In mid-July it’s not at all uncommon to see trading action become dull and listless. Traders are focused less on trading and more on family vacations and outdoor activities before school starts in late August. Barring an unexpected major event that rocks the market, look for more of the “summer doldrums” in metals over the next several weeks. Remember, too, that much of Europe takes off on vacation during the month of August. That means it may be until after the Labor Day holiday weekend in the U.S. that traders get back down to real business.

The Bull Case for Gold and Silver

The following are the bullish elements in gold and silver that will very likely keep a floor under prices for at least the near term.

- Charts for gold and silver remain overall bullish from both shorter-term and longer-term perspectives. That’s going to keep speculators wanting to buy any significant price dips, which has been the case the past couple months.

- Geopolitical matters have settled down from highs in recent weeks but remain simmering, with the potential to come to a boil rapidly. There are reports that Israeli forces and Syrian government troops have clashed in the Suwayda region, with Israeli airstrikes hitting Syrian military sites. The Russia-Ukraine war continues, with President Donald Trump getting increasingly frustrated with Russia’s foot-dragging on ceasefire talks. And the U.S. has ramped up its hawkish rhetoric on tariffs the past week. All the above are price-friendly elements for safe-haven metals.

- Better economic numbers coming from the U.S. and China suggest the world’s two largest economies are getting healthier. That suggests better consumer and commercial demand for precious metals. Growing U.S. and China economies are also a positive for improved economic growth in other industrialized countries.

- Up-trending crude oil prices are bullish for the metals markets. Nymex crude oil futures (CLQ25) this week hit a three-week high of $69.65 a barrel and are well up from the April and May lows that saw prices move below $55.00 a barrel. Crude oil is the leader of the raw commodity sector, and when its price rises, that helps lift other raw commodity markets’ prices, too.

The Bear Case for Gold and Silver

The following are the bearish factors that may limit the upside in gold and silver prices or even prompt some downside price pressure in the near term.

- While geopolitics may flare up again, there is a calmer mentality in the marketplace at present that has pushed the U.S. stock indexes to record highs. If the stock indexes continue to rally, gains in gold and silver will be hard to come by, as equities are a competing asset class with precious metals.

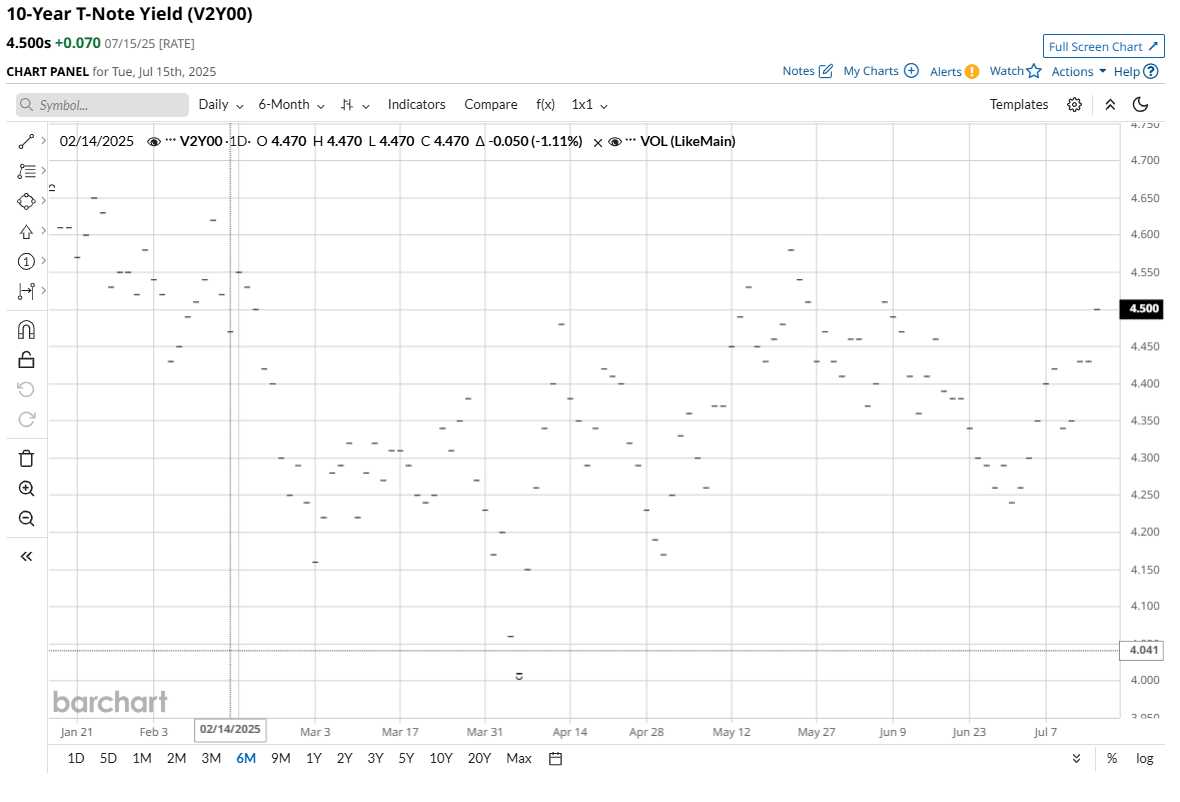

- U.S. Treasury yields have been on the rise the past two weeks. Increased worries about U.S. tariffs prompting higher inflation, along with better U.S. economic data, have played a major part in the rise in bond yields. Higher bond yields are bearish for gold and silver, which have no yields.

- There are early technical and fundamental clues that the U.S. dollar index has put in a major bottom. Historically, a higher U.S. dollar index on a daily trading basis, has been short-term negative for gold and silver, on an “outside-market” trading basis. However, on a longer-term basis, an appreciating greenback has not been a significantly bearish fundamental factor for gold and silver.

- Bull markets need to be fed fresh fundamental news often to keep price trends going up. Gold and silver have not seen much fresh, bullish news lately. It could be that traders have fully factored into present prices all the above-mentioned bullish market elements that have been in place for a while.

My Bottom Line on Gold and Silver Prices

My bias is that in the coming weeks, the gold market will continue to grind sideways between $3,475.00 and $3,250.00. And if you press me harder on the matter, I’d say maybe sideways to lower at least until after the Labor Day holiday. For silver, I think there is more room to run on the upside in the near term, with its record high of nearly $50.00 an ounce in striking distance. But if gold starts to see a sustained sideways-lower grind, silver will likely follow.

Let me know what you think. Have I missed something? Email me at jim@jimwyckoff.com. I enjoy hearing from my Barchart readers all over the world.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.