/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

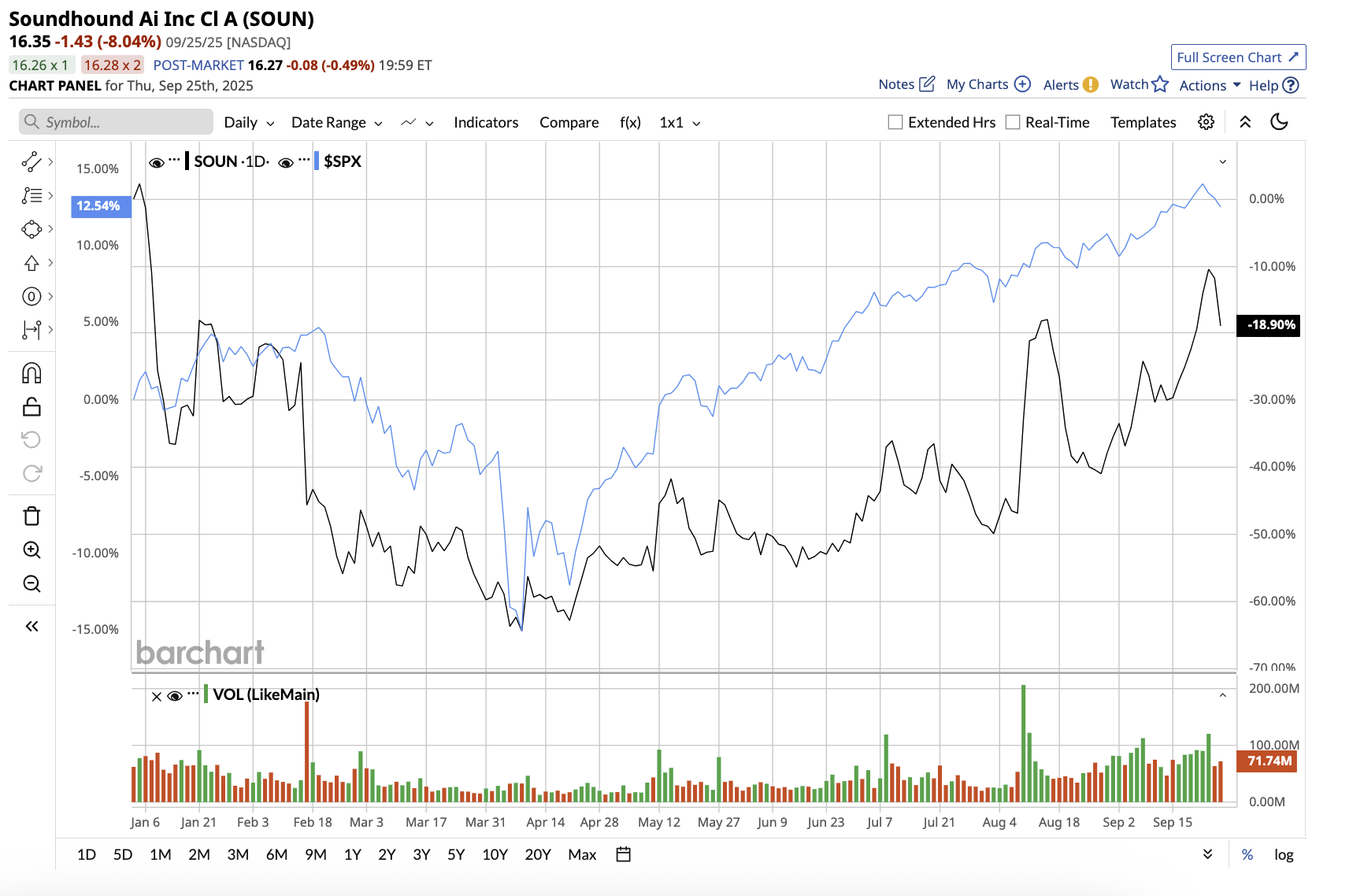

SoundHound AI (SOUN) has gone from a little-known voice recognition player to one of the hottest names in artificial intelligence (AI). Over the past year, its stock has surged from just $4 to $16, reaching a 52-week high of $24.98, rewarding early investors with a four- to sixfold increase. Backed by the rapid adoption of its conversational AI technology, SoundHound is quickly proving itself to be a real growth engine.

While SOUN stock has dipped 18.9% year-to-date, it has surged 250.8% in the past year.

SoundHound AI: A Growth Engine

Valued at $6.7 billion, SoundHound AI is a pure-play AI company that develops voice and conversational AI technology. Its platforms let people interact with devices and services using natural speech, much like talking to another person. SoundHound continues to penetrate diverse industries with partnerships with big enterprises in restaurants, automotive, healthcare, retail, and financial services; channel partnerships; and communications.

SoundHound AI recently posted its strongest quarter ever, marking a defining moment in the company’s evolution as a leader in conversational AI. In the second quarter, revenue surged to $43 million, representing a 217% year-over-year (YoY) increase, driven by broad-based momentum across automotive, enterprise customer service, and restaurant automation. Notably, the company has achieved a significant milestone by processing over 1 billion requests per month on its platform.

Acquisition Strategy Paying Off

SoundHound’s rapid expansion is tied to its successful acquisition strategy. Synq3's acquisition in 2024 has completely converted restaurant clients to SoundHound's proprietary Polaris foundation model, saving millions in third-party costs while boosting performance.Meanwhile, Amelia's pre-acquisition sales achievement of 40% has been reversed to more than 100%, demonstrating the resonance of SoundHound's integrated services. Management also stated that net revenue retention has increased from less than 90% to more than 120%, owing to improved product performance and customer success initiatives.

Polaris has consistently outperformed its major tech contemporaries, offering 35% higher accuracy, 4x lower latency, and lower costs. Customers who switch to Polaris report instant improvements, which drive renewals and increased closure rates.

Polaris additionally powers Amelia 7, SoundHound's recently released agentic AI platform. Amelia 7 allows businesses to deploy autonomous and directed AI agents with low-code and no-code flexibility. Already, 15 significant enterprise clients have migrated to the platform, resulting in additional upsell prospects.

More Success Stories Incoming

Recently, the company announced its acquisition of Interactions Corporation, a pioneer in AI-powered customer support. The $60 million deal, which includes potential milestone payments, is expected to rapidly boost profitability and increase SoundHound's enterprise reach.

The acquisition expands SoundHound's portfolio to include a diverse roster of Fortune 100 brands, such as global retailers, insurers, automakers, and technology businesses, while also increasing its intellectual property to over 400 patents.

More recently, SoundHound and Red Lobster announced a collaboration to implement an AI-powered phone ordering system at all Red Lobster restaurants. These integrations have resulted in cost and revenue synergies, with cross-selling and upselling fueling future growth. H.C. Wainwright analyst Scott Buck believes that the strategic acquisition of Interactions could immediately enhance profitability while opening up cross-selling and upselling potential throughout Interactions' customer base. He added that, given the success of the previous Amelia acquisition, this move strengthens management's execution. Consequently, Buck reiterated a Buy rating on SOUN stock with a price target of $18.

Despite increasing R&D, sales, and G&A spending as a result of acquisitions, SoundHound continues to invest in Polaris and agentic AI innovations that are currently showing competitive advantages. The company ended the quarter with $230 million in cash balance and no debt. With record growth, breakthrough innovations like Polaris and Amelia 7, and momentum across automotive, enterprise, restaurants, healthcare, and financial services, the company is well-positioned to expand its AI ecosystem.

Given strong deal flow and demand across verticals, SoundHound raised its 2025 revenue outlook to $160 million to $178 million. The company anticipates growth to accelerate in the second half of the year. Analysts predict a revenue increase of 96.04% in 2025, followed by a 28.9% increase in 2026. However, this rapid revenue growth is yet to translate to sustained profitability. The company reported an adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) loss of $14.3 million and an adjusted net loss of $0.03 per share in Q2. Management expects to achieve adjusted EBITDA profitability by the end of 2025.

Trading at 33 times forward 2026 sales, SOUN stock is expensive now. Those already invested in the company should hold on to this stock as it translates its rapid revenue growth to sustained profits. On the other hand, new investors might want to wait for a better entry point.

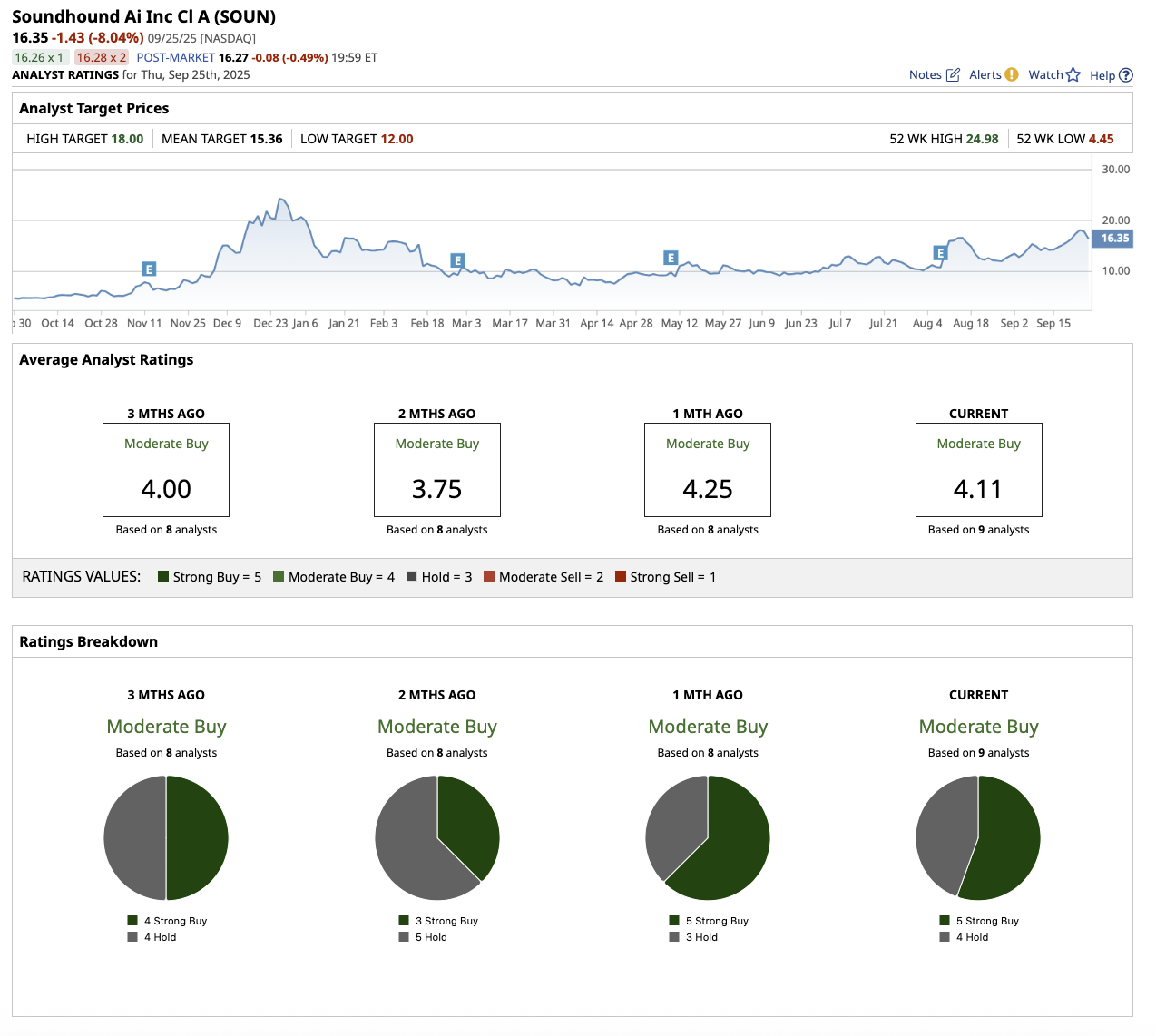

What Is the Target Price for SOUN Stock?

SOUN stock has surged from $4 a year ago to $16.35 as of writing, surpassing even its average analyst's target price of $15.36. Wall Street analysts believe the stock could go higher to $18, which implies a potential upside of 10% from current levels.

Overall, Wall Street rates SOUN stock as a “Moderate Buy.” Among the nine analysts covering the stock, five give it a “Strong Buy” rating, while four suggest a “Hold.”