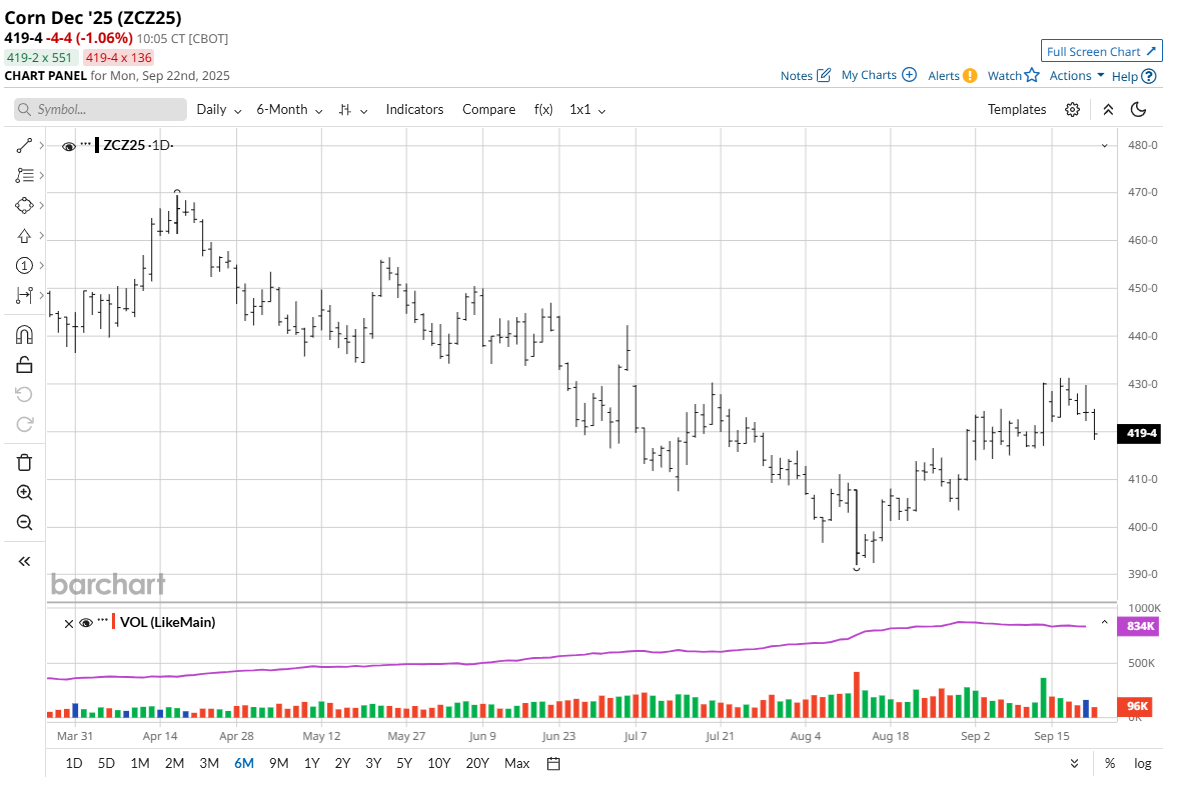

December corn (ZCZ25) futures prices lost 6 cents for the week last week. Friday’s close near the weekly low in December corn futures sets the speculative bears up for some chart-based selling pressure early this week. Corn bulls got little traction Friday from the USDA reporting a daily U.S. corn sale of 206,460 MT to unknown destinations during the 2025-26 marketing year.

The U.S. corn harvest has seen an early start in many parts of the Corn Belt this year. The related commercial hedge selling pressure will ramp up in the coming weeks, which could limit rallies in corn futures prices. However, as seen by corn prices still in an uptrend on the daily chart after the mid-September USDA supply and demand report showing a big U.S. corn crop, it appears the big and price-bearish corn crop has already been factored into futures prices.

The USDA last week reported weekly U.S. corn export sales of 1.232 million MT for the week ended Sept. 11. Export demand for U.S. corn has been good recently, which is likely to keep a floor under futures prices. New U.S. trade deals in the coming months would likely produce even more global demand for U.S. corn. Recent trade talks between the U.S. and China have apparently been going well, giving grain market bulls hopes that better U.S. grain export sales to China will occur in the coming months.

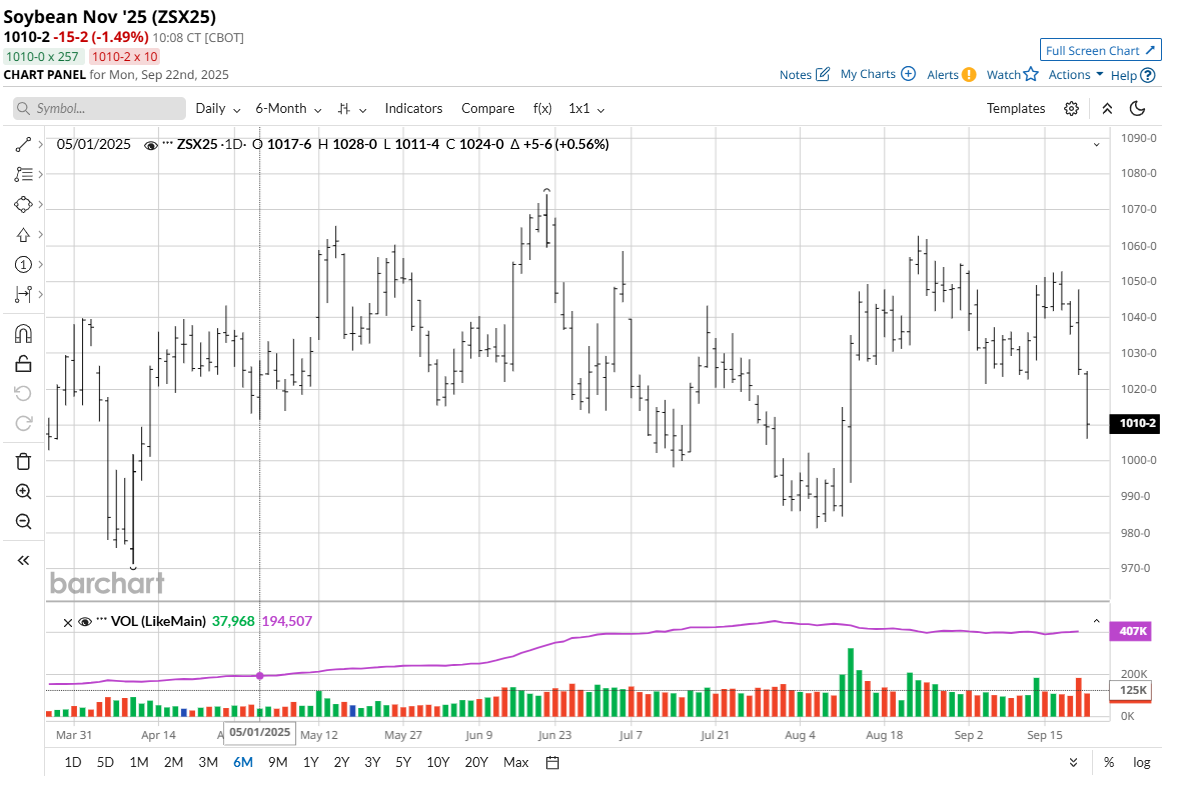

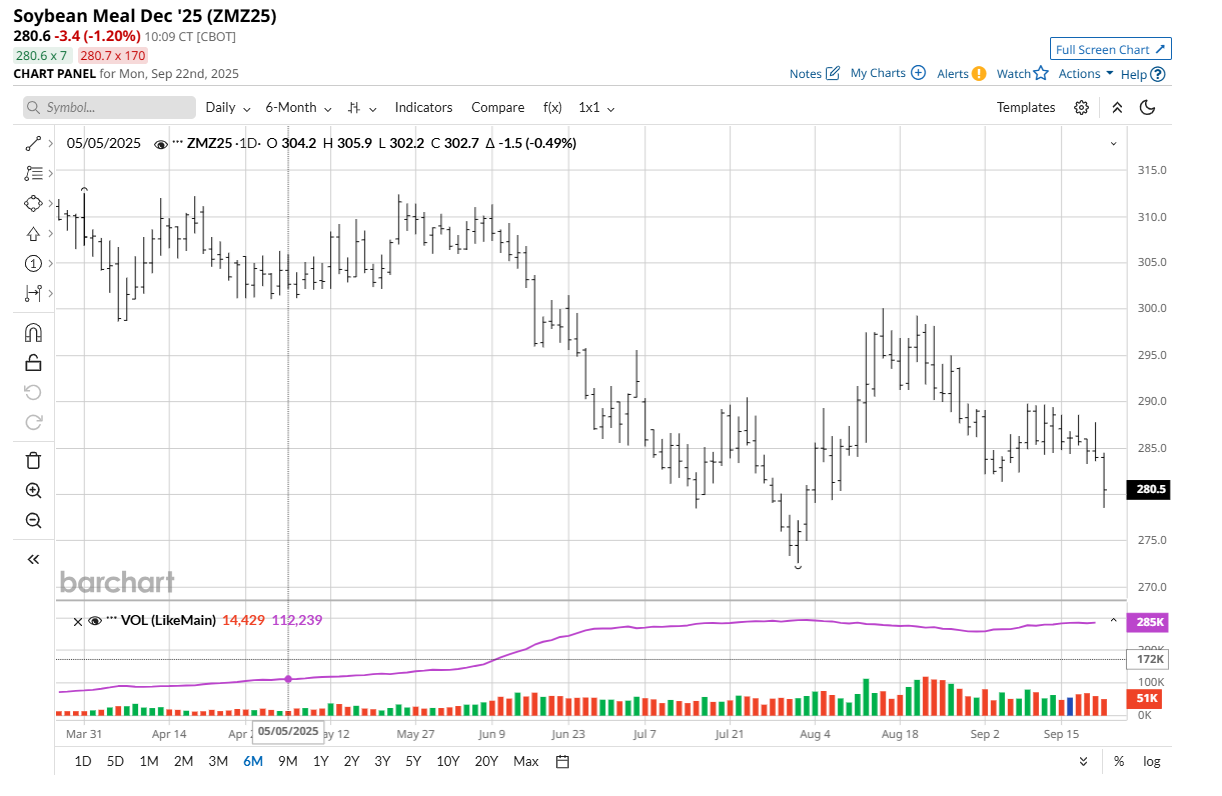

Soybeans Still Anchored by Lethargic Meal Market

November soybean (ZSX25) futures last were down 20 3/4 cents for the week last week. December soybean meal (ZMZ25) for the week was down $4.60. The soy complex bulls laid an egg late last week after some promising price action early in the week. The technically bearish weekly low closes in November beans and December meal and bean oil (ZLZ25) set the table for follow-through chart-based selling pressure early this week. The soybean meal futures market bulls need to get in gear for soybean futures to make any decent price headway.

President Donald Trump spoke with Chinese President Xi Jinping on Friday morning. While reports said the talks were positive and constructive, it appears U.S. soybean purchases were not a part of the discussion. That apparently deflated the soy complex bulls. Trump said the call was “very productive” and progress was made on many fronts. He also hinted at an in-person meeting with the Chinese president early next year, which would be beyond the main export window that China has historically booked most of its soybeans.

The U.S. soybean harvest is also getting an early jump in much of the Midwest, as the crop has dried down quickly. Weather forecasters say the Midwest will see a wet weather pattern through this Friday and much of the region will see multiple rounds of rain. Drier weather and improving conditions for fieldwork will occur Sept. 27-Oct. 3. Harvest pressure and the related commercial hedge selling will pick up as September winds down, which will likely keep any futures price rallies modest at best.

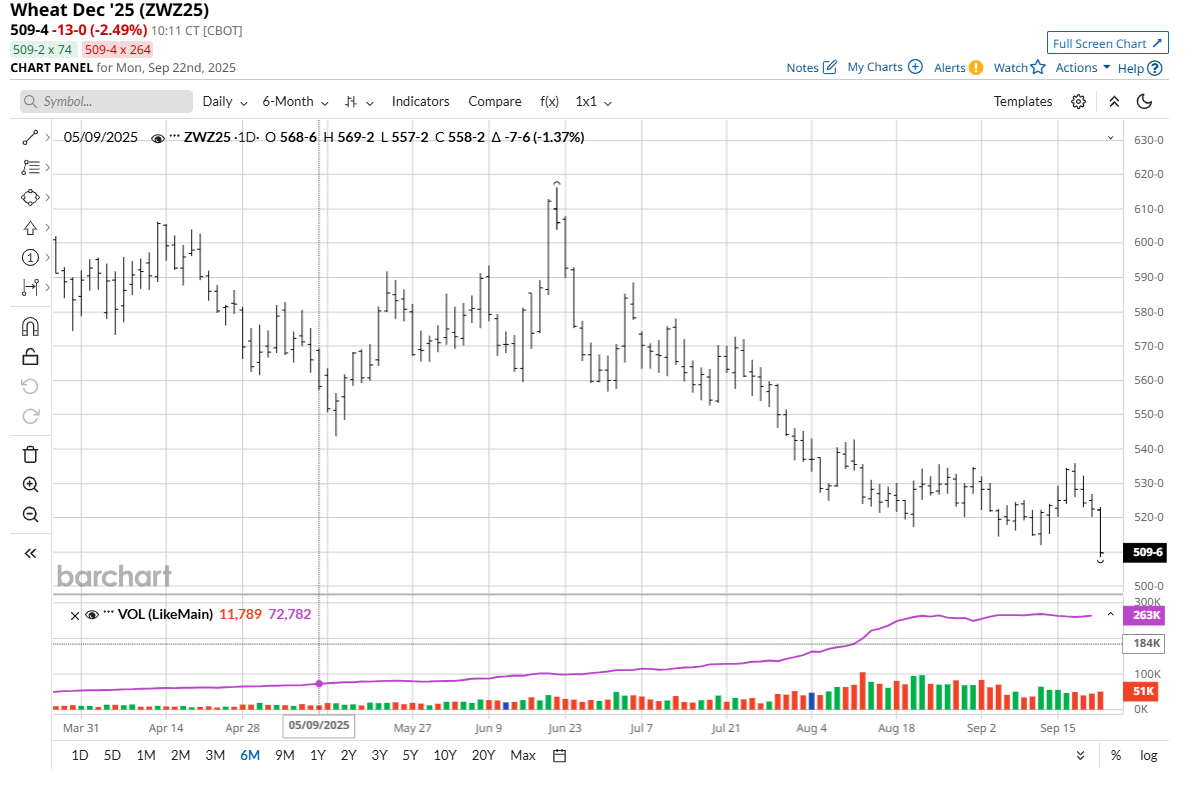

Wheat Bulls Need to ‘Eat Their Wheaties’

When I was a kid in the early 1970s, there was a TV commercial for Wheaties breakfast cereal. If the task for the day ahead was difficult, the commercial advised kids to “eat your Wheaties.”

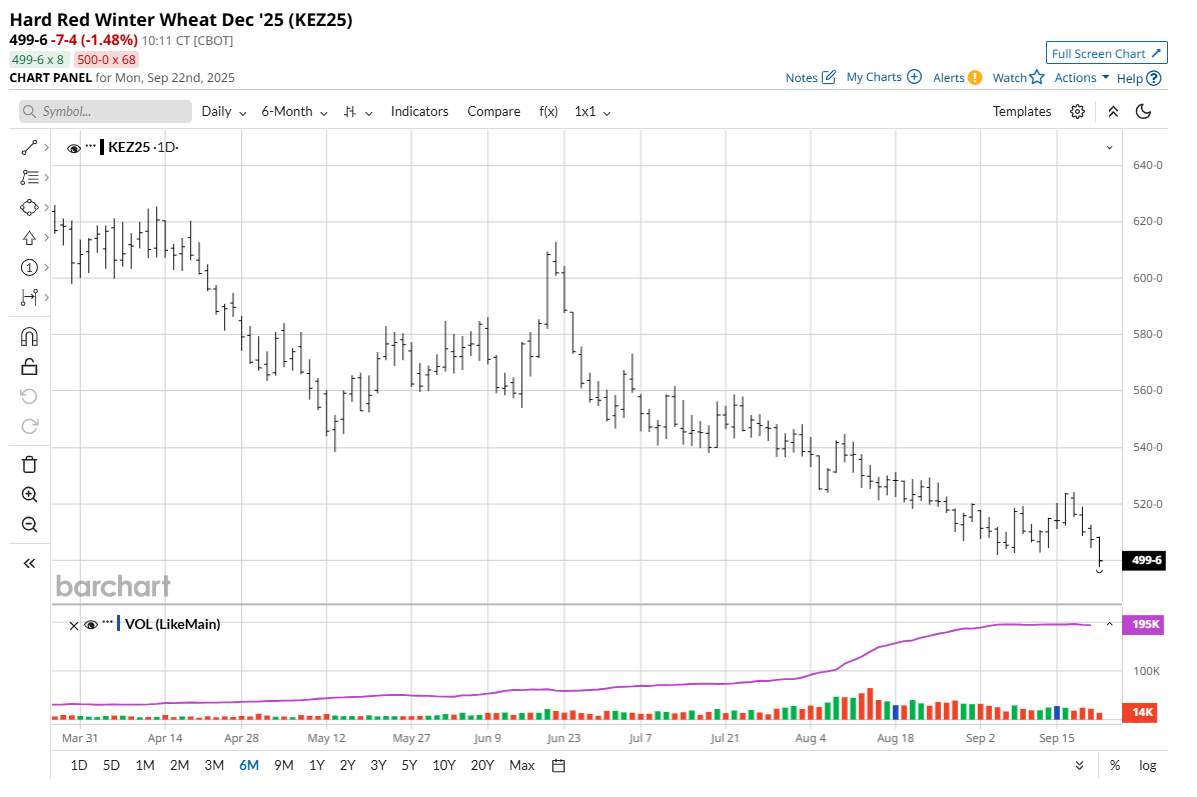

Such is the case for the winter wheat market bulls at present. December soft red winter wheat (ZWZ25) last week fell 1 cent on the week. December hard red winter wheat (KEZ25) gave up 4 1/4 cents on the week. The winter wheat futures markets earlier last week showed some bullish promise, but the bulls faded down the stretch late last week and proceeded to lose all their early week gains and then some. Friday’s technically bearish weekly low closes in December SRW and HRW wheat futures suggest the technical bears are still in technical command and will look to play the short side again early this week.

The wheat futures markets bulls in the coming weeks are likely to need some help from corn and soybean prices rallying, to get their own markets in forward gear. That’s a tall order, given that big U.S. corn and soybean crops are being harvested, which may limit rallies in those markets until harvesting is complete in November.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.