Earnings season isn’t off to a great start given the chaos of the stock market, and General Electric (GE) isn’t making things much better.

Shares are off the lows of the day but are still down about 6.5% on Tuesday following disappointing quarterly results.

The company was able to beat earnings expectations, but revenue of $20.3 billion fell 7% year over year and missed analysts’ estimates by more than $1 billion.

Worse, management’s earnings outlook for next year was well shy of consensus estimates. That said, the company’s free cash flow is set to improve impressively from 2021.

Still, the overall tone after the quarter is not great and the stock is near a one-month low as a result.

If the selling stops there, the bulls should be relieved — and to be honest, impressed — even if the quarter itself was not impressive.

Here are the levels to know now as we push forward amid a dicey time in the overall market.

Trading GE Stock

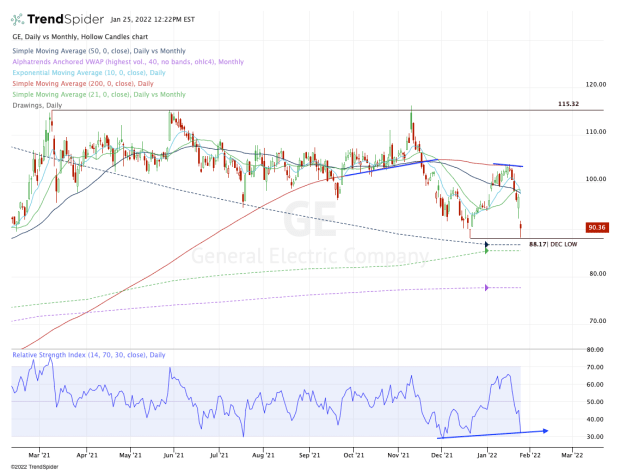

Chart courtesy of TrendSpider.com

GE stock traded down to a low of $88.30 and bounced. That barely missed the December low of $88.17.

If we see General Electric breach this level in the coming days — or in this tape, the coming hours — then we have to keep an eye on the 21-month and 50-month moving averages between $85.50 and $86.50.

That area will hopefully be support should the stock fall that far.

If GE stock does break below last month’s low — setting the table for a potential monthly-down rotation — we also have to be aware for the potential of a bullish reversal back up through $88.17.

If GE stock isn’t able to bounce and breaks below last month’s low and $85.50, we could have a situation on our hands where the stock trades down to the monthly VWAP level below $80.

However, should the stock rally from here, let’s see if it can reclaim its short-term moving averages and the 50-day.

The trend has shifted lower, so recapturing these moving averages is paramount to GE stock bulls regaining control.

Above these measures and the 200-day is in play. That was support earlier in the fourth quarter, but resistance earlier this month. Until proven otherwise, I expect it to remain resistance.