On Wednesday, Deepwater Asset Management's managing partner Gene Munster said that Apple Inc. (NASDAQ:AAPL) "scored deal of the year." His statement came after it was reported that Cupertino plans to pay $1 billion/year to Alphabet Inc.'s (NASDAQ:GOOG) (NASDAQ:GOOGL) Google to help power Siri's much-awaited overhaul.

Apple Reportedly Plans To Pay $1 Billion Annually To Use Gemini AI Model

Earlier in the day, Bloomberg columnist Mark Gurman reported that Cupertino intends to pay for an advanced AI model developed by Google, citing people with knowledge of the matter.

This model with 1.2 trillion parameters will help Apple's major Siri update.

For the updated Siri, which could launch next Spring, the tech giant has previously weighed in several other third-party models, including OpenAI's ChatGPT and Anthropic's Claude.

However, Apple ultimately chose to go with Google's Gemini.

Apple and Google did not immediately respond to Benzinga's request for comments.

See Also: Michael Burry Is Super-Bearish On Palantir — With 5 Million Puts

Munster: Apple Got A Bargain With Google Gemini

Following the publication of the report, Munster took to X, formerly Twitter, and said that while Google reportedly invested more than $100 million to build Gemini, Apple gets access for a fraction of the cost.

On the other hand, Apple gets $20 billion per year from Google for "search placement."

Moreover, Apple doesn't pay ChatGPT-maker anything because "that relationship seems to fall into the ‘you get what you pay for' camp," Munster stated.

If the report is true, Munster said, "Apple scored the deal of the year."

Apple Tops Q4 Estimates With $102.47 Billion Revenue

Last month, Apple reported fourth-quarter results. The company reported a revenue of $102.47 billion, surpassing analyst projections of $102.17 billion. Earnings came in at $1.85 per share, also topping expectations of $1.76 per share.

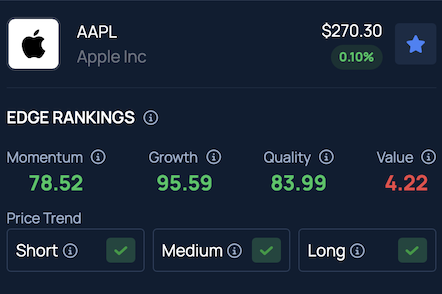

Price Action: Apple's stock closed at $270.14 on Wednesday, up 0.037% for the day, but slipped 0.11% to $269.85 in after-hours trading, according to Benzinga Pro.

The stock ranks strong in Quality and Growth according to Benzinga's Edge Stock Rankings, maintaining a positive price trend across short, medium and long-term periods. Click here to explore detailed insights on the stock, its peers and competitors.

Photo: DenPhotos / Shutterstock

Read More: