December corn (ZCZ25) futures prices lost 2 cents last week, while November soybeans (ZSX25) were down 11 3/4 cents on the week. December soft red winter (ZWZ25) and hard red winter wheat (KEZ25) futures last week fell 2 3/4 cents and rose 1/4 cent, respectively. The grain markets are wavering as U.S. corn and soybean harvesting is moving into high gear, and very large U.S. yields are expected. That’s giving the corn and bean bulls pause amid upcoming seasonal hedge selling from the commercials as farmers sell their crops at local elevators.

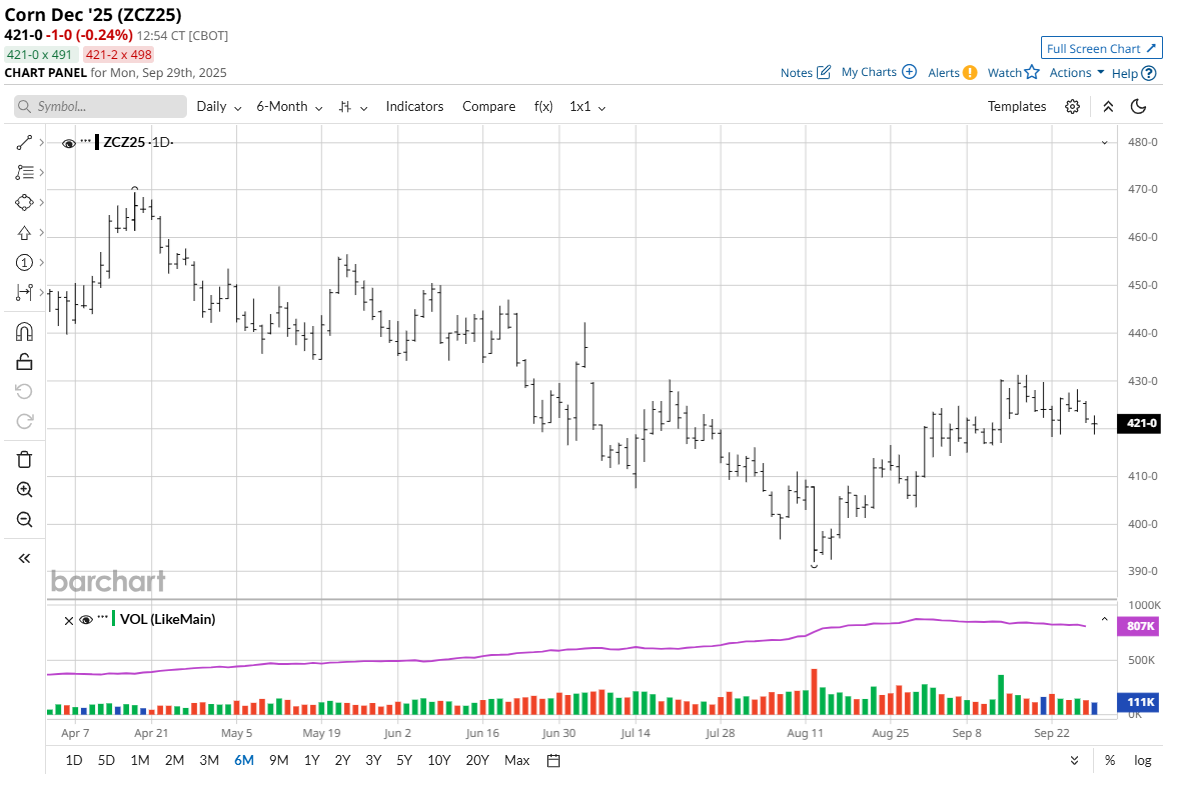

Corn Bulls Struggling to Keep Price Uptrend Alive

Last week’s trading was choppy for the corn futures market, with the bulls unable to put together a decent winning streak over the past two weeks. That suggests the price uptrend on the daily chart may be rolling over. Last week’s resurgence in the U.S. dollar index ($DXY), hitting a four-week high, also provided headwinds for the corn market as well as the other grains.

On the bright side, export demand for U.S. corn has been good recently, which is likely to keep a floor under prices. New U.S. trade deals in the coming months would likely produce even more global demand for U.S. corn.

Little rainfall is expected across the Midwest in the next two weeks, while warm temperatures through the next 10 days will keep crop maturation rates high and harvesting should become more aggressive. There is no risk of frost or freezes through late next week and likely into the following weekend as well. Thus, weather leans price-bearish for corn and soybeans as farmers’ combines should be rolling steadily the next two weeks.

Soybeans Continue to Feel the Pressure of the Slumping Meal Futures Market

The soybean market bulls are worried about a bearish pennant pattern on the daily bar chart for November futures that formed last week. Soybean meal (ZMZ25) futures continue to be the weakest link in the soy complex futures. Meal will have to perform better for soybeans to have a chance to restart a price uptrend.

The soy complex futures markets last week were hit by news that around 40 cargoes of Argentine soybeans were registered for export in November and December during the export tax suspension, mostly headed to China. However, it is important to note China typically buys around 90% of Argentina’s soybean exports. Total bookings so far still do not stray far from what is considered normal for Argentine exports. So, while Argentine soybean export sales increased markedly last week, total exports may not stray far from what was expected prior to the tax cut. China has shown a robust appetite for soybeans. While Argentina will supply short-term needs, global demand for soybeans will continue to grow and a tight U.S. balance sheet will persist. That’s a bullish longer-term element for the soybean markets.

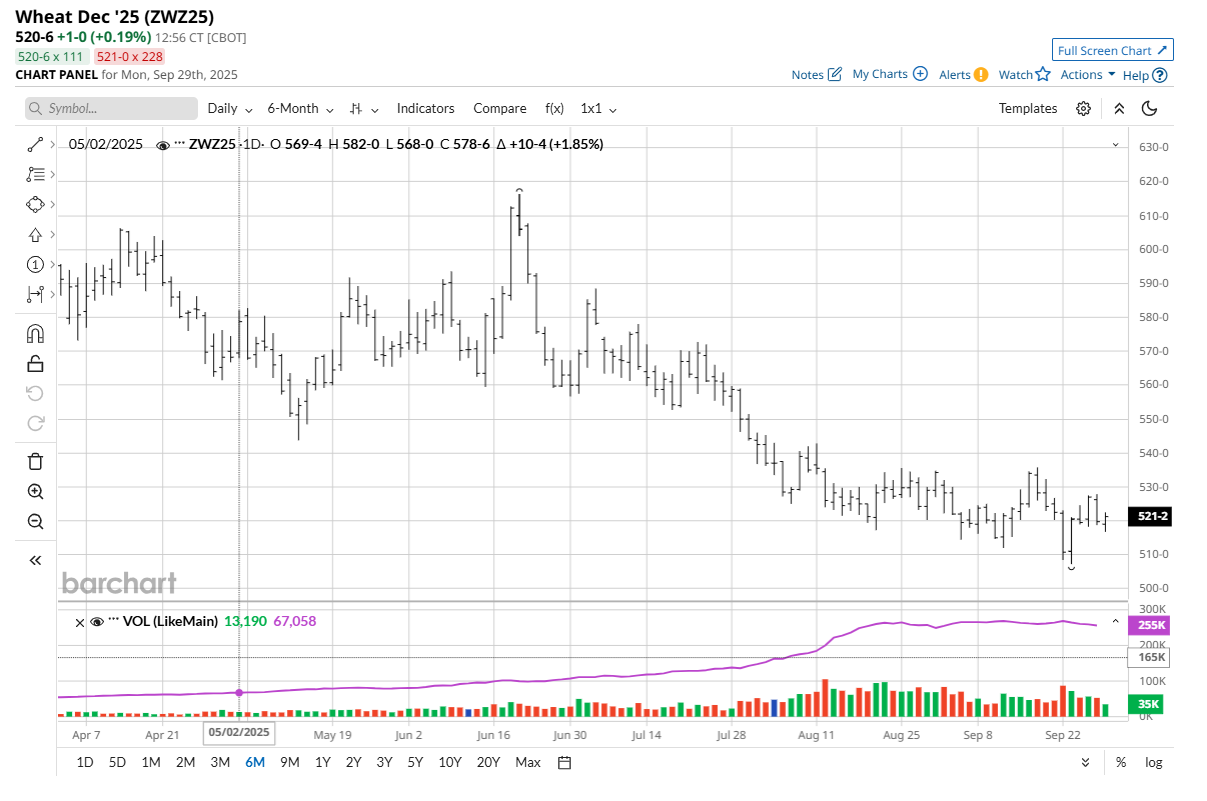

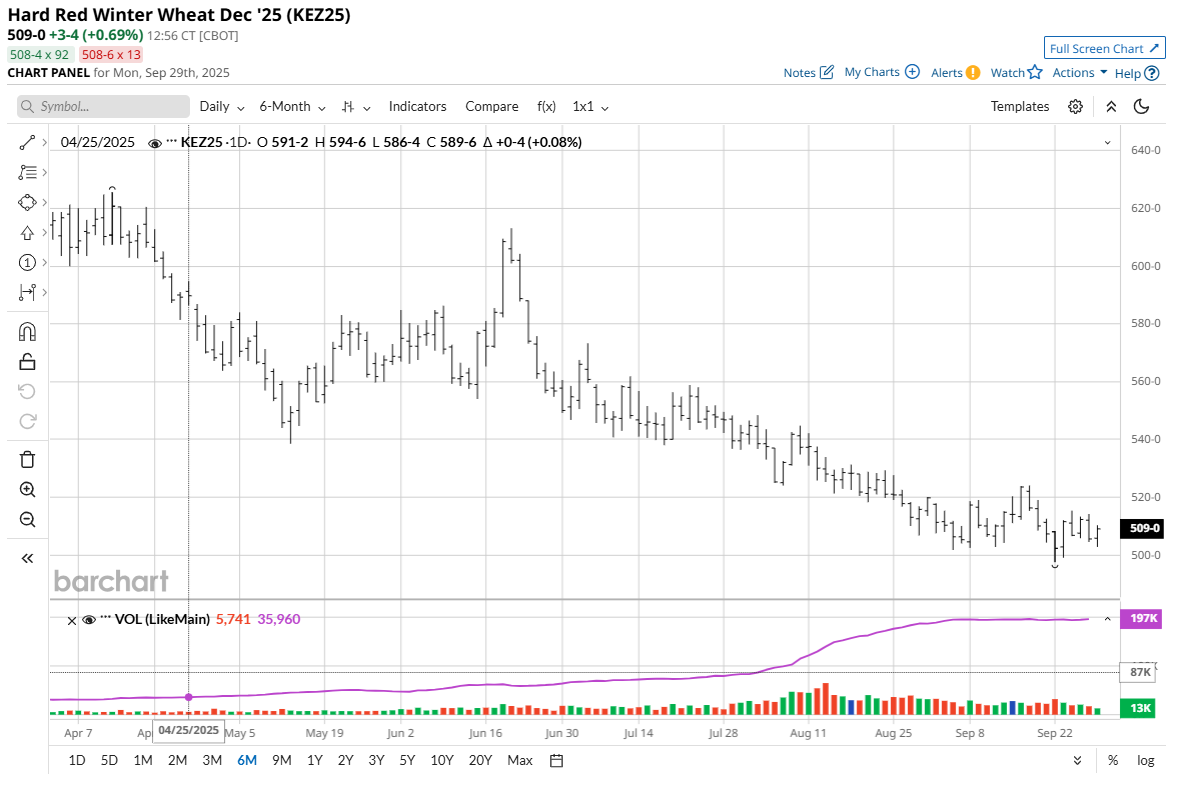

Winter Wheat Futures Markets Continue to Struggle Near Their Contract Lows

The winter wheat futures markets showed some promise early last week, but Friday’s losses put prices back down close to their contract lows and will give the chart-based speculators some momentum early this week.

Last week’s weekly USDA export sales report showed U.S. wheat sales of 539,800 metric tons (MT) for 2025/2026 were up 43% from the previous week and up 37% from the prior 4-week average. Exports of 896,000 MT were up 16% from the previous week and 18% above the prior 4-week average. Global demand for U.S. wheat is showing some promise, which may mean a near-term low is in place, or very close at hand.

Tuesday’s USDA Quarterly Grain Stocks Report the Data Point of the Week

Tuesday’s USDA quarterly stocks report will be key in providing greater insight into supply and demand over the last quarter. A Reuters survey of grain analysts shows the average estimate for Sept. 1 U.S. corn stocks, at 1.337 billion bushels, would be a four-year low and down 24% from a year earlier. However, the analysts’ collective estimate is above the 1.325 billion bushels USDA projected for 2024/25 corn ending stocks in its Sept. 12 monthly supply and demand report.

The report is expected to show U.S. soybeans stocks of 323 million bushels, according to the Reuters survey. That would be down 5.6% from the prior year and below the 330 million bushels USDA projected as 2024/25 soybean ending stocks in its Sept. 12 monthly supply and demand report.

For U.S. wheat stocks, the Reuters survey shows the average estimate of 2.043 billion bushels would be up 2.6% from 1.992 billion a year ago and would represent the largest Sept. 1 wheat stocks figure since 2020. USDA’s final estimate for the 2024-25 wheat crop production is set for release, too.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.