/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

Earlier, telecom giant Verizon (VZ) and satellite designer and manufacturer AST SpaceMobile (AST) generated business headlines by announcing a landmark commercial deal. Under the terms of the agreement, the two enterprises will collaborate to provide space-based cellular broadband service across the continental U.S. by 2026.

Following the disclosure, ASTS stock gained 8.63% on the day. For the trailing week, the security shot up almost 39%. On the other hand, VZ stock hasn’t been so lucky, slipping slightly below parity during the midweek session and falling more than 5% in the trailing five sessions.

However, if you’re an options trader, VZ stock — at least in the near term — might give you better odds for upside.

Let me be brutally honest: I’d estimate that a good 90% of financial publication articles are functionally unproductive. That’s because within the information age that we’re living in, we’re also experiencing a rapid technological paradigm shift. Today, the latest AI engines can rifle through decades of earnings disclosures within seconds and spit out cohesive analyses with exegetical robustness.

There’s not a human alive that can compete with that. And so, it is truly, utterly irrational to believe that an opinion on a publicly traded security counts as uniquely profound insight.

It does not. The machines are already well ahead of everyone.

Plus, even if a particular opinion was never publicly broadcasted, it doesn’t necessarily mean that the ideation has yet to be priced in. More than likely, it has. That’s why I’m not pounding the table to buy ASTS stock. Behaviorally, there’s nothing terribly unusual about AST at this juncture — retail traders are excited, leading to more accumulative sessions than distributive. It’s standard stuff.

But that’s not the case with VZ stock. Oh no — VZ is straight-up weird.

VZ Stock Exposes the Hole in Black-Scholes

Effectively serving as the bible of options pricing, the Black-Scholes-Merton (BSM) model provides a framework for deciphering a theoretical “fair value” for a derivative contract today using a forward-looking distribution of the underlying asset’s future price. With the BSM model integrated with key datapoints like implied volatility, it’s possible to calculate forward expectations.

For example, VZ stock is expected to land somewhere between $39.17 and $43.47 for the options chain expiring Nov. 21. That sounds incredibly insightful until you realize that the projected output is symmetrically stochastic. In other words, you don’t know which outcome is more likely — the $39 target or the $43 one.

That’s not a knock on the BSM model or the expected calculator tools derived from the framework; it’s just that we need another model beyond the “Greek” methodology to know which side of the stochastic cone VZ stock is likely to land on.

For that, we can use the “Russian” methodology of empirical distributions. Taking a page out of Markovian theory, we can convert the scalar language of price action into the discretized language of behavioral states. Specific to VZ stock, the security printed an accumulation-heavy profile with a net negative trajectory.

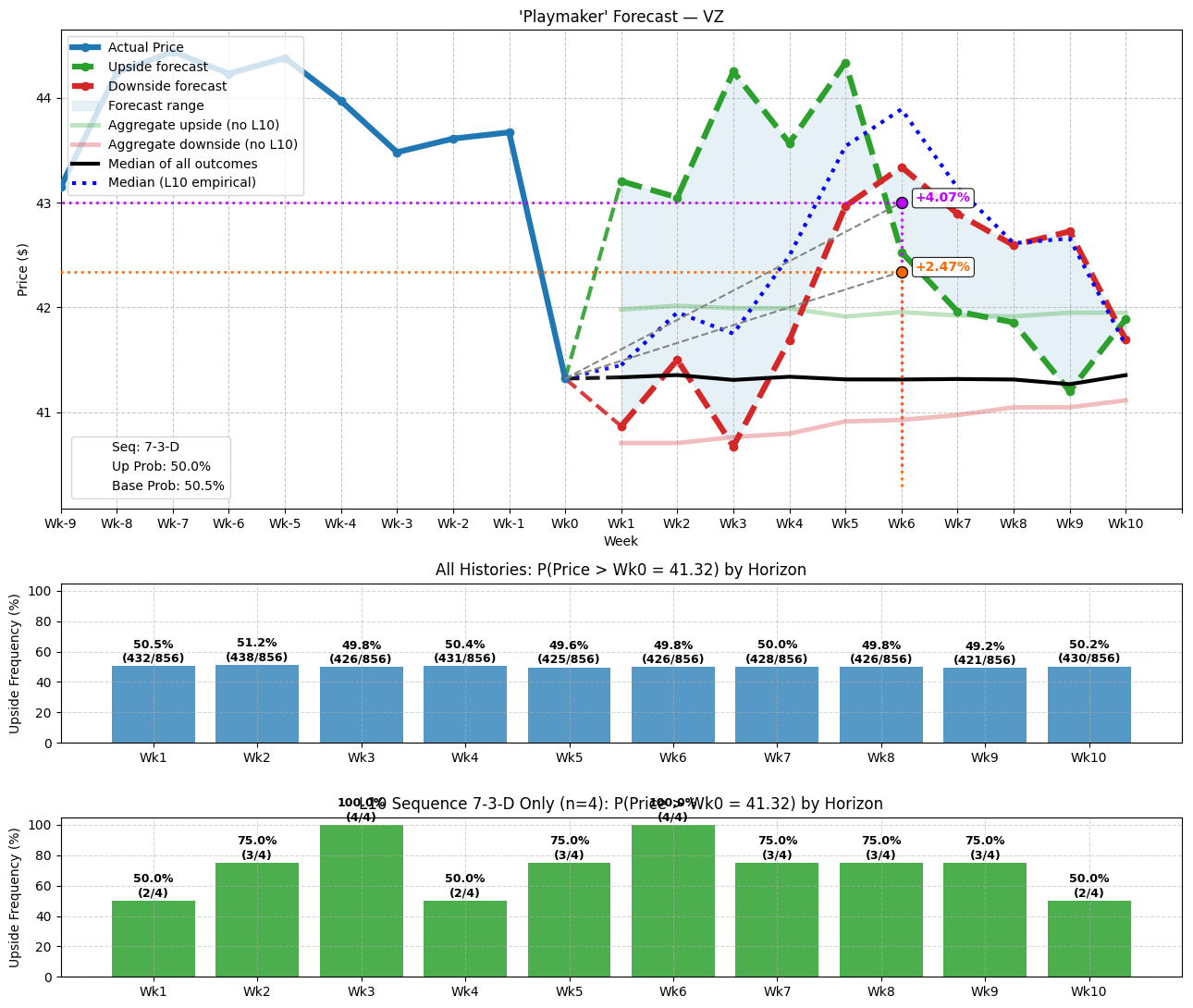

In sequencing language, Verizon just inked a 7-3-D: seven up weeks, three down weeks, with a negative return across the period. It’s so rare that since January 2009, this sequence has only materialized four times on a rolling basis.

For context, the total number of rolling sequences in the dataset is 856. So, the 7-3-D would only constitute less than half-a-percent of all of VZ’s behavioral states.

Because of the incredible rarity of this quantitative signal, the argument favoring VZ stock is inferred rather than scientifically calculated. The sample size is simply too small. However, what’s intriguing is that of the few times that this unique setup flashed, VZ has stormed higher, with the median price of outcomes tied to the 6-4-D sequence peaking in the sixth week.

That roughly coincides with the Nov. 21 expiration date.

Answering the Question…and Betting on It

To answer the question above, VZ stock is more likely — based on the limited empirical data — to land closer to the upper range of the expected calculator projection. Assuming an anchor price of $41.32 (Wednesday’s close), the median projected target is approximately $43.80 by the sixth week.

What’s really enticing is that market makers have very little optimism for Verizon. As such, you can buy the 42/43 bull call spread expiring Nov. 21 for a net debit of $34. Should VZ stock rise through the second-leg strike price ($43) at expiration, the maximum payout stands at over 194%.

Even better for intrepid speculators, the breakeven price for the above trade is $42.34. Under traditional methodologies, that’s considered a very low probability event. But under the Russian framework, it might be a counterintuitively favorable bet.