Apple Inc.'s (NASDAQ:AAPL) iPhone 17 launch appears to be gaining momentum, with analyst Gene Munster noting that pre-orders on China's JD.com Inc. (NASDAQ:JD) have surpassed last year's iPhone 16 levels, excluding the delayed iPhone Air model.

Strong Early Demand In China

Over the weekend, Munster, managing partner at Deepwater Asset Management, wrote on X, formerly Twitter, "First data point that iPhone cycle is off to a solid start."

Adding, "In China, online retailer JD says pre-orders surpassed the first-day pre-order volume of last year's iPhone 16 (excludes the Air given no y/y comps)."

Reports confirmed that the iPhone 17's 256GB configuration dominated early orders, making it the top-selling model on JD.com since pre-orders opened Friday.

See Also: Goldman Sachs Sees Apple Revenue Acceleration As iPhone 17, AI Take Center Stage

Value-Driven Base Model

The popularity of the base iPhone 17 is being credited to its combination of affordability and upgrades. Apple kept the starting price at $799, the same as the iPhone 16, despite speculation of price hikes.

The device now offers: a larger 6.3-inch display with slimmer bezels, 120Hz ProMotion support, previously exclusive to Pro models and double the storage at 256GB.

These changes bring the standard edition closer to professional-tier specifications, helping Apple address one of the key gaps that pushed consumers to higher-priced devices in the past.

iPhone Air Faces Regulatory Delay In China

While U.S. customers can expect to receive the new iPhone Air by its Sept. 19 launch date, Apple postponed pre-orders in China due to regulatory approval issues tied to eSIM technology, according to the South China Morning Post. The delay could temporarily dampen Apple's momentum in one of its most competitive markets.

Analysts Split On Long-Term Momentum

Despite strong pre-order data, skepticism remains about the iPhone's ability to drive another "supercycle." AT&T CEO John Stankey told Yahoo Finance, "I don't see super cycles as being kind of the dynamic around it."

Wall Street analysts echoed that sentiment, praising Apple's slimmer designs, camera improvements, and stronger battery life but flagging the company's delayed rollout of AI features as a limitation.

Market Context And Stock Performance

Apple continues to lead with a 25.71% global smartphone market share, ahead of Samsung's 20.96%. In the U.S., Apple dominates with a 57.24% share versus Samsung's 22.25%.

In the third quarter, iPhone revenue rose to $44.58 billion, up from $39.3 billion a year earlier, underscoring the device's importance to Apple's growth.

Shares of Apple have fallen 2.26% in the past five days and are down 4.01% year to date, according to Benzinga Pro.

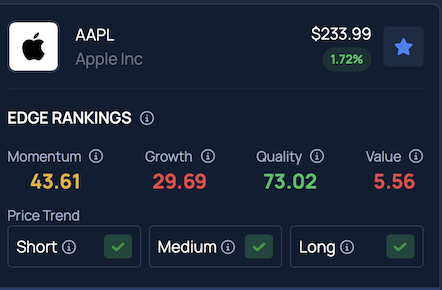

Benzinga's Edge Stock Rankings indicate that AAPL maintains a positive trend over the short, medium and long term, with additional performance insights available here.

Read Next:

Photo courtesy: jackpress / Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.