/Alphabet%20Inc_%20and%20Google%20logos%20by%20IgorGolovinov%20via%20Shutterstock.jpg)

After months of navigating regulatory hurdles and the constant looming threat of being forced to divest its Chrome browser by the U.S. Department of Justice (DOJ), Alphabet’s (GOOGL) Google has finally started to see brighter days on Wall Street. Earlier this month, a federal judge handed down an antitrust ruling that came in far lighter than investors feared, and, most importantly, confirmed that Google won’t have to sell its Chrome browser.

That clarity helped lift a major cloud over GOOGL stock, and sparked a surge in confidence. Of course, the market wasted no time rewarding the news. Following this favorable ruling, the company added billions of dollars in market value. On Sept. 15, the stock closed up roughly 4.5% to become the fourth company to officially join the $3 trillion market capitalization club, a rarefied space shared only by Nvidia (NVDA), Microsoft (MSFT), and Apple (AAPL).

This milestone arrives some 20 years after Google’s public market debut, marking a defining moment in its growth story. Even more notable is that Google now stands as the second-best-performing “Magnificent Seven” stock in 2025, just behind Meta Platforms (META) and outshining even artificial intelligence (AI) darling Nvidia. So, with regulatory clouds lifting and momentum on its side, should you buy GOOGL stock now?

About Google Stock

Powered by a wide range of revenue streams, Google’s dominance in tech is hard to overlook. The California-based tech giant has its footprint across nearly every corner of the digital world, from its cash-cow ad business and rapidly scaling cloud division to ad-supported streaming, self-driving technology, and even healthcare innovation. However, as technology continues to advance at a rapid pace, what sets Google apart now is its early bet on AI.

Long before AI became the market’s hottest trend, the company was weaving it into core offerings like search, YouTube, and Maps. Now, those efforts have culminated in Gemini, Google’s flagship suite of AI models, which sits at the heart of its strategy to compete at the very top of the AI race. With its market capitalization now hovering around $3 trillion, shares of this mega-cap stock are performing well on Wall Street, thanks to the favorable antitrust ruling and strong AI momentum.

Over the past 52 weeks, GOOGL stock has skyrocketed nearly 60%, outshining the S&P 500 Index’s ($SPX) 18% gain. So far this year, the stock is up about 33%, while the broader index has returned a modest 13% year-to-date (YTD). On Sept. 18, Google notched a new high of $253.99 and now trades only slightly below that level, maintaining strong momentum on Wall Street.

Digging Into Google’s Q2 Performance

Google reported its fiscal 2025 second-quarter results on July 23, and the numbers came in well ahead of Wall Street’s expectations. Revenue rose 14% year-over-year (YOY) to $96.4 billion, topping the $94 billion consensus estimate. EPS climbed 22% to $2.31, beating estimates by a 7.4% margin. Operating income increased 14% to $31.3 billion, and operating margin came in at 32% thanks to strong top-line growth and expense discipline.

By quarter-end, Google held a hefty $95 billion in cash and marketable securities. Diving deeper, Google Cloud once again stole the spotlight. Revenue surged 32% YOY to $13.6 billion, driven by the rapid adoption of Google Cloud Platform’s (GCP) core offerings, AI infrastructure, and generative AI solutions. Cloud backlog reached a whopping $106 billion at the end of Q2, up 18% sequentially and 38% from last year, underscoring strong and sustained demand from both new and existing customers.

Search and advertising, Google’s backbone businesses, also delivered solid results despite intensifying AI competition. Search revenue rose 11.7% YOY to $54.1 billion, while total advertising climbed 10.4% to $71.3 billion. These results highlight the company’s ability to preserve its market strength even as rivals push AI-powered alternatives. CEO Sundar Pichai emphasized the company’s rapid progress on the AI front in the Q2 earnings call.

Gemini app, home to Google’s AI chatbot, now boasts more than 450 million monthly active users. Meanwhile, AI Overviews, the AI-powered search tool that summarizes results, has expanded to over 2 billion monthly users across more than 200 countries and territories.

To support this momentum, Google is also stepping up its investment plans. The company now expects to spend roughly $85 billion in capital expenditures in fiscal 2025, compared with its earlier estimate of $75 billion. Management attributed the increase to surging demand for cloud services and AI-driven solutions, signaling just how quickly the business is scaling.

What Do Analysts Think About Google Stock?

Recently, Evercore ISI raised its price target on GOOGL stock to $300 from $240, while maintaining an “Outperform” rating on the tech giant. The upgrade comes after the investment firm’s sixth quarterly search survey, which showed Google holding its lead in commercial-intent searches even as competition in general search heats up.

According to Evercore, Google’s generative AI push is making search “an overall better Search Engine for users,” a shift they believe will fuel “consistently strong Search Revenue growth” for the company. On top of that, Evercore called Google its “Top Large Cap Long” pick, pointing to several growth drivers such as YouTube’s ad momentum, Google Cloud’s steady performance, and Waymo’s growing robotaxi rollout.

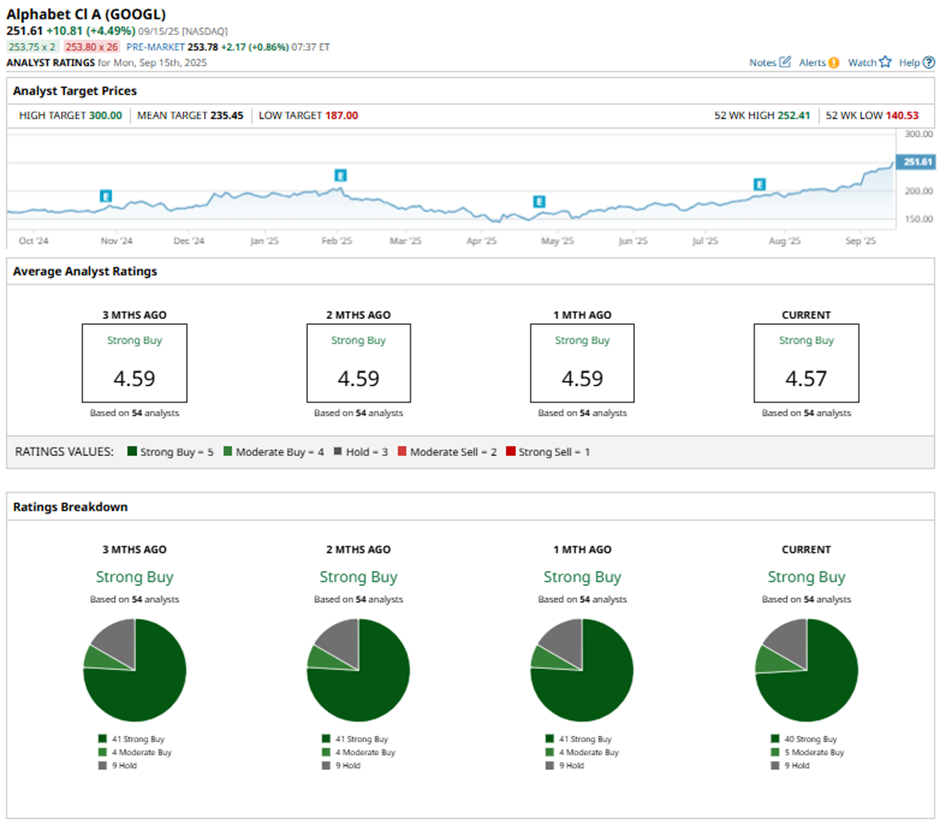

Overall, Wall Street remains largely bullish about GOOGL’s prospects, with the stock carrying a consensus “Strong Buy” rating. Among 54 analysts covering the stock, a majority of 40 analysts call it a “Strong Buy,” five lean toward a “Moderate Buy,” and the remaining nine have a “Hold' rating.

This year’s rally has pushed GOOGL stock above the average analyst price target of $236.53. However, the most bullish target on the Street of $300, assigned by Evercore ISI, indicates 19% potential upside from current levels, leaving plenty of room for new highs ahead.