With a market cap of $27.3 billion, General Mills, Inc. (GIS) is a leading global packaged foods company best known for its iconic brands like Cheerios, Pillsbury, Betty Crocker, Häagen-Dazs, Blue Buffalo, and Nature Valley. Headquartered in Minneapolis, Minnesota, the company operates across North America and international markets, offering a wide portfolio of cereals, snacks, yogurt, baking products, frozen meals, pet food, and more.

Companies worth $10 billion or more are typically referred to as "large-cap stocks." GIS fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the packaged foods industry. With a strong distribution network and household brand recognition, General Mills generates stable cash flows and emphasizes innovation, cost efficiencies, and expansion into growth categories such as natural/organic foods and premium pet nutrition.

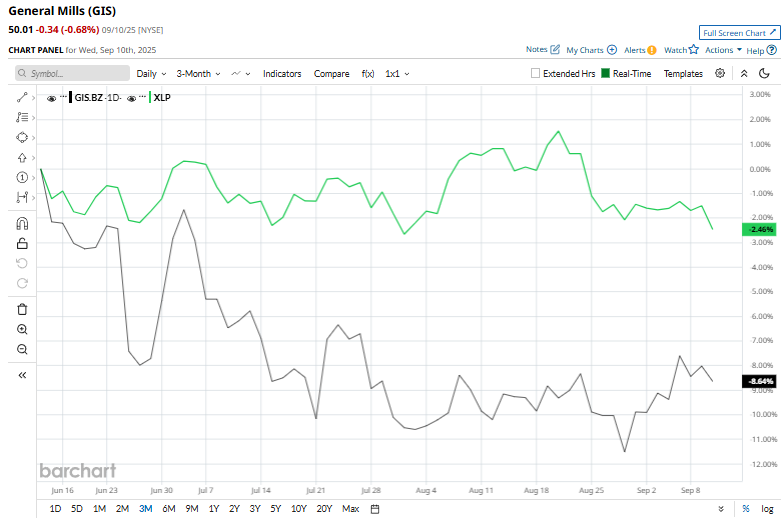

Despite its notable strengths, shares of GIS have dropped 33.9% 52-week high of $75.66, touched on Sept. 18 last year. In the past three months, GIS stock has declined 8.2%, lagging behind the Consumer Staples Select Sector SPDR Fund’s (XLP) 2.3% drop during the same time frame.

The stock’s performance looks grim over the longer term as well. GIS stock has fallen 33.2% over the past 52 weeks and 21.6% on a YTD basis, underperforming XLP’s 4.4% drop over the past year and a 1.7% rise in 2025.

Confirming its bearish trend, GIS has remained under its 200-day moving average since early November 2024 and has also traded below its 50-day moving average since early April.

Extending its downward trend, GIS shares fell 5.1% on June 25 following the release of its fiscal fourth-quarter results. The company posted net sales of $4.89 billion, a 6% year-over-year decline driven by softer volumes and pricing pressure. Operating profit dropped 8% to $805 million, while adjusted EPS slid 6% to $1.08.

Its peer, The Kraft Heinz Company (KHC), has declined 13.2% in 2025 and 25% over the past year, surpassing the stock.

Among the 20 analysts covering the GIS stock, the consensus rating is a “Hold.” Its mean price target of $54.68 suggests a robust 9.3% upside potential from current price levels.