ongoing war in Ukraine, and increasing demand from green energy initiatives support higher palladium prices over the coming months and years.

More Metals News from Barchart

- Stocks Undercut as Regional Bank Stocks Plunge

- Dollar Declines With T-note Yields

- Stocks Mixed Ahead of an Expected +25 bp Fed Rate Hike

- Dollar Retreats on Signs of U.S. Economic Weakness