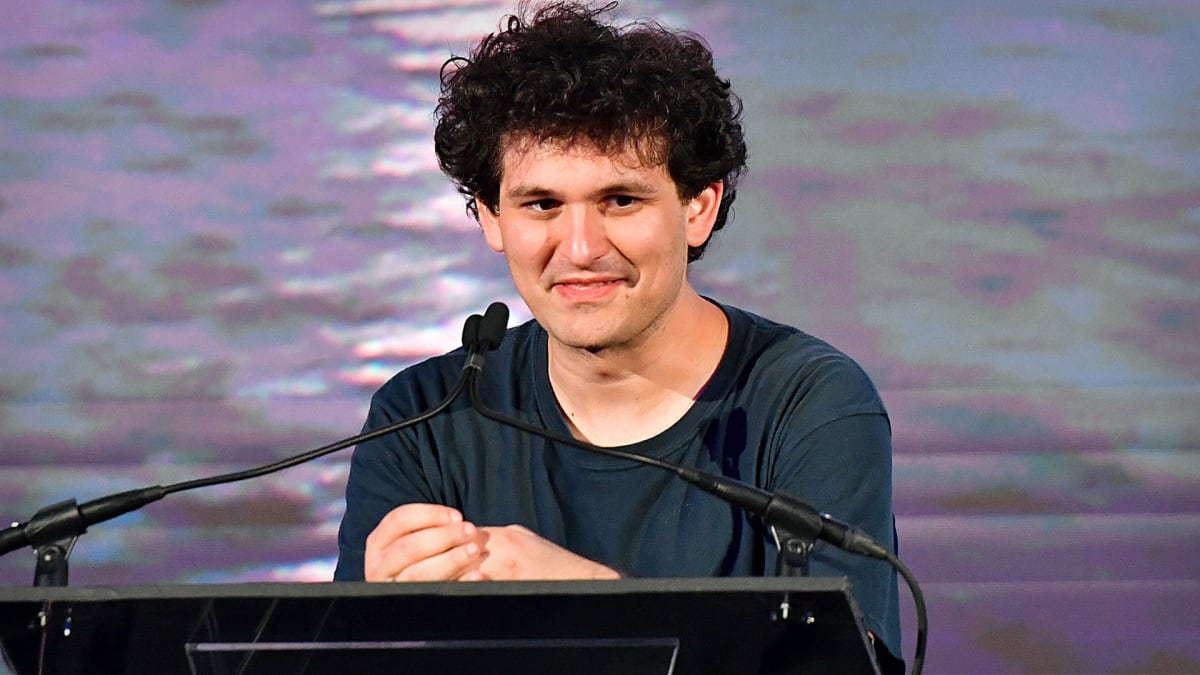

Sam Bankman-Fried, the fallen founder of the FTX cryptocurrency exchange, fears for his safety and that of his family and relatives.

This is what the lawyers for the former trader told the judge presiding over the criminal case against him.

The Department of Justice has filed charges of fraud against the former crypto king, alleging that he lied and cheated clients and investors of FTX and its sister company, Alameda Research.

Bankman-Fried is currently living under house arrest at his parents in California.

During a Jan. 3 hearing in U.S. District Court in New York, Bankman-Fried, known under the initial SBF in the crypto space, pleaded not guilty.

He was released after his parents, both law professors at Stanford University, signed a $250 million recognizance bond pledging their California home as collateral. Two other friends with significant assets also signed, according to court documents

The trial is scheduled for Oct. 8.

'You Won't Be Able to Keep Us Out'

In a letter to U.S. District Judge Lewis A. Kaplan, his lawyers indicate that a car with three men on board knowingly crashed into the metal barricade outside his parents' house in California.

The three occupants of the car were trying to enter the house where Bankman-Fried is under house arrest, the attorneys said.

"Mr. Bankman-Fried and his parents have been the target of actual efforts to cause them harm," attorneys Mark Cohen and Christian Everdell wrote in a court document filed on Jan. 19. "Recently, the Bankman-Frieds had a security incident at their home when a black car drove into the metal barricade set up outside their home."

"Three men got out of the car. When the security guard on duty confronted them, the men said something to the effect of: 'You won’t be able to keep us out.,'" the attorneys wrote.

"The men got back in the car and quickly drove away before the security guard was able to see the license plate. Neither the car nor the individuals have been identified.

"This incident underscores the risk to the Bankman-Frieds’ privacy and security that was already evident in the numerous threating and harassing communications referenced in our initial submission."

They do not say when the incident took place.

This incident, the lawyers said, demonstrates that the former trader and his family -- in particular the individuals who put up part of the bail to have him released -- are not safe.

"Given the notoriety of this case and the extraordinary media attention it is receiving, it is reasonable to assume that the non-parent sureties will also face significant privacy and safety concerns if their identities are disclosed," asserted the two lawyers.

They are asking Judge Kaplan to reject a request by several media outlets to publish the names of the two other people who helped to pay Bankman-Fried's bail.

Media See Public Interest in Disclosure

Indeed, the car incident came to light as part of the media's request that the judge disclose the names of the individuals who helped put up the huge bail.

The media that made the request say it is in the public interest to make public the names of the individuals who provided the massive financial assistance to someone suspected of such a fraud.

"The Court should deny the motions and affirm its prior ruling that the names and addresses of the non-parent sureties be redacted on their appearance bonds," urge Cohen and Everdell.

Bankman-Fried filed for Chapter 11 bankruptcy on Nov. 11 after two of his star firms, FTX and Alameda Research, were unable to meet massive withdrawal demands from their clients.

FTX was using the client cryptocurrencies as collateral to borrow money, which in turn it had transferred to Alameda Research with which it shares several links. Alameda used this money to invest in crypto businesses and also for trading operations.

"Bankman-Fried was orchestrating a massive, yearslong fraud, diverting billions of dollars of the trading platform’s customer funds for his own personal benefit and to help grow his crypto empire,” the Securities and Exchange Commission alleges in its civil complaint.